- Hong Kong

- /

- Specialty Stores

- /

- SEHK:8418

Further weakness as Optima Automobile Group Holdings (HKG:8418) drops 12% this week, taking three-year losses to 60%

Investing in stocks inevitably means buying into some companies that perform poorly. But the long term shareholders of Optima Automobile Group Holdings Limited (HKG:8418) have had an unfortunate run in the last three years. So they might be feeling emotional about the 60% share price collapse, in that time. And more recent buyers are having a tough time too, with a drop of 39% in the last year. The falls have accelerated recently, with the share price down 39% in the last three months.

With the stock having lost 12% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Optima Automobile Group Holdings

Optima Automobile Group Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over three years, Optima Automobile Group Holdings grew revenue at 26% per year. That's well above most other pre-profit companies. The share price has moved in quite the opposite direction, down 17% over that time, a bad result. It seems likely that the market is worried about the continual losses. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

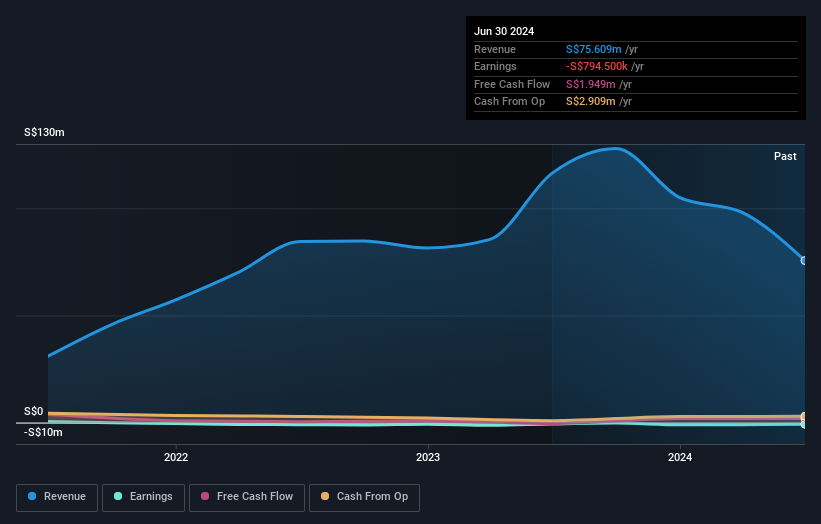

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Optima Automobile Group Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 31% in the last year, Optima Automobile Group Holdings shareholders lost 39%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 0.8% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Optima Automobile Group Holdings that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

If you're looking to trade Optima Automobile Group Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8418

Optima Automobile Group Holdings

An investment holding company, provides after-market automotive services in Singapore, the People’s Republic of China, and rest of Asian countries.

Excellent balance sheet very low.

Market Insights

Community Narratives