Could Inspur (SEHK:596) Redefine Its Competitive Edge Through Energy-Efficient Data Center Innovations?

Reviewed by Sasha Jovanovic

- At the recent Indonesia International Data Center & Cloud Computing Summit, Inspur Digital Enterprise Technology showcased its prefabricated modular data center solution featuring air-liquid hybrid cooling and rapid deployment capabilities, engaging with local operators for collaborative growth in the region.

- This approach focuses on reducing both construction timelines and energy consumption, appealing to markets seeking cost-effective and sustainable data center infrastructure.

- We'll explore how Inspur's emphasis on energy-efficient data center solutions in Southeast Asia may shape the company's broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Inspur Digital Enterprise Technology's Investment Narrative?

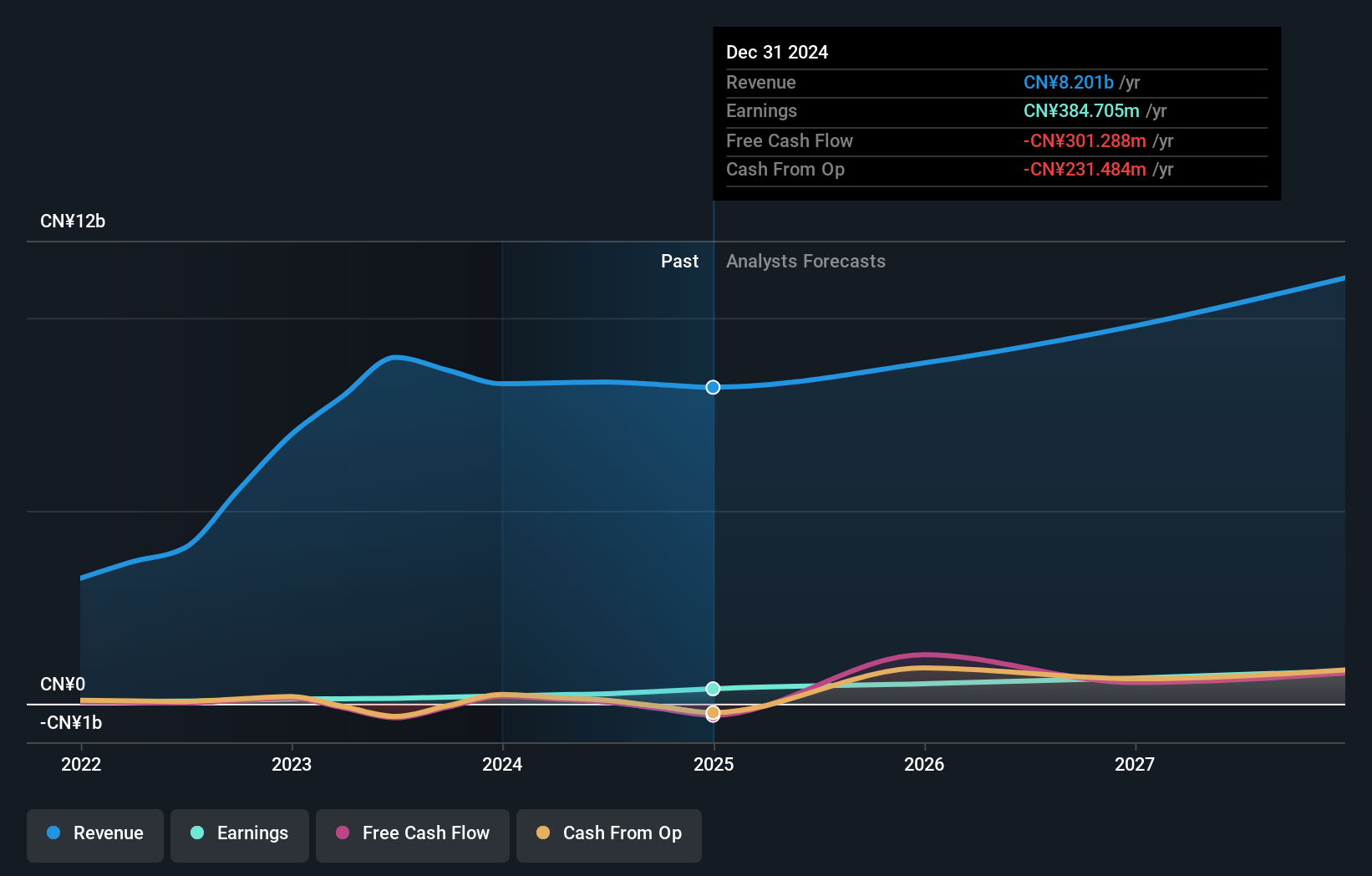

For shareholders of Inspur Digital Enterprise Technology, the story hinges on belief in ongoing demand for energy-efficient and rapidly deployable data center infrastructure across Southeast Asia and other key markets. With earnings and profit margins improving, as well as sustained momentum in cloud service revenues, the recent showcase in Indonesia underscores management’s intent to leverage advanced technologies, like air-liquid hybrid cooling, to shorten build times and drive cost efficiencies. This move potentially sharpens Inspur’s edge on a key catalyst: capturing opportunities from regional digitalization initiatives. However, short-term share price softness and uncertainty around industry adoption rates leave some open questions about how quickly this innovation translates to financial impact. While the announcement enhances its competitive positioning, it may take time before these efforts are fully reflected in earnings, and near-term risks around evolving tech standards and board independence remain just as relevant.

On the flip side, board independence remains a critical factor investors should keep in mind.

Exploring Other Perspectives

Explore 4 other fair value estimates on Inspur Digital Enterprise Technology - why the stock might be worth 37% less than the current price!

Build Your Own Inspur Digital Enterprise Technology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inspur Digital Enterprise Technology research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Inspur Digital Enterprise Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inspur Digital Enterprise Technology's overall financial health at a glance.

No Opportunity In Inspur Digital Enterprise Technology?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:596

Inspur Digital Enterprise Technology

An investment holding company, engages in management software development, cloud services, and sale of Internet of Things (IoT) solutions in the People’s Republic of China.

Very undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion