The Bull Case For Inspur Digital Enterprise Technology (SEHK:596) Could Change Following Its HK$494m Follow-on Equity Offering

Reviewed by Sasha Jovanovic

- Inspur Digital Enterprise Technology Limited has completed a follow-on equity offering of HK$493,728,200, issuing 67,634,000 new ordinary shares at HK$7.30 per share with a HK$0.0511 discount per share via a subsequent direct listing.

- This capital raise expands the company’s funding flexibility while modestly increasing the free float, factors that can reshape how investors view its balance between growth ambitions and ownership dilution.

- We’ll now examine how this follow-on equity offering, and the associated increase in outstanding shares, influences Inspur Digital Enterprise Technology’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Inspur Digital Enterprise Technology's Investment Narrative?

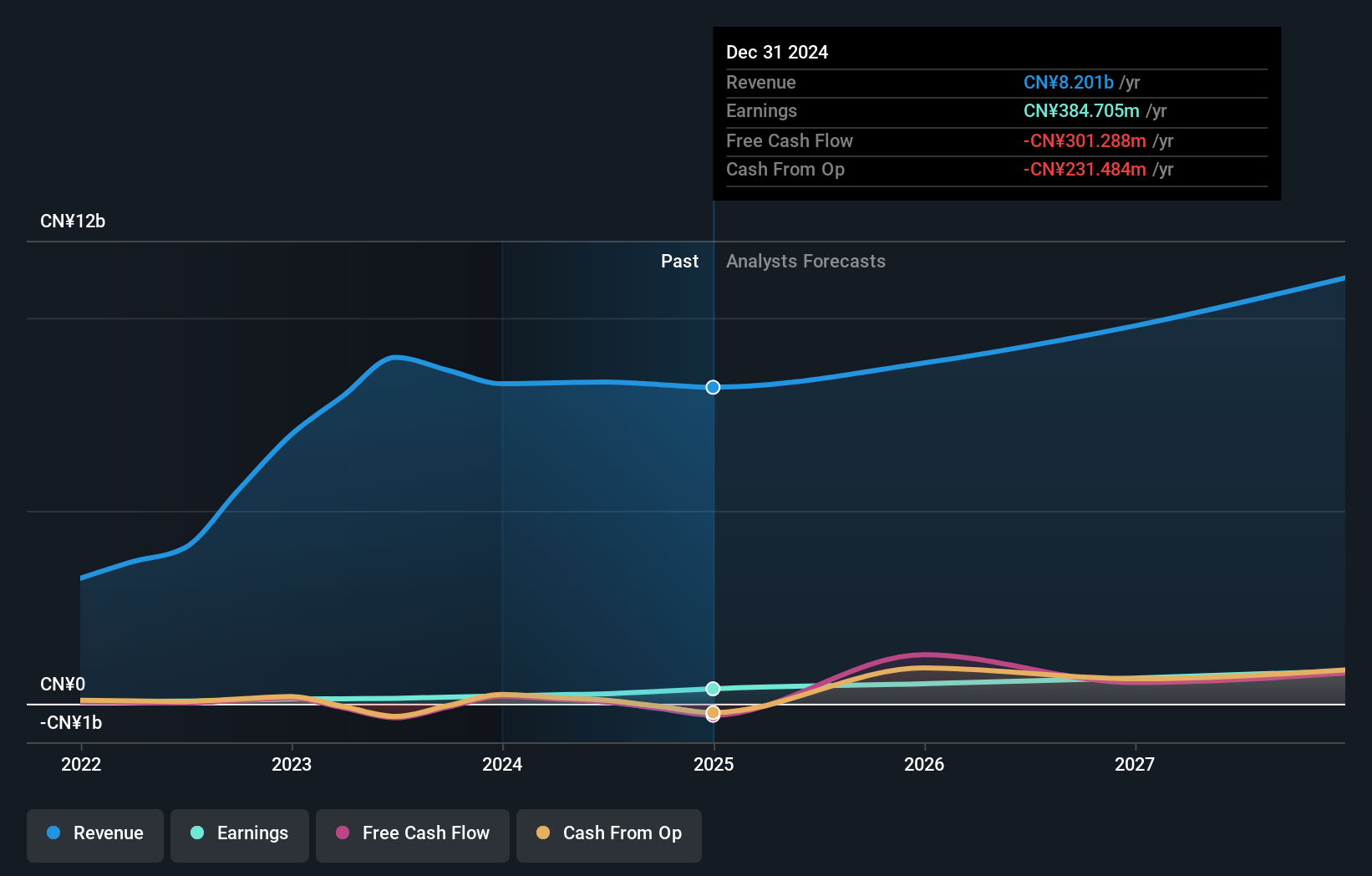

To own Inspur Digital Enterprise Technology, you really need to believe its cloud and software transition can keep translating into steady revenue and earnings growth, even if that trajectory is uneven at times. Recent results have shown improving profitability and margins, and the board has been willing to return some cash via dividends, which helps anchor the story. The new HK$493,728,200 follow-on equity offering fits into this narrative as fresh funding that can support further cloud build‑out or product investment without stretching the balance sheet, but it also slightly dilutes existing holders and raises the execution bar for management. In the near term, the key catalysts still sit around sustaining profit growth and integrating new capital efficiently, while governance quality and non‑cash earnings remain important watchpoints.

However, investors should be aware of how dilution and governance could interact with those earnings headlines. Despite retreating, Inspur Digital Enterprise Technology's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 4 other fair value estimates on Inspur Digital Enterprise Technology - why the stock might be worth over 2x more than the current price!

Build Your Own Inspur Digital Enterprise Technology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inspur Digital Enterprise Technology research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Inspur Digital Enterprise Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inspur Digital Enterprise Technology's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:596

Inspur Digital Enterprise Technology

An investment holding company, engages in management software development, cloud services, and sale of Internet of Things (IoT) solutions in the People’s Republic of China.

Very undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026