- Hong Kong

- /

- Specialty Stores

- /

- SEHK:493

Not Many Are Piling Into GOME Retail Holdings Limited (HKG:493) Stock Yet As It Plummets 31%

GOME Retail Holdings Limited (HKG:493) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

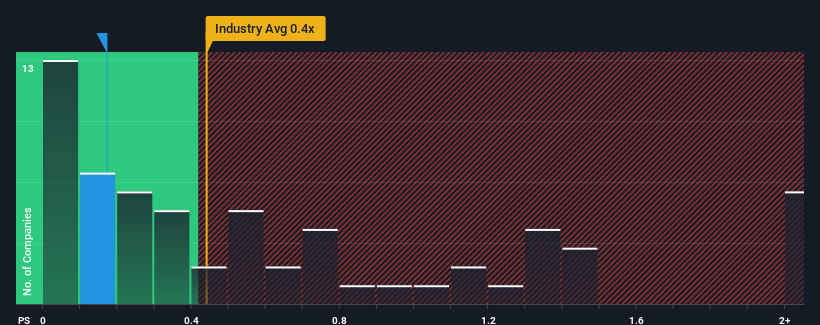

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about GOME Retail Holdings' P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Specialty Retail industry in Hong Kong is also close to 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for GOME Retail Holdings

How GOME Retail Holdings Has Been Performing

While the industry has experienced revenue growth lately, GOME Retail Holdings' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on GOME Retail Holdings.How Is GOME Retail Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, GOME Retail Holdings would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 62%. The last three years don't look nice either as the company has shrunk revenue by 71% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 188% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 47%, which is noticeably less attractive.

In light of this, it's curious that GOME Retail Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From GOME Retail Holdings' P/S?

Following GOME Retail Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at GOME Retail Holdings' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 4 warning signs for GOME Retail Holdings (2 are significant!) that you need to take into consideration.

If these risks are making you reconsider your opinion on GOME Retail Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:493

GOME Retail Holdings

Operates and manages retail stores for electrical appliances, consumer electronic products, and general merchandise in the People’s Republic of China.

Low with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives