- Hong Kong

- /

- Semiconductors

- /

- SEHK:968

Xinyi Solar Holdings (HKG:968) Is Increasing Its Dividend To HK$0.17

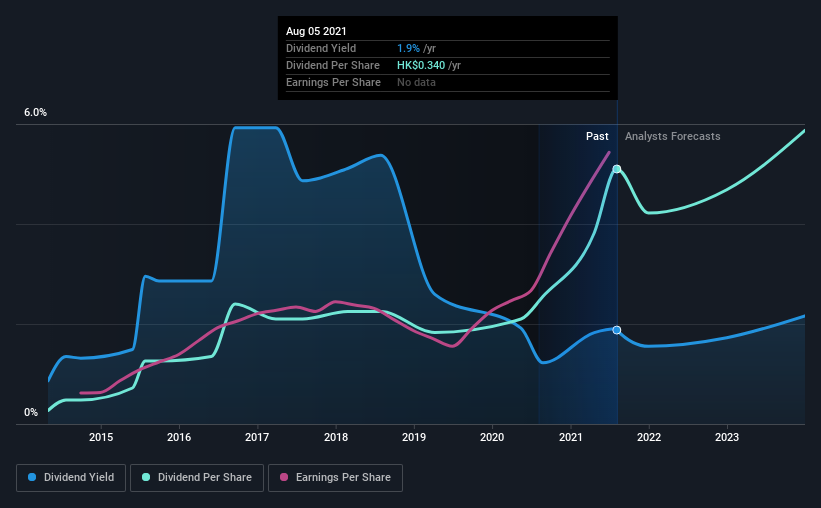

Xinyi Solar Holdings Limited's (HKG:968) dividend will be increasing to HK$0.17 on 21st of September. This takes the annual payment to 1.9% of the current stock price, which is about average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Xinyi Solar Holdings' stock price has increased by 76% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Xinyi Solar Holdings

Xinyi Solar Holdings' Payment Has Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Based on the last dividend, Xinyi Solar Holdings is earning enough to cover the payment, but the it makes up 161% of cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Over the next year, EPS is forecast to fall by 10.7%. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 63%, which is comfortable for the company to continue in the future.

Xinyi Solar Holdings' Dividend Has Lacked Consistency

Xinyi Solar Holdings has been paying dividends for a while, but the track record isn't stellar. This suggests that the dividend might not be the most reliable. Since 2014, the dividend has gone from HK$0.018 to HK$0.34. This implies that the company grew its distributions at a yearly rate of about 52% over that duration. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Xinyi Solar Holdings has seen EPS rising for the last five years, at 23% per annum. The company's earnings per share has grown rapidly in recent years, and it has a good balance between reinvesting and paying dividends to shareholders, so we think that Xinyi Solar Holdings could prove to be a strong dividend payer.

Our Thoughts On Xinyi Solar Holdings' Dividend

In summary, while it's always good to see the dividend being raised, we don't think Xinyi Solar Holdings' payments are rock solid. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think Xinyi Solar Holdings is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 2 warning signs for Xinyi Solar Holdings that investors should take into consideration. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:968

Xinyi Solar Holdings

An investment holding company, produces and sells solar glass products in Mainland China, rest of Asia, North America, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives