After Leaping 31% Chinasoft International Limited (HKG:354) Shares Are Not Flying Under The Radar

Chinasoft International Limited (HKG:354) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 15% over that time.

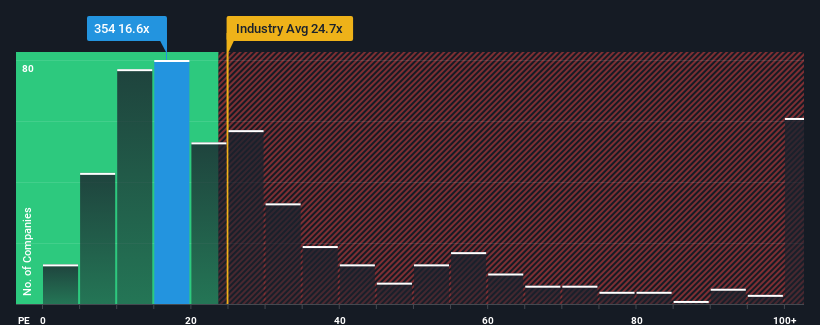

Following the firm bounce in price, Chinasoft International's price-to-earnings (or "P/E") ratio of 16.6x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been advantageous for Chinasoft International as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Chinasoft International

Is There Enough Growth For Chinasoft International?

In order to justify its P/E ratio, Chinasoft International would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 30% last year. Still, incredibly EPS has fallen 36% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 18% per annum as estimated by the twelve analysts watching the company. With the market only predicted to deliver 12% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Chinasoft International's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in Chinasoft International have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Chinasoft International's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Chinasoft International with six simple checks.

Of course, you might also be able to find a better stock than Chinasoft International. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:354

Chinasoft International

Engages in development and provision of information technology (IT) solutions, IT outsourcing, and training services in the People’s Republic of China, the United States, Malaysia, Japan, Singapore, India, and Saudi Arabia.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026