- Hong Kong

- /

- Consumer Services

- /

- SEHK:8296

Spotlight On Promising Penny Stocks For December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of interest rate cuts and mixed economic signals, investors are keenly observing shifts in major indices. Amidst this backdrop, penny stocks—though an outdated term—remain a relevant area for those seeking opportunities in smaller or newer companies. By focusing on strong financials and growth potential, these stocks can offer hidden value without the high risks typically associated with them.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.97 | HK$43.72B | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.49 | £66.56M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.885 | £185.28M | ★★★★★★ |

| CSE Global (SGX:544) | SGD0.46 | SGD324.93M | ★★★★★☆ |

Click here to see the full list of 5,768 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Newton Resources (SEHK:1231)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Newton Resources Ltd is an investment holding company involved in the sourcing and supply of iron ores and other commodities in Mainland China and internationally, with a market cap of HK$1.18 billion.

Operations: The company generates revenue primarily from its Resources Business, totaling $485.41 million.

Market Cap: HK$1.18B

Newton Resources Ltd. has shown impressive earnings growth of 103% over the past year, surpassing industry averages, and boasts a significant reduction in its debt to equity ratio from 160.5% to 42.5% over five years, indicating improved financial health. However, recent guidance suggests a projected net loss of US$1 million for 2024 due to decreased iron ore supply and weaker demand impacting gross profit margins. Despite having no long-term liabilities and satisfactory short-term asset coverage, challenges remain with negative operating cash flow affecting debt coverage capabilities. The board's average tenure is strong at 9.3 years, providing experienced oversight amidst these challenges.

- Get an in-depth perspective on Newton Resources' performance by reading our balance sheet health report here.

- Understand Newton Resources' track record by examining our performance history report.

China Automotive Interior Decoration Holdings (SEHK:48)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Automotive Interior Decoration Holdings Limited is an investment holding company that manufactures and sells nonwoven fabric products for automotive interior decoration in the People’s Republic of China, with a market cap of HK$42.73 million.

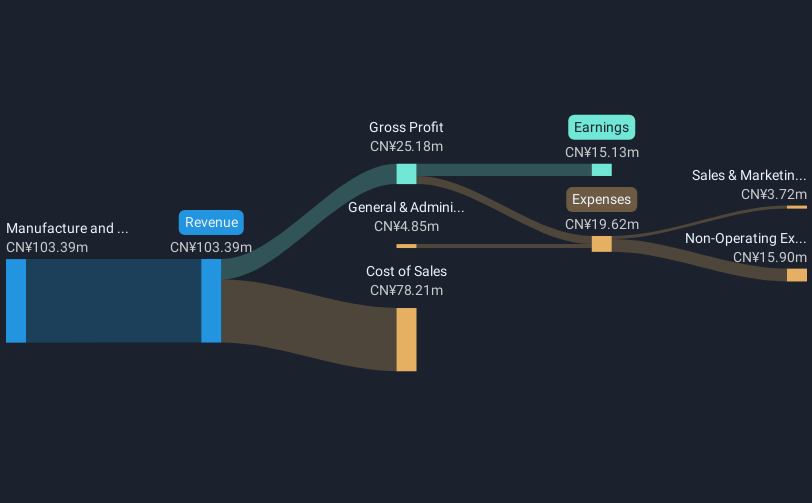

Operations: The company's revenue is derived entirely from the manufacture and sale of nonwoven fabric related products, totaling CN¥103.39 million.

Market Cap: HK$42.73M

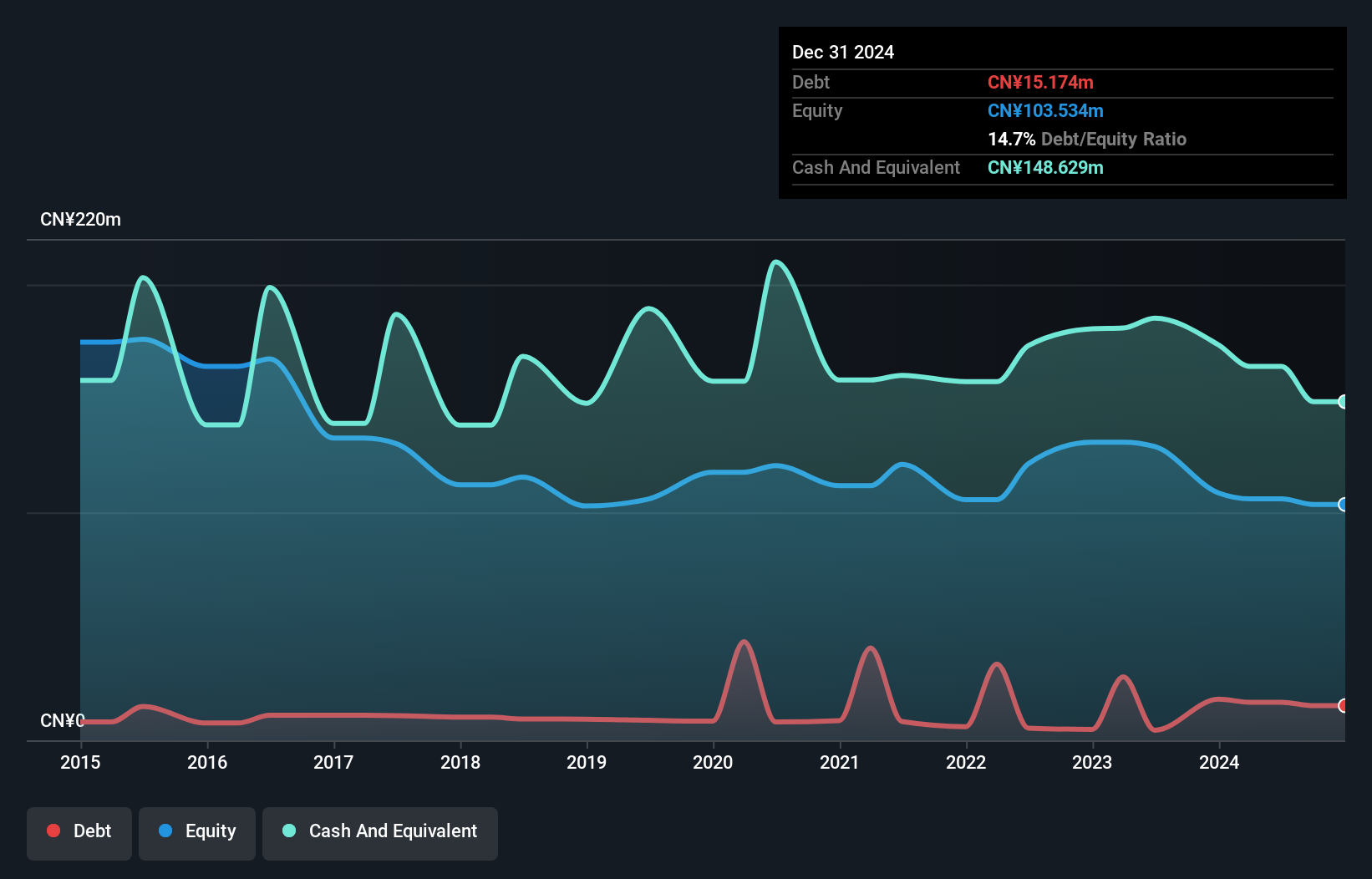

China Automotive Interior Decoration Holdings has transitioned to profitability, with earnings growth of 20.6% annually over five years. Its short-term assets of CN¥159.8 million comfortably cover both short and long-term liabilities, highlighting a strong liquidity position. The company's debt management is prudent, evidenced by cash exceeding total debt and a reduced debt-to-equity ratio from 21.9% to 17.5%. Interest payments are well-covered by EBIT at 20.7 times coverage, though the management team lacks experience with an average tenure of just 1.2 years, potentially impacting strategic consistency amidst high share price volatility.

- Take a closer look at China Automotive Interior Decoration Holdings' potential here in our financial health report.

- Explore historical data to track China Automotive Interior Decoration Holdings' performance over time in our past results report.

Sino-Life Group (SEHK:8296)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sino-Life Group Limited is an investment holding company that offers funeral and related services across the People’s Republic of China, Taiwan, Hong Kong, and Vietnam, with a market cap of HK$51.03 million.

Operations: The company generates its revenue primarily from funeral services, totaling CN¥66.05 million.

Market Cap: HK$51.03M

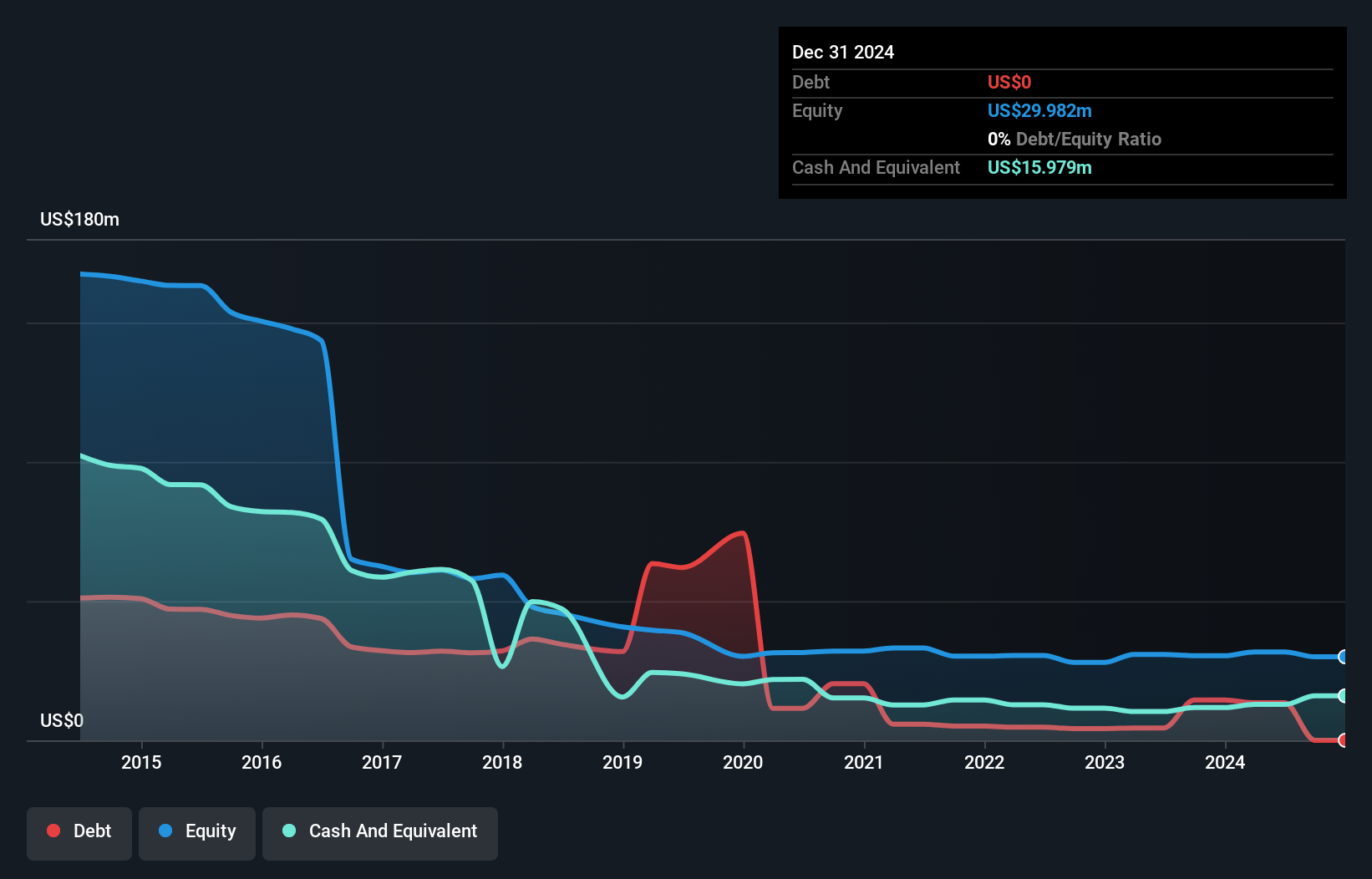

Sino-Life Group faces challenges as it remains unprofitable, with earnings declining by 12.7% annually over the past five years. The company's debt-to-equity ratio has risen from 8.3% to 15.7%, although its cash reserves exceed total debt, providing a buffer for financial obligations. Despite shareholder dilution and increased share price volatility, Sino-Life maintains a substantial cash runway exceeding three years if free cash flow trends persist. Its board and management teams are experienced, with average tenures of seven and 9.2 years respectively, but negative return on equity underscores ongoing profitability issues in a competitive market environment.

- Click here to discover the nuances of Sino-Life Group with our detailed analytical financial health report.

- Evaluate Sino-Life Group's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click here to access our complete index of 5,768 Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8296

Sino-Life Group

An investment holding company, provides funeral and related services in the People’s Republic of China, Taiwan, Hong Kong, and Vietnam.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives