- Hong Kong

- /

- Specialty Stores

- /

- SEHK:9992

If EPS Growth Is Important To You, Pop Mart International Group (HKG:9992) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Pop Mart International Group (HKG:9992). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Pop Mart International Group with the means to add long-term value to shareholders.

See our latest analysis for Pop Mart International Group

How Fast Is Pop Mart International Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Pop Mart International Group has managed to grow EPS by 23% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

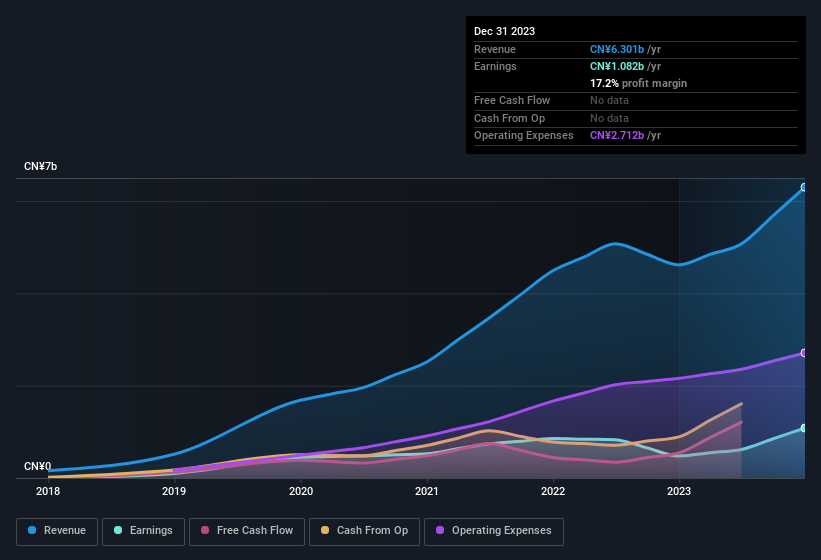

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Pop Mart International Group is growing revenues, and EBIT margins improved by 7.9 percentage points to 20%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Pop Mart International Group's future profits.

Are Pop Mart International Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for Pop Mart International Group, in the last year, is that a certain insider has buying shares with ample enthusiasm. In one big hit, COO, President of China Business & Executive Director De Si paid HK$10.0m, for shares at an average price of HK$18.83 per share. It doesn't get much better than that, in terms of large investments from insiders.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Pop Mart International Group insiders own more than a third of the company. In fact, they own 43% of the shares, making insiders a very influential shareholder group. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. at the current share price. That means they have plenty of their own capital riding on the performance of the business!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Ning Wang is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Pop Mart International Group, with market caps between CN¥29b and CN¥87b, is around CN¥6.7m.

The Pop Mart International Group CEO received total compensation of just CN¥1.4m in the year to December 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Pop Mart International Group Worth Keeping An Eye On?

You can't deny that Pop Mart International Group has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. Astute investors will want to keep this stock on watch. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Pop Mart International Group. You might benefit from giving it a glance today.

Keen growth investors love to see insider buying. Thankfully, Pop Mart International Group isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9992

Pop Mart International Group

An investment holding company, engages in the design, development, and sale of pop toys in the People’s Republic of China and internationally.

Exceptional growth potential with flawless balance sheet.