Most Shareholders Will Probably Find That The CEO Compensation For SUNeVision Holdings Ltd. (HKG:1686) Is Reasonable

CEO Raymond Tong has done a decent job of delivering relatively good performance at SUNeVision Holdings Ltd. (HKG:1686) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 29 October 2021. Here is our take on why we think the CEO compensation looks appropriate.

See our latest analysis for SUNeVision Holdings

Comparing SUNeVision Holdings Ltd.'s CEO Compensation With the industry

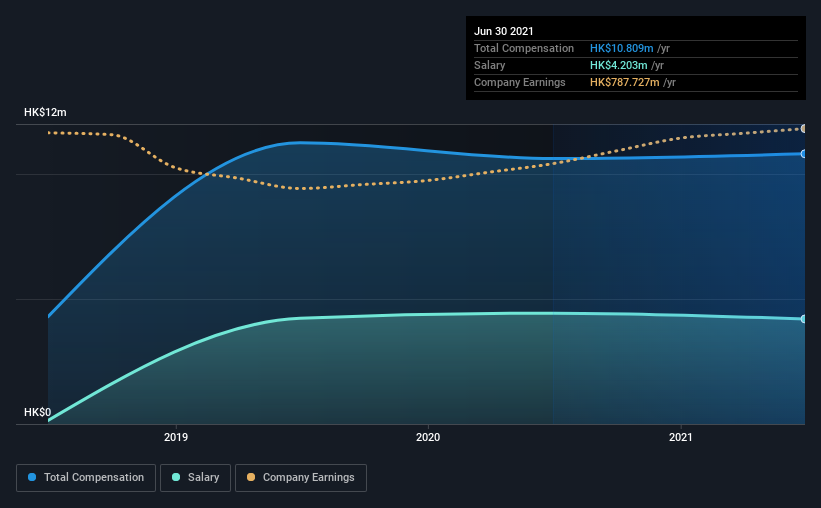

According to our data, SUNeVision Holdings Ltd. has a market capitalization of HK$30b, and paid its CEO total annual compensation worth HK$11m over the year to June 2021. This means that the compensation hasn't changed much from last year. We think total compensation is more important but our data shows that the CEO salary is lower, at HK$4.2m.

On examining similar-sized companies in the industry with market capitalizations between HK$16b and HK$50b, we discovered that the median CEO total compensation of that group was HK$11m. From this we gather that Raymond Tong is paid around the median for CEOs in the industry. Moreover, Raymond Tong also holds HK$1.5m worth of SUNeVision Holdings stock directly under their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$4.2m | HK$4.4m | 39% |

| Other | HK$6.6m | HK$6.2m | 61% |

| Total Compensation | HK$11m | HK$11m | 100% |

On an industry level, roughly 68% of total compensation represents salary and 32% is other remuneration. SUNeVision Holdings pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at SUNeVision Holdings Ltd.'s Growth Numbers

SUNeVision Holdings Ltd. saw earnings per share stay pretty flat over the last three years. In the last year, its revenue is up 9.3%.

We'd prefer higher revenue growth, but we're happy with the modest EPS growth. So there are some positives here, but not enough to earn high praise. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has SUNeVision Holdings Ltd. Been A Good Investment?

Most shareholders would probably be pleased with SUNeVision Holdings Ltd. for providing a total return of 77% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for SUNeVision Holdings that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1686

SUNeVision Holdings

An investment holding company, provides data centre and information technology (IT) facility services in Hong Kong.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026