Chanjet Information Technology (HKG:1588) jumps 11% this week, though earnings growth is still tracking behind one-year shareholder returns

Unfortunately, investing is risky - companies can and do go bankrupt. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Chanjet Information Technology Company Limited (HKG:1588) share price has soared 124% in the last 1 year. Most would be very happy with that, especially in just one year! It's also up 17% in about a month. However, the stock hasn't done so well in the longer term, with the stock only up 9.4% in three years.

Since it's been a strong week for Chanjet Information Technology shareholders, let's have a look at trend of the longer term fundamentals.

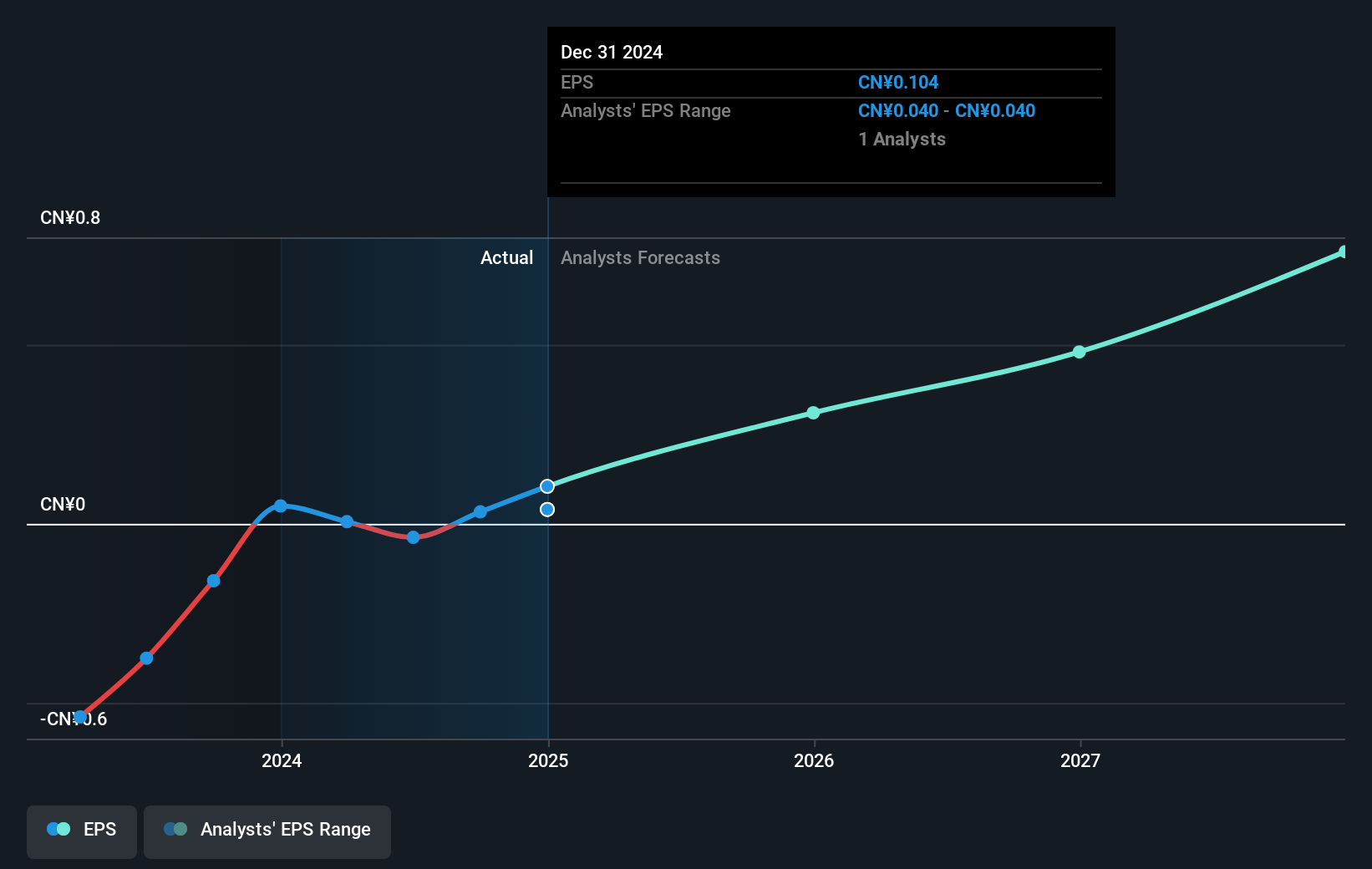

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Chanjet Information Technology went from making a loss to reporting a profit, in the last year.

The company was close to break-even last year, so earnings per share of CN¥0.10 isn't particularly stand out. But from the looks of the share price gain, the market is certainly pleased the company is now profitable. Some investors scan for companies that have just become profitable, since that's an important business development milestone.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Chanjet Information Technology has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Chanjet Information Technology stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Chanjet Information Technology has rewarded shareholders with a total shareholder return of 124% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 5% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before forming an opinion on Chanjet Information Technology you might want to consider these 3 valuation metrics.

We will like Chanjet Information Technology better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1588

Chanjet Information Technology

Engages in the cloud service and software businesses in Mainland China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives