- Hong Kong

- /

- Semiconductors

- /

- SEHK:1347

Why Investors Shouldn't Be Surprised By Hua Hong Semiconductor Limited's (HKG:1347) 29% Share Price Surge

Hua Hong Semiconductor Limited (HKG:1347) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 65% in the last year.

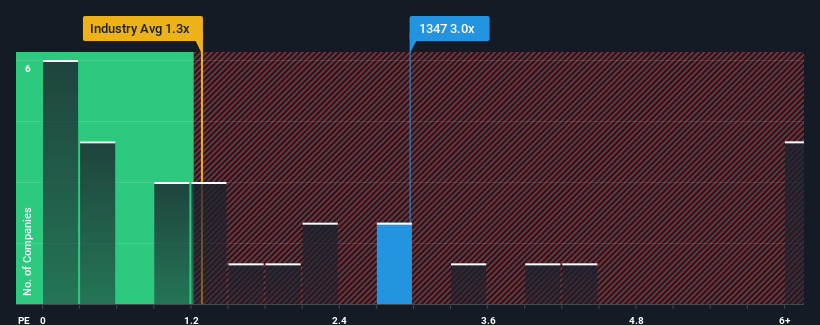

Since its price has surged higher, given close to half the companies operating in Hong Kong's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Hua Hong Semiconductor as a stock to potentially avoid with its 3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Hua Hong Semiconductor

How Hua Hong Semiconductor Has Been Performing

Hua Hong Semiconductor hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Hua Hong Semiconductor's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Hua Hong Semiconductor?

The only time you'd be truly comfortable seeing a P/S as high as Hua Hong Semiconductor's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 39% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 21% each year over the next three years. That's shaping up to be materially higher than the 17% each year growth forecast for the broader industry.

In light of this, it's understandable that Hua Hong Semiconductor's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Hua Hong Semiconductor's P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Hua Hong Semiconductor shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Hua Hong Semiconductor is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hua Hong Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1347

Hua Hong Semiconductor

An investment holding company, engages in the manufacture and sale of semiconductor products in China, North America, Asia, Europe, and Japan.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives