Shareholders May Not Be So Generous With Kingdee International Software Group Company Limited's (HKG:268) CEO Compensation And Here's Why

Key Insights

- Kingdee International Software Group will host its Annual General Meeting on 22nd of May

- Salary of CN¥4.02m is part of CEO Robert Xu's total remuneration

- The total compensation is 120% higher than the average for the industry

- Over the past three years, Kingdee International Software Group's EPS grew by 36% and over the past three years, the total loss to shareholders 8.6%

In the past three years, shareholders of Kingdee International Software Group Company Limited (HKG:268) have seen a loss on their investment. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 22nd of May. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Kingdee International Software Group

How Does Total Compensation For Robert Xu Compare With Other Companies In The Industry?

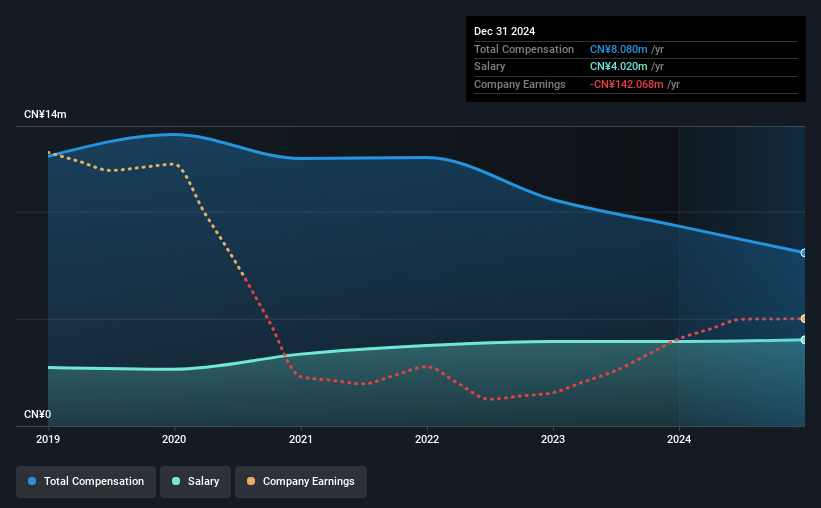

According to our data, Kingdee International Software Group Company Limited has a market capitalization of HK$48b, and paid its CEO total annual compensation worth CN¥8.1m over the year to December 2024. That's a notable decrease of 13% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CN¥4.0m.

On comparing similar companies from the Hong Kong Software industry with market caps ranging from HK$31b to HK$94b, we found that the median CEO total compensation was CN¥3.7m. Accordingly, our analysis reveals that Kingdee International Software Group Company Limited pays Robert Xu north of the industry median. Moreover, Robert Xu also holds HK$9.4b worth of Kingdee International Software Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥4.0m | CN¥3.9m | 50% |

| Other | CN¥4.1m | CN¥5.4m | 50% |

| Total Compensation | CN¥8.1m | CN¥9.3m | 100% |

On an industry level, around 68% of total compensation represents salary and 32% is other remuneration. Kingdee International Software Group sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Kingdee International Software Group Company Limited's Growth Numbers

Kingdee International Software Group Company Limited has seen its earnings per share (EPS) increase by 36% a year over the past three years. Its revenue is up 10% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Kingdee International Software Group Company Limited Been A Good Investment?

Since shareholders would have lost about 8.6% over three years, some Kingdee International Software Group Company Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for Kingdee International Software Group that investors should be aware of in a dynamic business environment.

Switching gears from Kingdee International Software Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Kingdee International Software Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:268

Kingdee International Software Group

An investment holding company, engages in the enterprise resource planning business.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026