- Hong Kong

- /

- Semiconductors

- /

- SEHK:757

Solargiga Energy Holdings' (HKG:757) investors will be pleased with their incredible 604% return over the last three years

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. But when you hold the right stock for the right time period, the rewards can be truly huge. One such superstar is Solargiga Energy Holdings Limited (HKG:757), which saw its share price soar 461% in three years. It's even up 10.0% in the last week.

So let's assess the underlying fundamentals over the last 3 years and see if they've moved in lock-step with shareholder returns.

Check out our latest analysis for Solargiga Energy Holdings

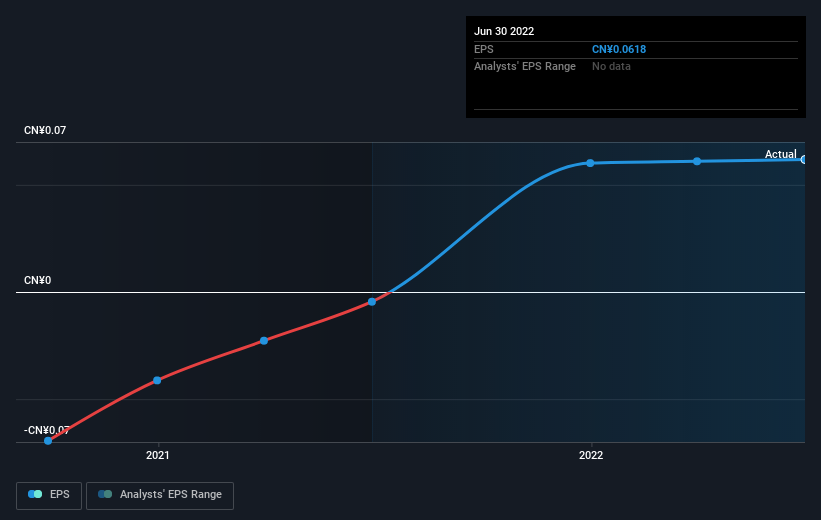

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Solargiga Energy Holdings became profitable within the last three years. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About The Total Shareholder Return (TSR)?

We've already covered Solargiga Energy Holdings' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Solargiga Energy Holdings' TSR of 604% over the last 3 years is better than the share price return.

A Different Perspective

We regret to report that Solargiga Energy Holdings shareholders are down 5.5% for the year. Unfortunately, that's worse than the broader market decline of 3.8%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Solargiga Energy Holdings better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Solargiga Energy Holdings , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:757

Solargiga Energy Holdings

An investment holding company, manufactures and sells downstream photovoltaic modules for the photovoltaic industry in Mainland China, Japan, Europe, Asia, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives