In recent weeks, global markets have experienced notable gains, with U.S. indices like the Dow Jones Industrial Average and S&P 500 reaching record highs, while small-cap stocks such as those in the Russell 2000 Index have also surged to new peaks. Amid these dynamic market conditions, high growth tech stocks present intriguing opportunities for investors seeking companies with strong potential for innovation and expansion; understanding key economic indicators and geopolitical factors can be crucial in identifying promising candidates within this sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| CD Projekt | 22.02% | 28.64% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1286 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

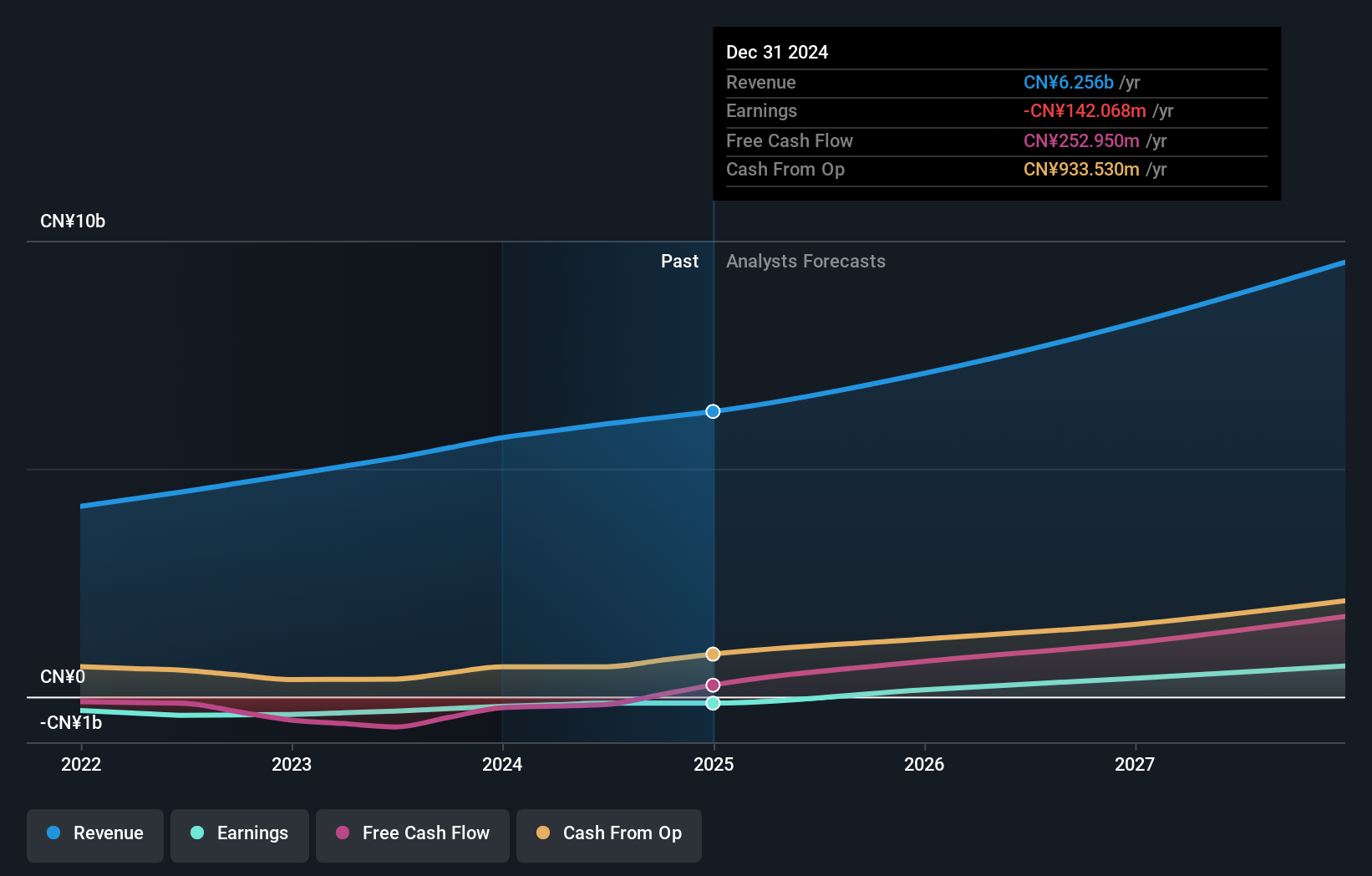

Overview: Kingdee International Software Group Company Limited is an investment holding company focused on enterprise resource planning, with a market capitalization of approximately HK$31.07 billion.

Operations: The company generates revenue primarily from its Cloud Service Business, contributing CN¥4.86 billion, and its ERP Business, which adds CN¥1.13 billion.

Kingdee International Software Group, navigating through a challenging tech landscape, has managed to earmark a significant 14.1% annual revenue growth forecast, outpacing the Hong Kong market's 7.8%. This growth is supported by a robust R&D commitment, with expenses reaching $46.8 million last year alone—highlighting a strategic focus on innovation despite current unprofitability. As the company transitions towards profitability with earnings expected to surge by 46.83% annually, its future in cloud-based enterprise solutions looks promising albeit competitive pressures remain from larger industry players.

- Dive into the specifics of Kingdee International Software Group here with our thorough health report.

Learn about Kingdee International Software Group's historical performance.

Leyard Optoelectronic (SZSE:300296)

Simply Wall St Growth Rating: ★★★★☆☆

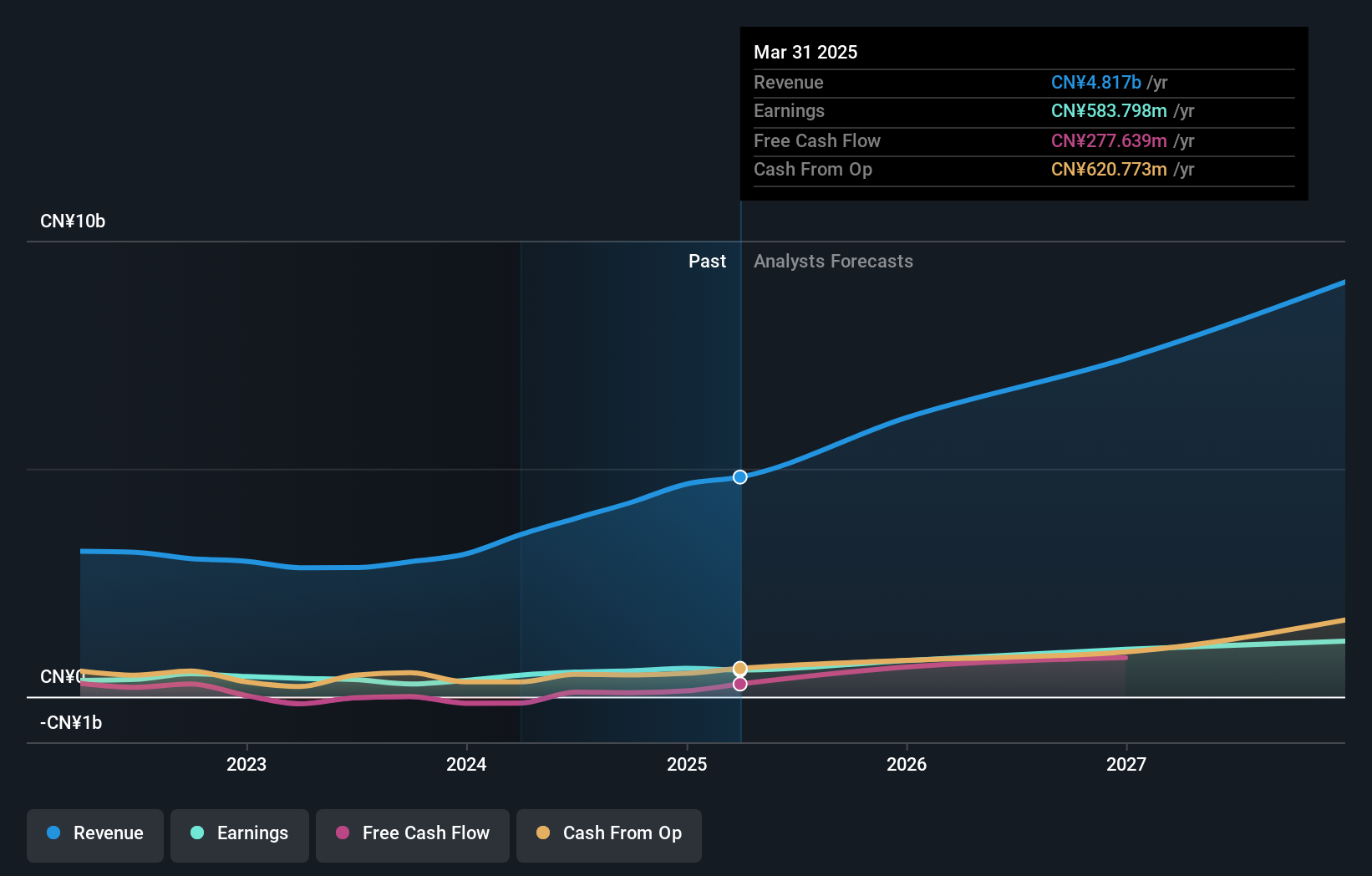

Overview: Leyard Optoelectronic Co., Ltd. is an audio-visual technology company operating in China and internationally, with a market cap of CN¥14.64 billion.

Operations: Leyard Optoelectronic focuses on the development and production of LED display products, which contribute significantly to its revenue. The company also engages in providing integrated solutions for audio-visual systems, enhancing its market presence both domestically and internationally.

Leyard Optoelectronic is navigating a challenging landscape with a notable 19.6% annual revenue growth, although this pace is slightly below the 20% high-growth benchmark. Despite recent financial strains evident from a significant drop in net income to CNY 181.38 million from last year's CNY 460.9 million, the company is aggressively investing in its future, as evidenced by its R&D expenses and a robust forecast for earnings growth at an impressive rate of 90.5% annually. This commitment to innovation could be pivotal in recovering and potentially exceeding past performance levels, especially considering the strategic buyback of shares amounting to CNY 22.4 million this year, signaling confidence in its own stock and operational strategy moving forward.

- Get an in-depth perspective on Leyard Optoelectronic's performance by reading our health report here.

Evaluate Leyard Optoelectronic's historical performance by accessing our past performance report.

Electric Connector Technology (SZSE:300679)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Electric Connector Technology Co., Ltd. specializes in the research, design, development, manufacture, sale, and marketing of electronic connectors and interconnection system products globally with a market capitalization of CN¥23.49 billion.

Operations: The company generates revenue primarily from the connector industry, amounting to CN¥3.89 billion. It focuses on the technical aspects of electronic connectors and interconnection systems for global markets.

Electric Connector Technology has demonstrated robust financial performance, with a significant revenue increase to CNY 3.33 billion, up from CNY 2.20 billion year-over-year, and a net income surge to CNY 458.59 million from CNY 247.4 million. This growth is underpinned by an aggressive R&D strategy, which reflects in their forecasted earnings growth of 28.4% annually, outpacing the CN market's average of 26.3%. Additionally, the company's strategic share repurchases totaling CNY 100.28 million underscore management’s confidence in its operational direction and future prospects amidst competitive industry dynamics where technological innovation is critical.

- Unlock comprehensive insights into our analysis of Electric Connector Technology stock in this health report.

Understand Electric Connector Technology's track record by examining our Past report.

Next Steps

- Click through to start exploring the rest of the 1283 High Growth Tech and AI Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingdee International Software Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:268

Kingdee International Software Group

An investment holding company, engages in the enterprise resource planning business.

Excellent balance sheet with reasonable growth potential.