Vobile Group Limited's (HKG:3738) 34% Share Price Surge Not Quite Adding Up

Vobile Group Limited (HKG:3738) shares have continued their recent momentum with a 34% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 38%.

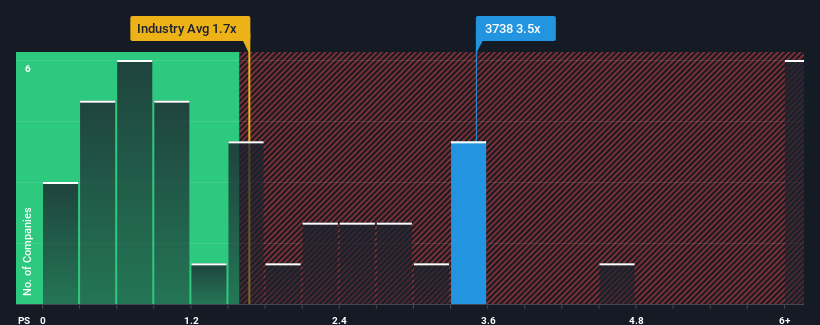

Following the firm bounce in price, given close to half the companies operating in Hong Kong's Software industry have price-to-sales ratios (or "P/S") below 1.7x, you may consider Vobile Group as a stock to potentially avoid with its 3.5x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Vobile Group

What Does Vobile Group's Recent Performance Look Like?

Vobile Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Vobile Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Vobile Group's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 26% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 24%, which is not materially different.

With this information, we find it interesting that Vobile Group is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Vobile Group's P/S?

Vobile Group's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given Vobile Group's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Vobile Group, and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3738

Vobile Group

An investment holding company, provides software as a service for digital content asset protection and transaction in the United States, Mainland China, and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives