Unveiling Three SEHK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, Hong Kong's Hang Seng Index has experienced a 1.5% decline amidst concerns over slowing economic growth and foreign selling pressures. In this context, identifying growth companies with high insider ownership in Hong Kong can offer investors potential resilience and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

| Fenbi (SEHK:2469) | 32.6% | 43% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| DPC Dash (SEHK:1405) | 38.2% | 90.2% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.5% |

| Beijing Airdoc Technology (SEHK:2251) | 28.7% | 83.9% |

Underneath we present a selection of stocks filtered out by our screen.

Xiamen Yan Palace Bird's Nest Industry (SEHK:1497)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd. operates in the People’s Republic of China, focusing on the research, development, production, and marketing of edible bird’s nest products with a market capitalization of HK$4.52 billion.

Operations: The company generates revenue through various channels, including CN¥824.40 million from direct online customer sales, CN¥509.04 million from offline distributors, CN¥351.17 million from direct offline customer sales, and CN¥262.89 million from sales to e-commerce platforms.

Insider Ownership: 26.7%

Xiamen Yan Palace Bird's Nest Industry, a growth-oriented company in Hong Kong, demonstrates a robust insider ownership structure that aligns with its strategic interests. Recently affirming a dividend of RMB 2.15 per 10 shares, the company shows commitment to shareholder returns amidst modest revenue and earnings growth forecasts of 12.6% and 15.58% per year respectively. Despite not reaching high growth thresholds, its forecasted Return on Equity of 27.3% suggests efficient capital management compared to market benchmarks.

- Navigate through the intricacies of Xiamen Yan Palace Bird's Nest Industry with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Xiamen Yan Palace Bird's Nest Industry's share price might be on the expensive side.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers AI solutions in China, with a market capitalization of approximately HK$24.84 billion.

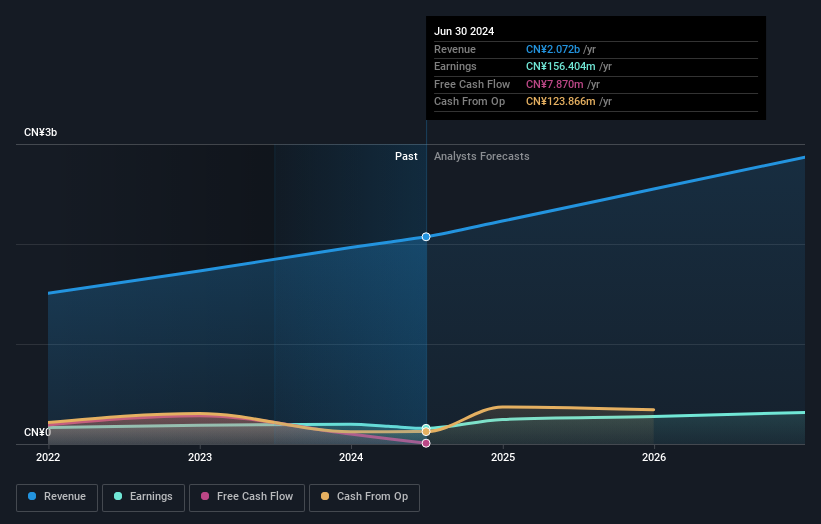

Operations: The company generates revenue primarily through its Sage AI Platform, which contributes CN¥2.51 billion, followed by Shift Intelligent Solutions at CN¥1.28 billion, and SageGPT AiGS Services at CN¥0.42 billion.

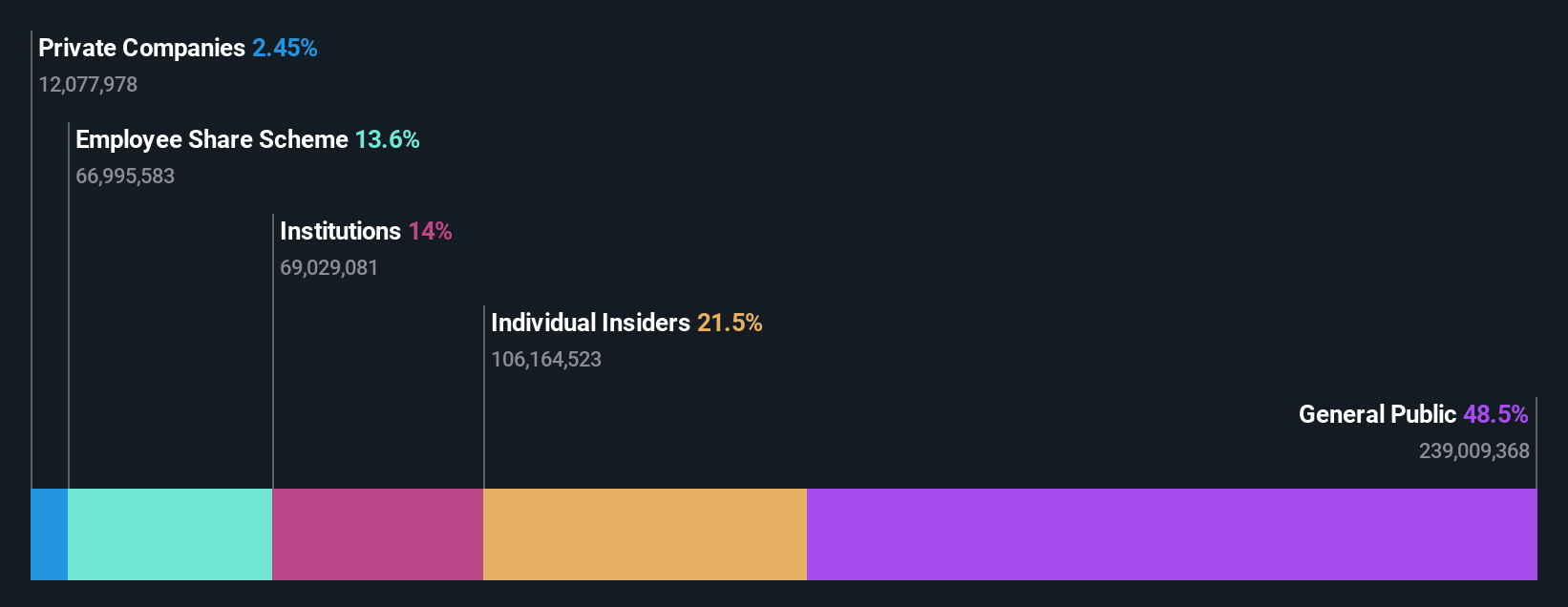

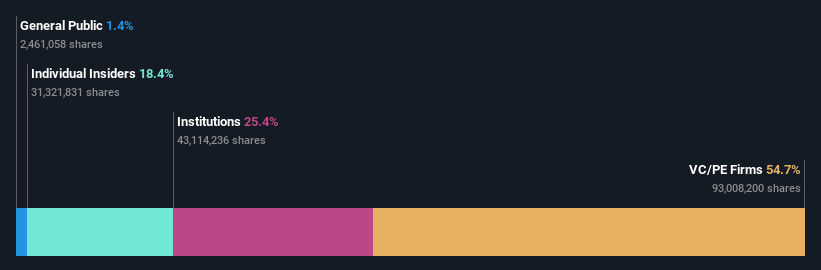

Insider Ownership: 22.8%

Beijing Fourth Paradigm Technology, a company with significant insider ownership, is navigating strategic shifts with recent executive changes. The firm has seen a 36.4% revenue growth over the past year and anticipates becoming profitable within three years, outpacing average market expectations. Despite slower revenue growth projections of 19.3% annually compared to higher benchmarks, its earnings are expected to surge by 95.97% per year. However, its forecasted Return on Equity remains low at 6%.

- Take a closer look at Beijing Fourth Paradigm Technology's potential here in our earnings growth report.

- The analysis detailed in our Beijing Fourth Paradigm Technology valuation report hints at an inflated share price compared to its estimated value.

Angelalign Technology (SEHK:6699)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Angelalign Technology Inc. is an investment holding company that focuses on researching, developing, designing, manufacturing, and marketing clear aligner treatment solutions in the People’s Republic of China, with a market capitalization of approximately HK$10.41 billion.

Operations: The company generates its revenue primarily from the dental equipment and supplies segment, amounting to CN¥1.48 billion.

Insider Ownership: 18.5%

Angelalign Technology, a growth-oriented firm with substantial insider ownership, recently announced a special dividend and its expansion into Canada with innovative product features. While the company's profit margins have decreased to 3.6% from last year's 16.8%, it is set to experience significant earnings growth at an annual rate of 50.9%, outpacing the Hong Kong market average of 11.3%. However, its forecasted Return on Equity in three years is low at 7.4%, reflecting some challenges ahead despite positive revenue and profit trajectories.

- Dive into the specifics of Angelalign Technology here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Angelalign Technology's share price might be too optimistic.

Seize The Opportunity

- Take a closer look at our Fast Growing SEHK Companies With High Insider Ownership list of 54 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Fourth Paradigm Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6682

Beijing Fourth Paradigm Technology

An investment holding company, provides platform-centric artificial intelligence (AI) solutions in the People's Republic of China.

Excellent balance sheet with reasonable growth potential.