- Hong Kong

- /

- Semiconductors

- /

- SEHK:1010

Balk 1798 Group (HKG:1010) Takes On Some Risk With Its Use Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Balk 1798 Group Limited (HKG:1010) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Balk 1798 Group

What Is Balk 1798 Group's Net Debt?

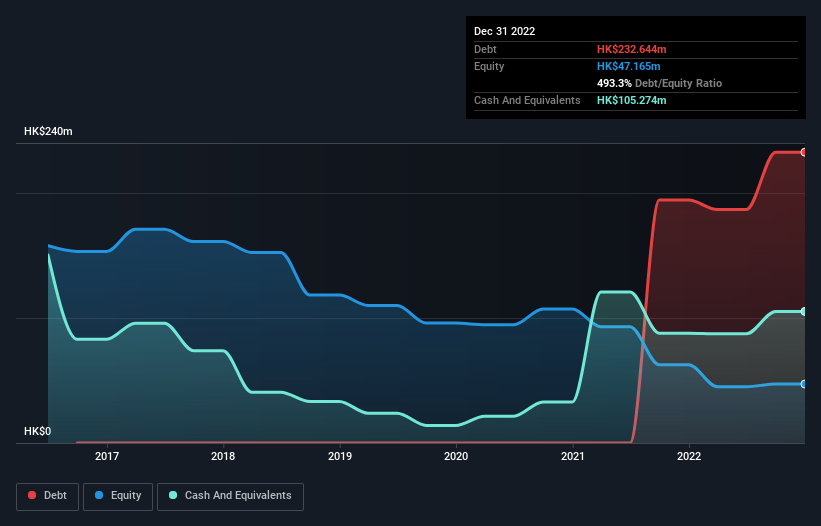

The image below, which you can click on for greater detail, shows that at December 2022 Balk 1798 Group had debt of HK$232.6m, up from HK$194.3m in one year. However, because it has a cash reserve of HK$105.3m, its net debt is less, at about HK$127.4m.

How Strong Is Balk 1798 Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Balk 1798 Group had liabilities of HK$413.9m due within 12 months and liabilities of HK$881.0k due beyond that. Offsetting this, it had HK$105.3m in cash and HK$141.6m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$167.9m.

Balk 1798 Group has a market capitalization of HK$322.1m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 1.6 times and a disturbingly high net debt to EBITDA ratio of 15.5 hit our confidence in Balk 1798 Group like a one-two punch to the gut. The debt burden here is substantial. However, the silver lining was that Balk 1798 Group achieved a positive EBIT of HK$7.3m in the last twelve months, an improvement on the prior year's loss. There's no doubt that we learn most about debt from the balance sheet. But it is Balk 1798 Group's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Balk 1798 Group recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

On the face of it, Balk 1798 Group's interest cover left us tentative about the stock, and its net debt to EBITDA was no more enticing than the one empty restaurant on the busiest night of the year. But at least its EBIT growth rate is not so bad. Looking at the bigger picture, it seems clear to us that Balk 1798 Group's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Balk 1798 Group (1 is potentially serious) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1010

Sky Blue 11

An investment holding company, engages in the design, distribution, and trade of integrated circuits and semiconductor parts in the People’s Republic of China, Hong Kong, and Taiwan.

Moderate risk and overvalued.

Market Insights

Community Narratives