- Hong Kong

- /

- Retail Distributors

- /

- SEHK:8179

Palinda Group Holdings (HKG:8179) Seems To Be Using A Lot Of Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Palinda Group Holdings Limited (HKG:8179) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Palinda Group Holdings

What Is Palinda Group Holdings's Debt?

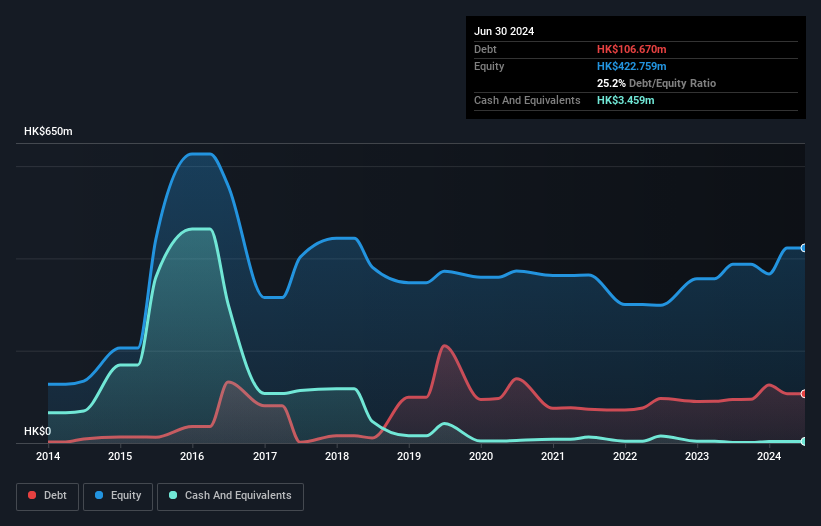

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Palinda Group Holdings had HK$106.7m of debt, an increase on HK$94.4m, over one year. On the flip side, it has HK$3.46m in cash leading to net debt of about HK$103.2m.

A Look At Palinda Group Holdings' Liabilities

We can see from the most recent balance sheet that Palinda Group Holdings had liabilities of HK$132.4m falling due within a year, and liabilities of HK$53.0k due beyond that. On the other hand, it had cash of HK$3.46m and HK$89.3m worth of receivables due within a year. So its liabilities total HK$39.7m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Palinda Group Holdings has a market capitalization of HK$150.5m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 0.61 times and a disturbingly high net debt to EBITDA ratio of 23.4 hit our confidence in Palinda Group Holdings like a one-two punch to the gut. The debt burden here is substantial. Even worse, Palinda Group Holdings saw its EBIT tank 91% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Palinda Group Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last two years, Palinda Group Holdings saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Palinda Group Holdings's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. Having said that, its ability to handle its total liabilities isn't such a worry. Overall, it seems to us that Palinda Group Holdings's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Palinda Group Holdings is showing 4 warning signs in our investment analysis , and 1 of those can't be ignored...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8179

Palinda Group Holdings

An investment holding company, engages in the sale and distribution of wine products and ancillary wine-related products in Hong Kong, the British Virgin Islands, and Australia.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026