As global markets edge toward record highs, with the Nasdaq Composite leading gains and growth stocks outpacing value shares, investors are navigating a landscape marked by accelerating inflation and cautious optimism surrounding trade policies. In this environment, identifying high-growth tech stocks involves considering companies that not only demonstrate strong innovation and adaptability but also have the potential to thrive amid evolving economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 25.36% | 25.10% | ★★★★★★ |

| AVITA Medical | 29.97% | 53.77% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1213 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Ependion (OM:EPEN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ependion AB, with a market cap of SEK3.47 billion, offers digital solutions focused on secure control, management, visualization, and data communication for industrial applications through its subsidiaries.

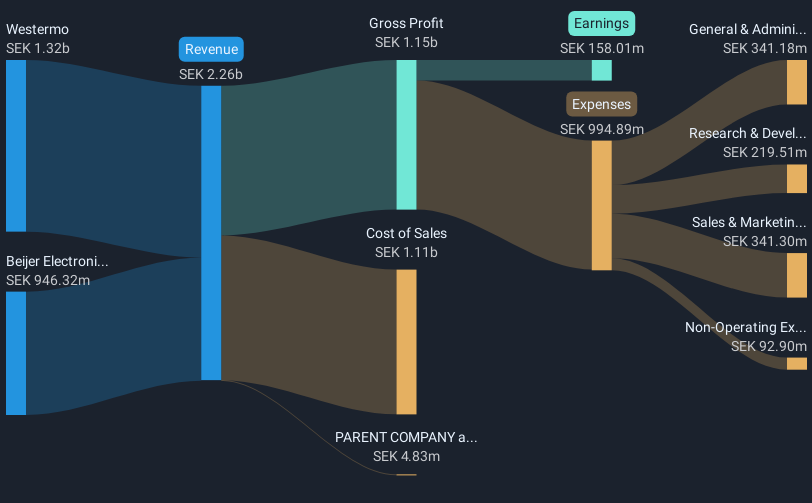

Operations: Ependion AB generates revenue primarily from its subsidiaries, with Westermo contributing SEK1.32 billion and Beijer Electronics (including Korenix) adding SEK946.32 million.

Ependion AB, navigating a challenging tech landscape, reported a slight dip in annual sales to SEK 2.26 billion from SEK 2.47 billion previously but has maintained resilience with a net income increase to SEK 158 million. Notably, the firm's commitment to innovation is underscored by its robust R&D spending which aligns with its strategic focus on high-quality earnings and significant expected earnings growth of 24.2% annually, outpacing the Swedish market's average. Moreover, Ependion's recent dividend increase to SEK 1.25 per share reflects confidence in sustained financial health and shareholder value enhancement amidst forecasts of revenue growth at an impressive rate of 9.5% per year.

- Click to explore a detailed breakdown of our findings in Ependion's health report.

Review our historical performance report to gain insights into Ependion's's past performance.

Dmall (SEHK:2586)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dmall Inc. is an investment holding company that offers retail digitalization solutions across various countries in Asia and Europe, with a market capitalization of approximately HK$5.66 billion.

Operations: Dmall generates revenue primarily through its Retail Core Service Cloud and E-Commerce Service Cloud, with the former contributing significantly more at CN¥1.63 billion compared to CN¥143.82 million from the latter. The company's operations span several Asian and European countries, focusing on enhancing retail digitalization for retailers in these regions.

Amidst a bustling tech landscape, Dmall Inc. recently enhanced its market presence with an IPO, raising HKD 778.63 million, signaling robust investor confidence and capital for expansion. The company's revenue surged by 20.9% over the past year, outpacing the Hong Kong market's growth rate of 7.8%. This performance is underscored by an aggressive R&D investment strategy that not only fuels innovation but also aligns with Dmall’s trajectory towards profitability, forecasted to grow earnings by an impressive 88.37% annually. As it navigates post-IPO dynamics and integrates strategic changes like the recent board reshuffle, Dmall stands poised for significant transformation in its sector.

- Get an in-depth perspective on Dmall's performance by reading our health report here.

Assess Dmall's past performance with our detailed historical performance reports.

Bengo4.comInc (TSE:6027)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bengo4.com, Inc. provides online professional consultancy services in Japan and has a market capitalization of approximately ¥66.61 billion.

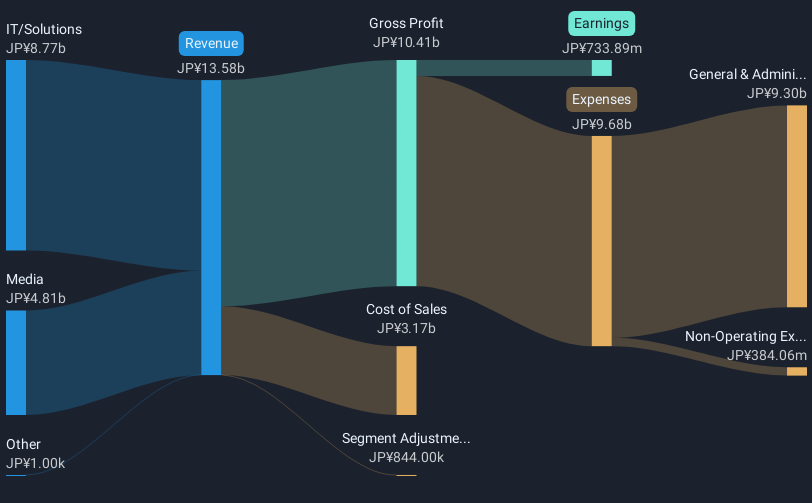

Operations: The company generates revenue primarily through its IT/Solutions and Media segments, with the IT/Solutions segment contributing ¥8.77 billion and the Media segment contributing ¥4.81 billion.

Bengo4.comInc. is navigating a challenging yet evolving tech landscape, evidenced by a 20.2% annual revenue growth outpacing the Japanese market's 4.2%. Despite a recent dip in net income from JPY 571.22 million to JPY 467.44 million, the firm's commitment to innovation remains robust with R&D expenses aimed at enhancing its CloudSign and Media services—sectors critical for future growth amid rising demand for electronic contract solutions. This strategic focus is complemented by an impressive forecast of earnings growth at 65.8% annually, positioning Bengo4.comInc as a resilient contender in high-tech amidst volatile market conditions and revised corporate guidance signaling cautious yet optimistic revenue projections of JPY 14 billion.

- Dive into the specifics of Bengo4.comInc here with our thorough health report.

Gain insights into Bengo4.comInc's past trends and performance with our Past report.

Where To Now?

- Reveal the 1213 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2586

Dmall

An investment holding company, provides retail digitalization solutions to retailers in China, Hong Kong, Cambodia, Singapore, Malaysia, Poland, Macau, Indonesia, the Philippines, and Brunei.

Exceptional growth potential with imperfect balance sheet.

Market Insights

Community Narratives