3 Asian Growth Companies With High Insider Ownership And 58% Earnings Growth

Reviewed by Simply Wall St

In the current global market landscape, Asian economies are navigating a complex environment marked by trade tensions and mixed economic signals. Amid these challenges, growth companies with high insider ownership can offer unique insights into potential resilience and confidence in their business models.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.6% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 25.8% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 25.7% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 42.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Underneath we present a selection of stocks filtered out by our screen.

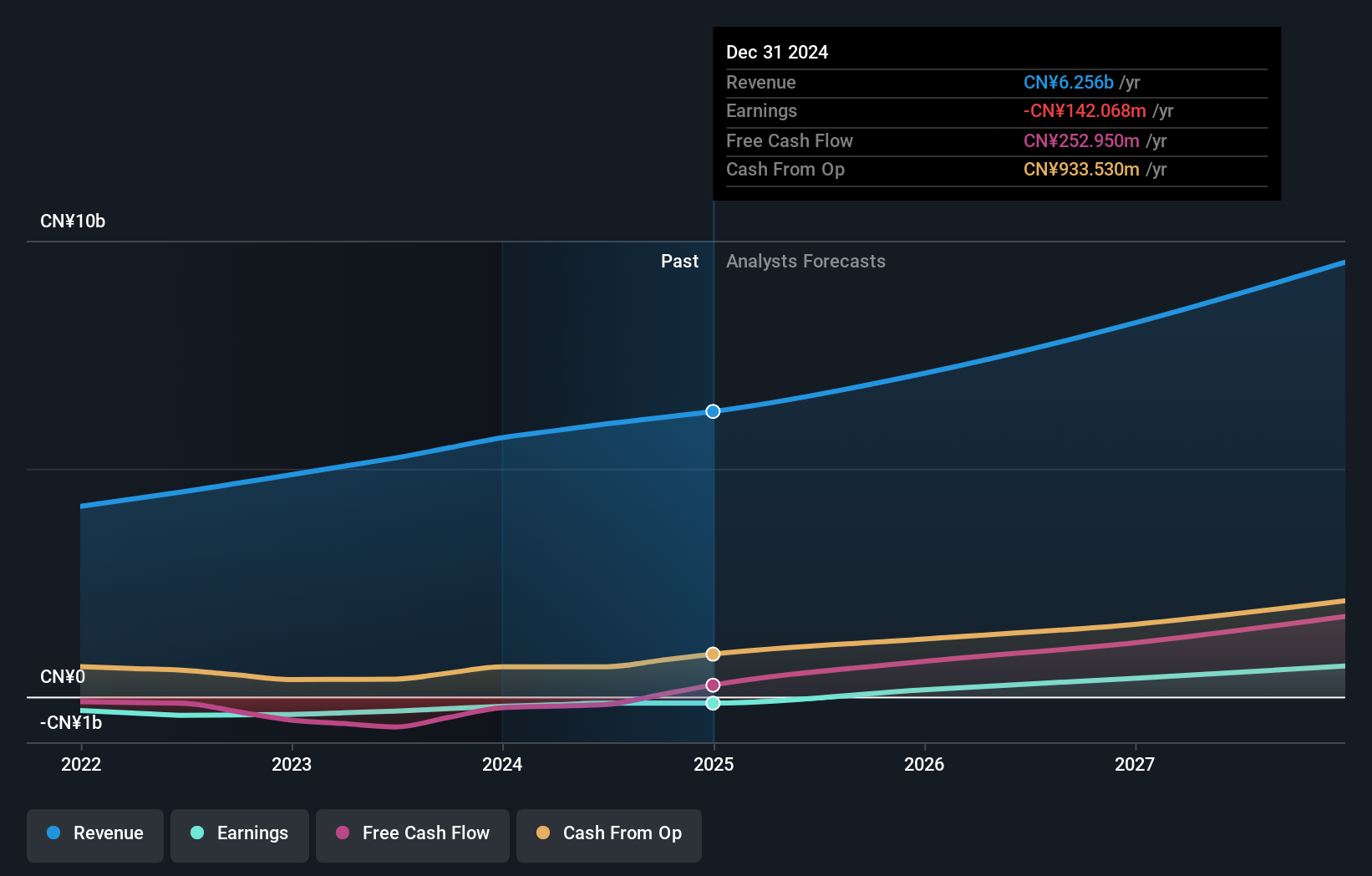

China Ruyi Holdings (SEHK:136)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Ruyi Holdings Limited is an investment holding company involved in content production and online streaming across Mainland China, Hong Kong, Europe, and other international markets with a market cap of HK$51.53 billion.

Operations: The company's revenue primarily comes from its content production business, which generated CN¥127.04 million, and its online streaming and gaming businesses, which brought in CN¥3.51 billion.

Insider Ownership: 16.9%

Earnings Growth Forecast: 48.7% p.a.

China Ruyi Holdings, with significant insider ownership, is forecast to achieve above-market revenue growth of 17.7% annually, surpassing the Hong Kong market's 8.1%. Despite past shareholder dilution, the company is expected to become profitable within three years and its earnings are projected to grow at 48.65% per year. Recent events include participation in the Macquarie Asia Conference and an upcoming AGM addressing financial statements and director elections on June 3, 2025.

- Dive into the specifics of China Ruyi Holdings here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, China Ruyi Holdings' share price might be too optimistic.

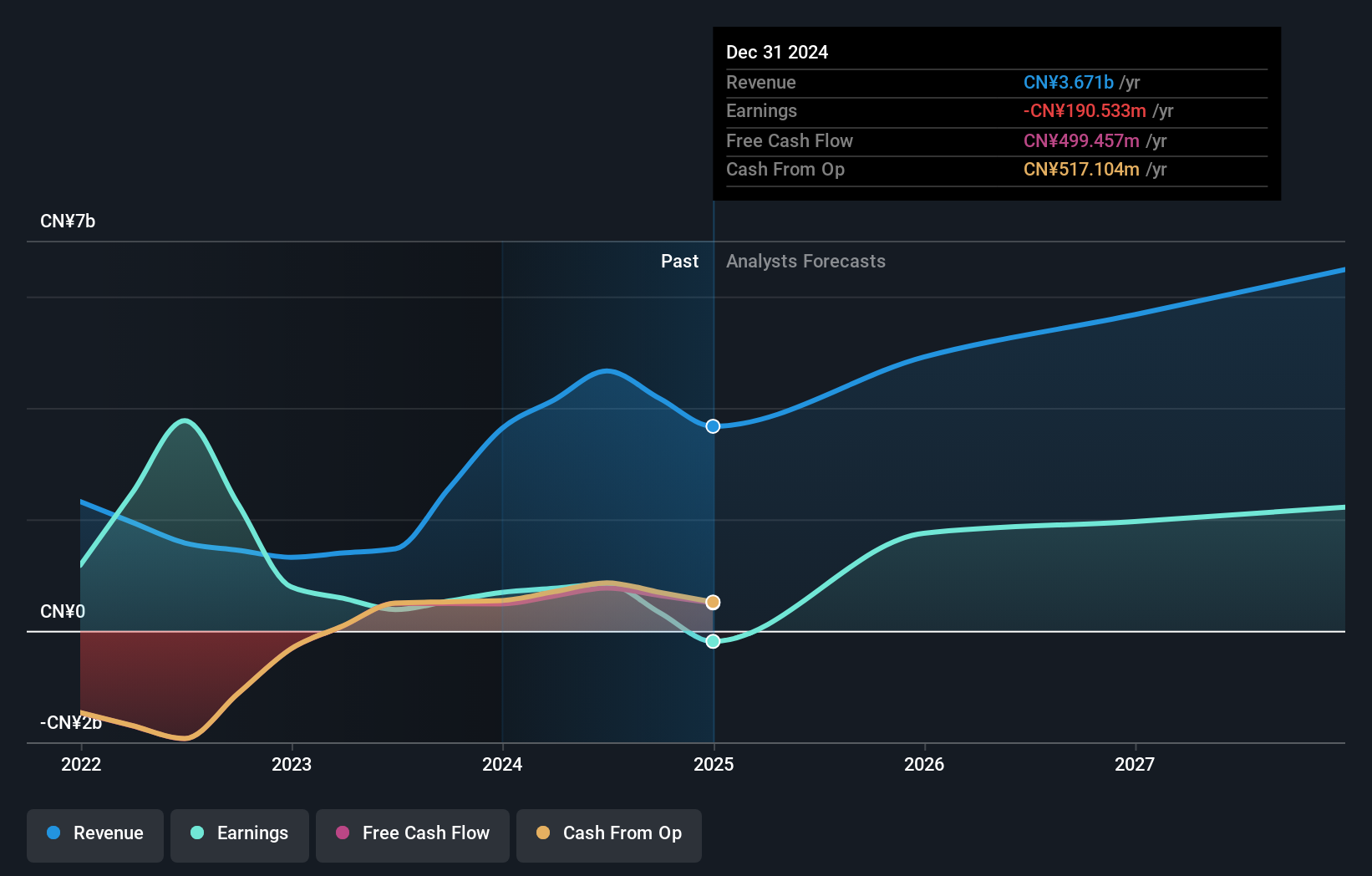

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingdee International Software Group Company Limited is an investment holding company that operates in the enterprise resource planning sector, with a market capitalization of approximately HK$58.70 billion.

Operations: The company generates revenue from its ERP Business, amounting to CN¥1.15 billion, and its Cloud Services Business, contributing CN¥5.11 billion.

Insider Ownership: 19.9%

Earnings Growth Forecast: 41.6% p.a.

Kingdee International Software Group, characterized by high insider ownership, is projected to outpace the Hong Kong market with a revenue growth of 13.6% annually. The company is anticipated to transition to profitability within three years, with earnings expected to grow significantly at 41.56% per year. Despite a forecasted low return on equity of 7.6%, Kingdee trades at 35.5% below its estimated fair value, suggesting potential undervaluation in the market context.

- Click here to discover the nuances of Kingdee International Software Group with our detailed analytical future growth report.

- The analysis detailed in our Kingdee International Software Group valuation report hints at an deflated share price compared to its estimated value.

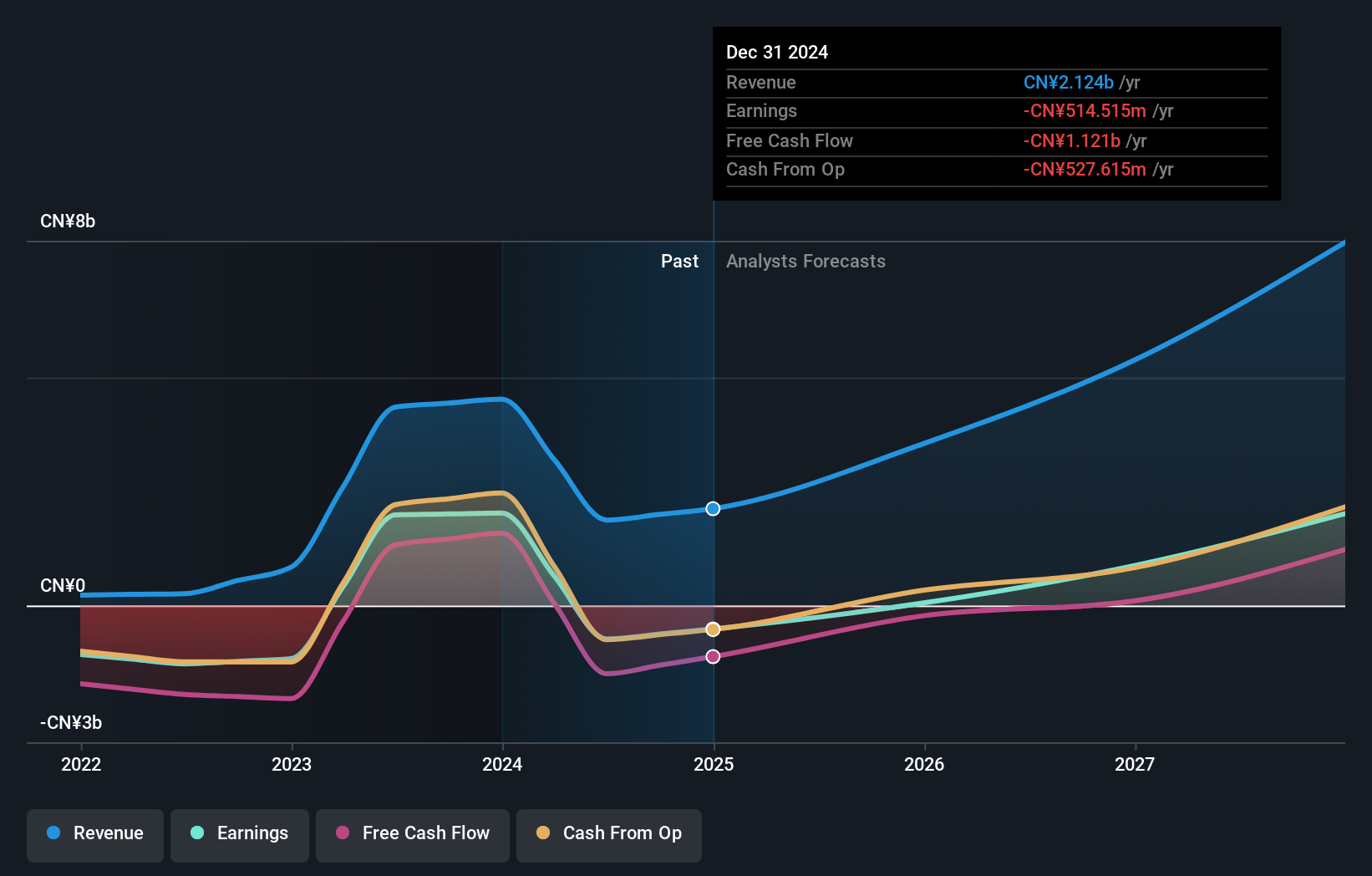

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacture, and commercialization of antibody drugs globally, with a market cap of HK$108.34 billion.

Operations: The company's revenue primarily comes from the research, development, production, and sale of biopharmaceutical products, totaling CN¥2.12 billion.

Insider Ownership: 18.9%

Earnings Growth Forecast: 58.5% p.a.

Akeso, with significant insider ownership, is positioned for robust growth in Asia's biopharmaceutical sector. The company is forecast to achieve a remarkable revenue increase of 29.8% annually and transition to profitability within three years. Recent advancements include the U.S. FDA approval of its PD-1 monoclonal antibody, penpulimab-kcqx, and promising clinical trial outcomes for its bispecific antibodies, enhancing Akeso's global leadership in cancer immunotherapy innovation and expanding its therapeutic portfolio beyond oncology.

- Delve into the full analysis future growth report here for a deeper understanding of Akeso.

- Our expertly prepared valuation report Akeso implies its share price may be too high.

Next Steps

- Delve into our full catalog of 603 Fast Growing Asian Companies With High Insider Ownership here.

- Ready To Venture Into Other Investment Styles? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kingdee International Software Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:268

Kingdee International Software Group

An investment holding company, engages in the enterprise resource planning business.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives