- Hong Kong

- /

- Healthtech

- /

- SEHK:2158

January 2025's Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have shown resilience, with major U.S. stock indexes rebounding and value stocks outperforming growth shares, driven by easing core inflation and strong bank earnings. In the context of this positive market momentum, penny stocks—often smaller or newer companies—remain a niche yet promising area for investors seeking growth opportunities. While the term 'penny stock' may seem outdated, these investments can still offer significant potential when backed by solid financial health and strategic positioning in their respective industries.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.49B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.00 | HK$628.44M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.68 | HK$42.36B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.67 | £418.56M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.984 | £156.82M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.50 | £66.75M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.03M | ★★★★☆☆ |

| Starflex (SET:SFLEX) | THB2.64 | THB1.99B | ★★★★☆☆ |

Click here to see the full list of 5,705 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Yidu Tech (SEHK:2158)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yidu Tech Inc. is an investment holding company that offers healthcare solutions utilizing big data and artificial intelligence technologies across China, Brunei, Singapore, and other international markets, with a market cap of HK$4.51 billion.

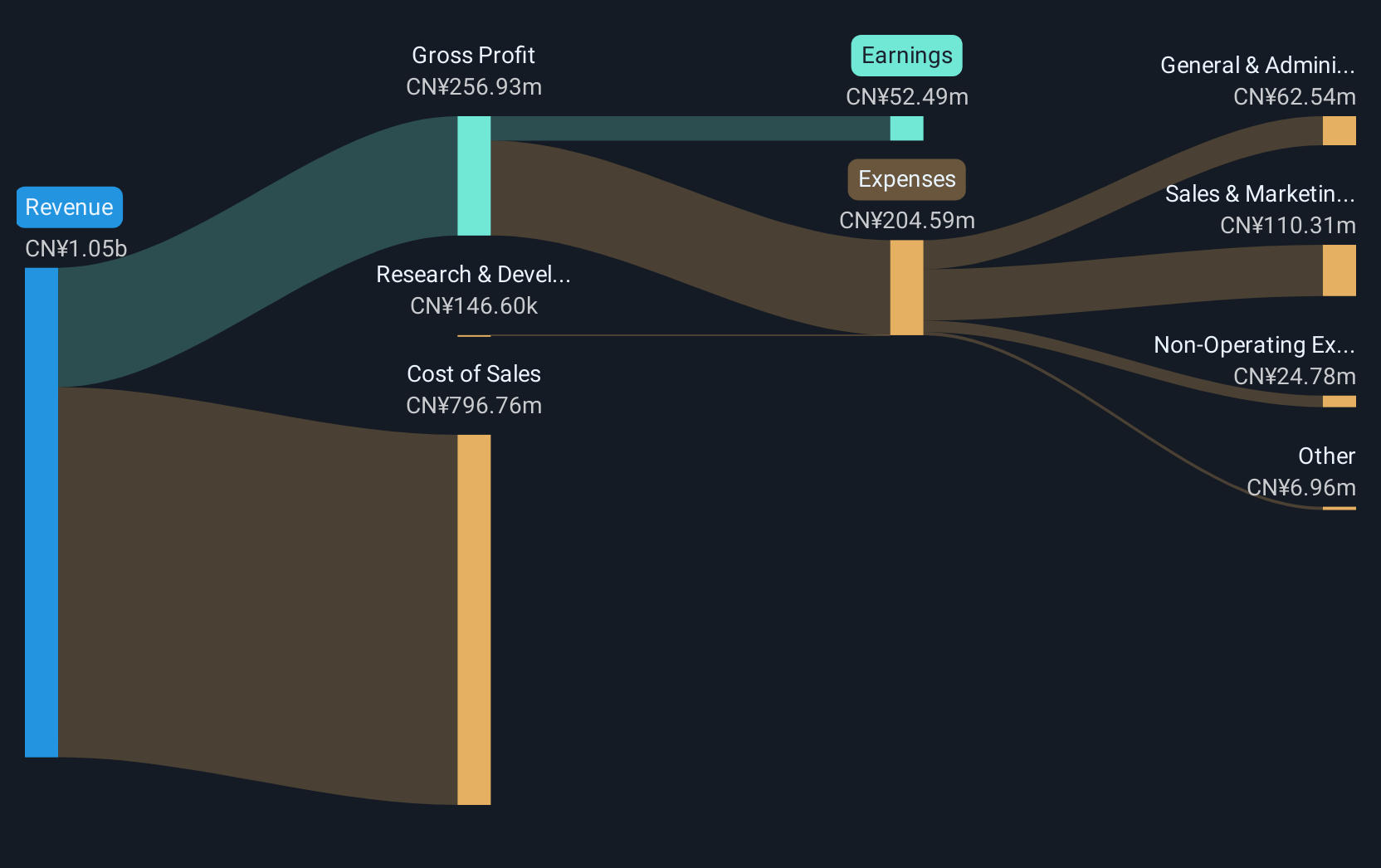

Operations: The company generates revenue from three main segments: Life Sciences Solutions (CN¥298.50 million), Big Data Platform and Solutions (CN¥319.37 million), and Health Management Platform and Solutions (CN¥162.18 million).

Market Cap: HK$4.51B

Yidu Tech Inc. is navigating the penny stock landscape with a focus on healthcare solutions powered by big data and AI, generating revenue across three segments totaling CN¥780.05 million. Despite being unprofitable, Yidu Tech has reduced its losses significantly over the past five years, showing promise in its financial trajectory. The company maintains a strong cash position with short-term assets exceeding liabilities and a sufficient cash runway for more than three years. Recent activities include completing a share buyback program and reporting improved net loss figures for the half-year ended September 30, 2024, compared to the previous year.

- Click here to discover the nuances of Yidu Tech with our detailed analytical financial health report.

- Gain insights into Yidu Tech's future direction by reviewing our growth report.

CStone Pharmaceuticals (SEHK:2616)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CStone Pharmaceuticals is a biopharmaceutical company focused on researching, developing, and commercializing immuno-oncology and precision medicines for cancer patients in China and internationally, with a market cap of HK$2.76 billion.

Operations: The company generates revenue from its pharmaceuticals segment, amounting to CN¥456.53 million.

Market Cap: HK$2.76B

CStone Pharmaceuticals, with a market cap of HK$2.76 billion, is advancing its biopharmaceutical endeavors despite being unprofitable. The company has shown revenue growth from its pharmaceuticals segment totaling CN¥456.53 million and possesses a robust cash runway exceeding three years. Recent strategic moves include the appointment of Ms. Yip Betty Ho to the board and significant progress in clinical trials for CS2009 and CS5001, promising assets in their Pipeline 2.0 aimed at treating various cancers. CStone's strategic collaboration with Pharmalink enhances their commercial reach within the Middle East and North Africa regions for sugemalimab, further bolstering their pipeline potential.

- Navigate through the intricacies of CStone Pharmaceuticals with our comprehensive balance sheet health report here.

- Explore CStone Pharmaceuticals' analyst forecasts in our growth report.

Fortune Ng Fung Food (Hebei)Ltd (SHSE:600965)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fortune Ng Fung Food (Hebei) Co., Ltd operates in the beef cattle breeding, slaughtering, and food processing sectors in China and internationally, with a market cap of CN¥3.33 billion.

Operations: Fortune Ng Fung Food (Hebei) Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥3.33B

Fortune Ng Fung Food (Hebei) Co., Ltd, with a market cap of CN¥3.33 billion, operates in the beef cattle sector but faces challenges as it is currently unprofitable. The company reported declining sales and net income for the nine months ending September 2024, with revenues at CN¥708.1 million compared to CN¥837.67 million the previous year. Despite this, its financial position remains relatively stable; short-term assets exceed liabilities and debt is well covered by operating cash flow. Additionally, Fortune Ng Fung's board has an experienced tenure of 3.7 years on average, indicating potential management stability amidst financial hurdles.

- Jump into the full analysis health report here for a deeper understanding of Fortune Ng Fung Food (Hebei)Ltd.

- Gain insights into Fortune Ng Fung Food (Hebei)Ltd's historical outcomes by reviewing our past performance report.

Key Takeaways

- Click here to access our complete index of 5,705 Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2158

Yidu Tech

An investment holding company, provides healthcare solutions built on big data and artificial intelligence (AI) technologies in the People’s Republic of China, Brunei, Singapore, and internationally.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives