- Hong Kong

- /

- Semiconductors

- /

- SEHK:981

Semiconductor Manufacturing International's (HKG:981) earnings growth rate lags the 13% CAGR delivered to shareholders

Semiconductor Manufacturing International Corporation (HKG:981) shareholders might be concerned after seeing the share price drop 14% in the last week. On the bright side the returns have been quite good over the last half decade. Its return of 81% has certainly bested the market return!

Since the long term performance has been good but there's been a recent pullback of 14%, let's check if the fundamentals match the share price.

See our latest analysis for Semiconductor Manufacturing International

SWOT Analysis for Semiconductor Manufacturing International

- Debt is not viewed as a risk.

- Earnings growth over the past year underperformed the Semiconductor industry.

- Expensive based on P/E ratio and estimated fair value.

- 981's financial characteristics indicate limited near-term opportunities for shareholders.

- Annual earnings are forecast to decline for the next 3 years.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

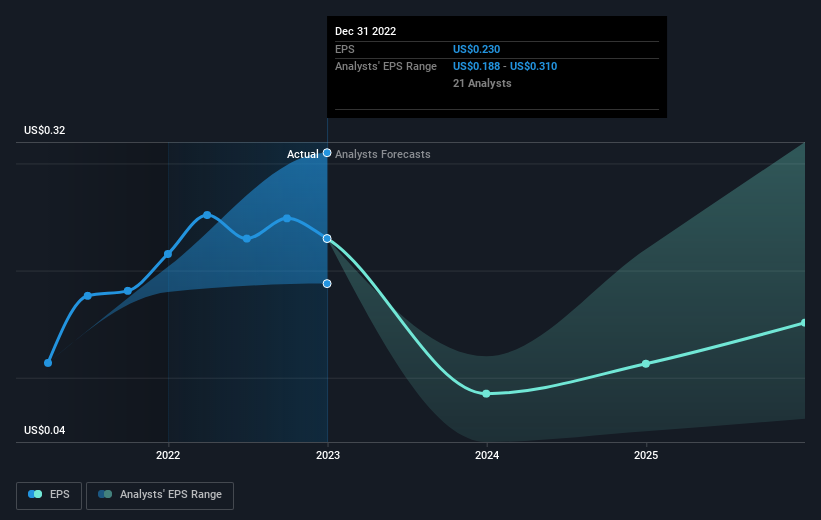

During five years of share price growth, Semiconductor Manufacturing International achieved compound earnings per share (EPS) growth of 43% per year. This EPS growth is higher than the 13% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. The reasonably low P/E ratio of 10.71 also suggests market apprehension.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Semiconductor Manufacturing International has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Semiconductor Manufacturing International stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Semiconductor Manufacturing International shareholders have received a total shareholder return of 27% over the last year. That's better than the annualised return of 13% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Semiconductor Manufacturing International that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:981

Semiconductor Manufacturing International

An investment holding company, engages in the manufacture, testing, and sale of integrated circuits wafer and various compound semiconductors in the United States, China, and Eurasia.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives