- Hong Kong

- /

- Specialty Stores

- /

- SEHK:590

Here's Why Luk Fook Holdings (International) (HKG:590) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Luk Fook Holdings (International) (HKG:590). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Luk Fook Holdings (International) with the means to add long-term value to shareholders.

View our latest analysis for Luk Fook Holdings (International)

How Quickly Is Luk Fook Holdings (International) Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Impressively, Luk Fook Holdings (International) has grown EPS by 33% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

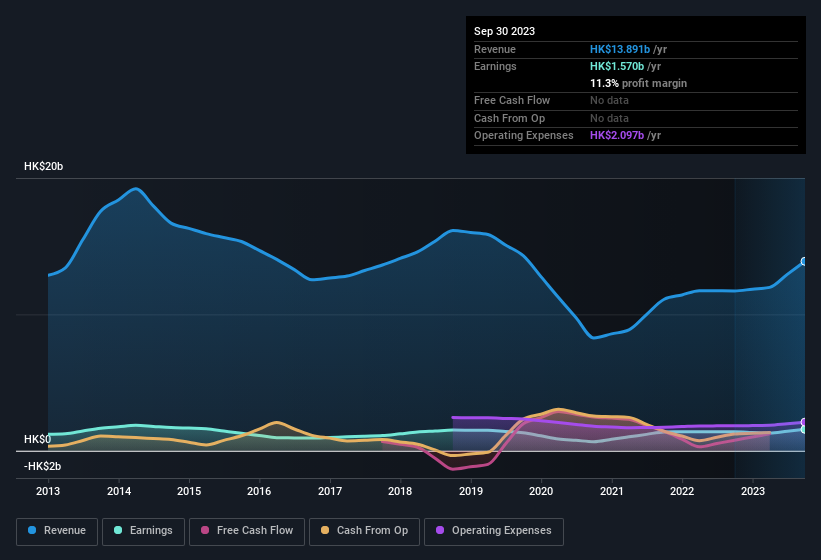

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Luk Fook Holdings (International) remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 19% to HK$14b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Luk Fook Holdings (International)'s future profits.

Are Luk Fook Holdings (International) Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Although we did see some insider selling (worth HK$1.2m) this was overshadowed by a mountain of buying, totalling HK$10m in just one year. This bodes well for Luk Fook Holdings (International) as it highlights the fact that those who are important to the company having a lot of faith in its future. It is also worth noting that it was Founder Wai Sheung Wong who made the biggest single purchase, worth HK$6.5m, paying HK$19.54 per share.

On top of the insider buying, it's good to see that Luk Fook Holdings (International) insiders have a valuable investment in the business. As a matter of fact, their holding is valued at HK$252m. That's a lot of money, and no small incentive to work hard. Despite being just 2.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Luk Fook Holdings (International) Worth Keeping An Eye On?

You can't deny that Luk Fook Holdings (International) has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. These things considered, this is one stock worth watching. Still, you should learn about the 1 warning sign we've spotted with Luk Fook Holdings (International).

The good news is that Luk Fook Holdings (International) is not the only growth stock with insider buying. Here's a list of growth-focused companies in HK with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:590

Luk Fook Holdings (International)

An investment holding company, engages in sourcing, designing, wholesaling, trademark licensing, and retailing various gold and platinum jewelry, and gem-set jewelry products in Hong Kong and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives