- Hong Kong

- /

- Specialty Stores

- /

- SEHK:590

Here's Why Shareholders May Want To Be Cautious With Increasing Luk Fook Holdings (International) Limited's (HKG:590) CEO Pay Packet

Share price growth at Luk Fook Holdings (International) Limited (HKG:590) has remained rather flat over the last few years and it may be because earnings has struggled to grow at all. Some of these issues will occupy shareholders' minds as the AGM rolls around on 19 August 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

View our latest analysis for Luk Fook Holdings (International)

How Does Total Compensation For Wai Sheung Wong Compare With Other Companies In The Industry?

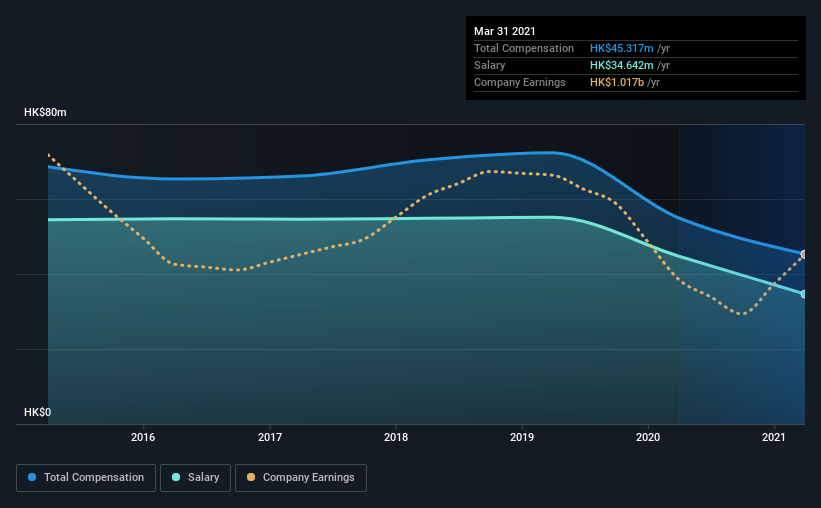

According to our data, Luk Fook Holdings (International) Limited has a market capitalization of HK$14b, and paid its CEO total annual compensation worth HK$45m over the year to March 2021. That's a notable decrease of 18% on last year. In particular, the salary of HK$34.6m, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between HK$7.8b and HK$25b, we discovered that the median CEO total compensation of that group was HK$16m. Accordingly, our analysis reveals that Luk Fook Holdings (International) Limited pays Wai Sheung Wong north of the industry median. What's more, Wai Sheung Wong holds HK$201m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$35m | HK$45m | 76% |

| Other | HK$11m | HK$10m | 24% |

| Total Compensation | HK$45m | HK$55m | 100% |

Talking in terms of the industry, salary represented approximately 88% of total compensation out of all the companies we analyzed, while other remuneration made up 12% of the pie. Luk Fook Holdings (International) pays a modest slice of remuneration through salary, as compared to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Luk Fook Holdings (International) Limited's Growth

Luk Fook Holdings (International) Limited has reduced its earnings per share by 9.4% a year over the last three years. In the last year, its revenue is down 21%.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Luk Fook Holdings (International) Limited Been A Good Investment?

Luk Fook Holdings (International) Limited has not done too badly by shareholders, with a total return of 1.4%, over three years. It would be nice to see that metric improve in the future. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

While it's true that the share price growth hasn't been bad, it's hard to overlook the lack of earnings growth and this makes us question whether there will be any strong catalyst for the stock to improve. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Luk Fook Holdings (International) that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Luk Fook Holdings (International), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:590

Luk Fook Holdings (International)

An investment holding company, engages in sourcing, designing, wholesaling, trademark licensing, and retailing various gold and platinum jewelry, and gem-set jewelry products.

Flawless balance sheet, undervalued and pays a dividend.