- Hong Kong

- /

- Semiconductors

- /

- SEHK:85

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of rate cuts and mixed economic signals, with the Nasdaq reaching new heights amidst broader index declines, investors are keenly focused on strategies that can offer stability and income. In such an environment, dividend stocks stand out as they provide regular income streams and potential resilience against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.24% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.32% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.00% | ★★★★★★ |

| Shaanxi International TrustLtd (SZSE:000563) | 3.16% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

China Electronics Huada Technology (SEHK:85)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Electronics Huada Technology Company Limited is an investment holding company that focuses on the design, development, and sale of integrated circuit chips in the People’s Republic of China, with a market cap of HK$2.56 billion.

Operations: The company's revenue is primarily derived from its integrated circuit chip segment, amounting to HK$2.57 billion.

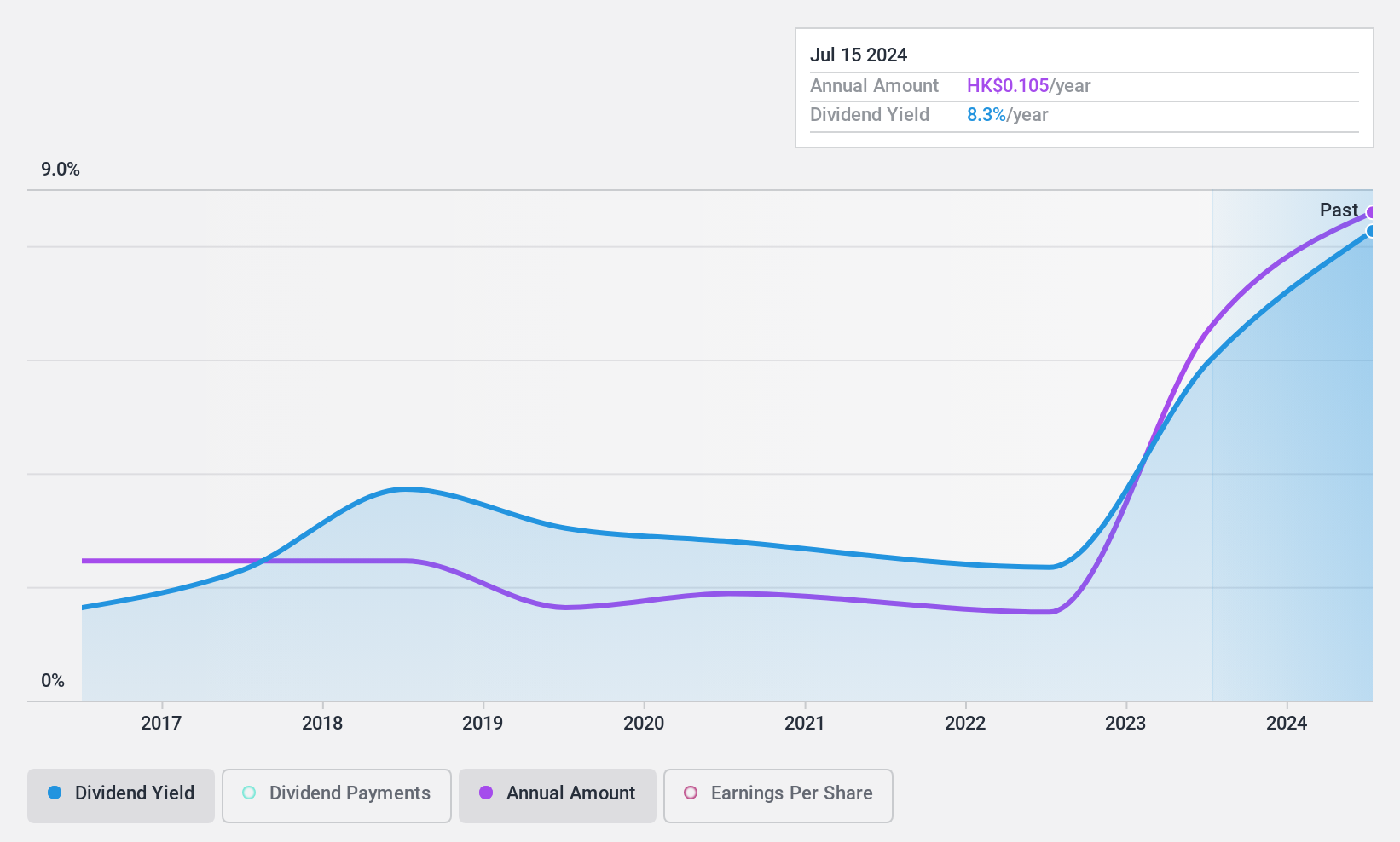

Dividend Yield: 8.3%

China Electronics Huada Technology's dividend payments are well-covered by earnings (48.1% payout ratio) and cash flows (37.6% cash payout ratio), but they have been volatile over the past decade, impacting reliability. Despite a strong dividend yield in the top 25% of Hong Kong payers, profit margins have declined from last year. Recent board changes include Mr. Fu Dan's appointment as a non-executive director, which may influence strategic direction amid fluctuating share prices.

- Delve into the full analysis dividend report here for a deeper understanding of China Electronics Huada Technology.

- According our valuation report, there's an indication that China Electronics Huada Technology's share price might be on the expensive side.

Toyota Tsusho (TSE:8015)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toyota Tsusho Corporation operates globally across various sectors including metals, parts and logistics, mobility, machinery, energy and projects, chemicals and electronics, as well as food and consumer services, with a market cap of ¥2.79 trillion.

Operations: Toyota Tsusho Corporation's revenue is derived from its diverse operations in metals, parts and logistics, mobility, machinery, energy and projects, chemicals and electronics, along with food and consumer services on a global scale.

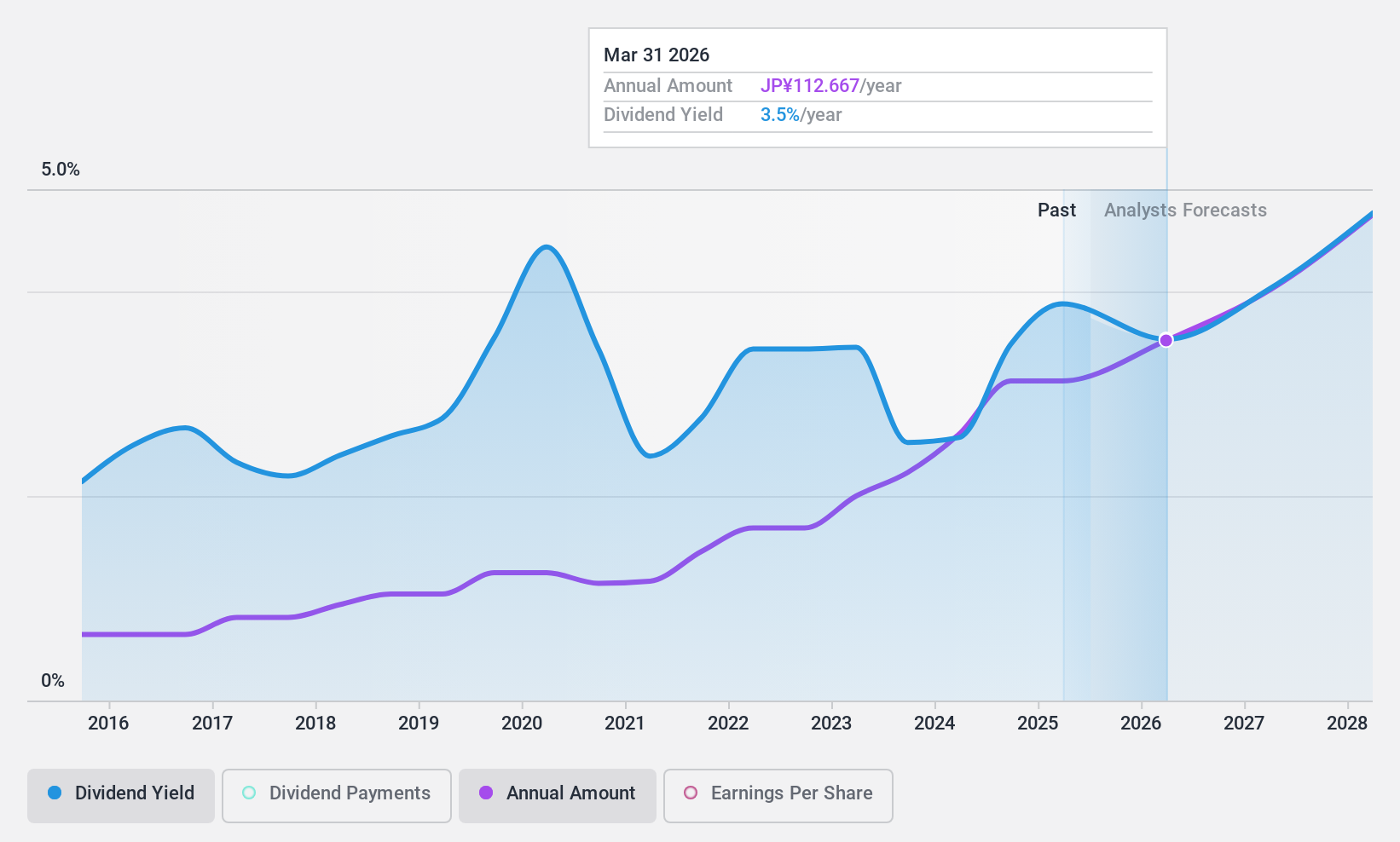

Dividend Yield: 3.8%

Toyota Tsusho's dividend payments, despite being volatile over the past decade, are well-covered by earnings (29.4% payout ratio) and cash flows (35.3% cash payout ratio). The company's earnings growth of 7.9% last year supports its dividend sustainability, though the yield is slightly below Japan's top 25%. Trading at a favorable price-to-earnings ratio of 8.3x compared to the market average of 13.4x, it presents good value despite high debt levels.

- Navigate through the intricacies of Toyota Tsusho with our comprehensive dividend report here.

- The analysis detailed in our Toyota Tsusho valuation report hints at an deflated share price compared to its estimated value.

Sanshin Electronics (TSE:8150)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sanshin Electronics Co., Ltd. engages in the sale and trade of electronic components and other devices both in Japan and internationally, with a market cap of ¥22.93 billion.

Operations: Sanshin Electronics Co., Ltd. generates revenue through its Device Segment, which accounts for ¥125.14 billion, and its Solution Segment, contributing ¥15.90 billion.

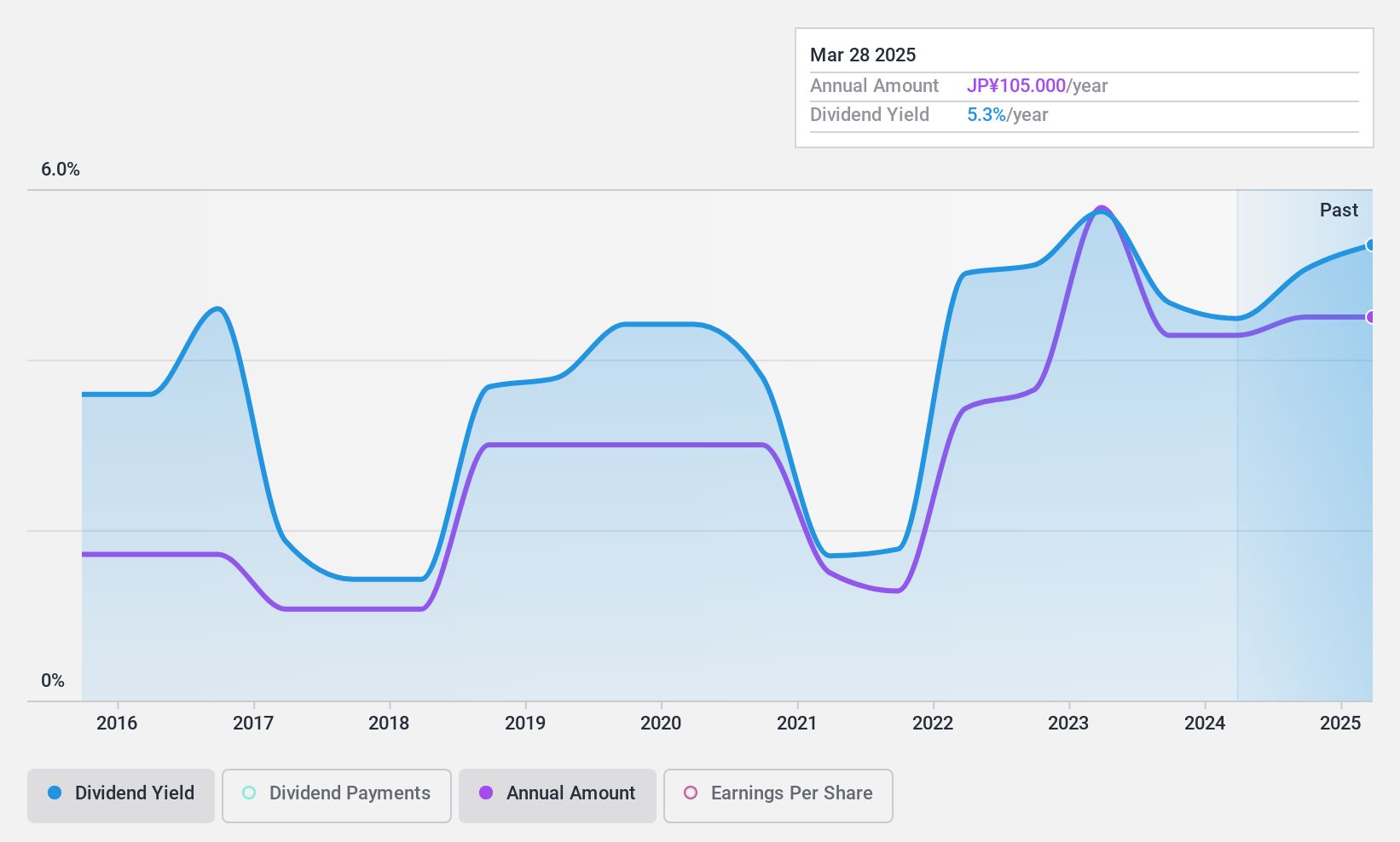

Dividend Yield: 5.6%

Sanshin Electronics offers a compelling dividend yield of 5.6%, placing it in the top quartile of Japanese dividend payers. The dividends are well-supported by both earnings and cash flows, with payout ratios at 43.5% and 20.8%, respectively, indicating sustainability. However, the company has a history of volatile and unreliable dividend payments over the past decade. Despite this instability, Sanshin is trading at a significant discount to its estimated fair value, suggesting potential investment appeal for value-focused investors.

- Dive into the specifics of Sanshin Electronics here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Sanshin Electronics is priced lower than what may be justified by its financials.

Key Takeaways

- Access the full spectrum of 1976 Top Dividend Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:85

China Electronics Huada Technology

An investment holding company, engages in the design, development, and sale of integrated circuit chips in the People’s Republic of China.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives