- Hong Kong

- /

- Retail Distributors

- /

- SEHK:370

Asian Market Insights C-MER Medical Holdings And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As trade tensions between the U.S. and China show signs of easing, Asian markets have experienced a positive shift in sentiment, with key indices reflecting modest gains. In this context, penny stocks—despite their somewhat outdated label—remain a relevant area for investors seeking potential value in smaller or newer companies. These stocks can offer affordability and growth potential when underpinned by strong financial foundations, making them an intriguing option for those looking to uncover hidden opportunities within the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.86 | THB3.01B | ✅ 4 ⚠️ 3 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.56 | THB1.62B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.098 | SGD41.65M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.191 | SGD38.05M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.22 | SGD8.74B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.02 | HK$46.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.08 | HK$681.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.11 | HK$1.85B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.93 | HK$1.61B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,165 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

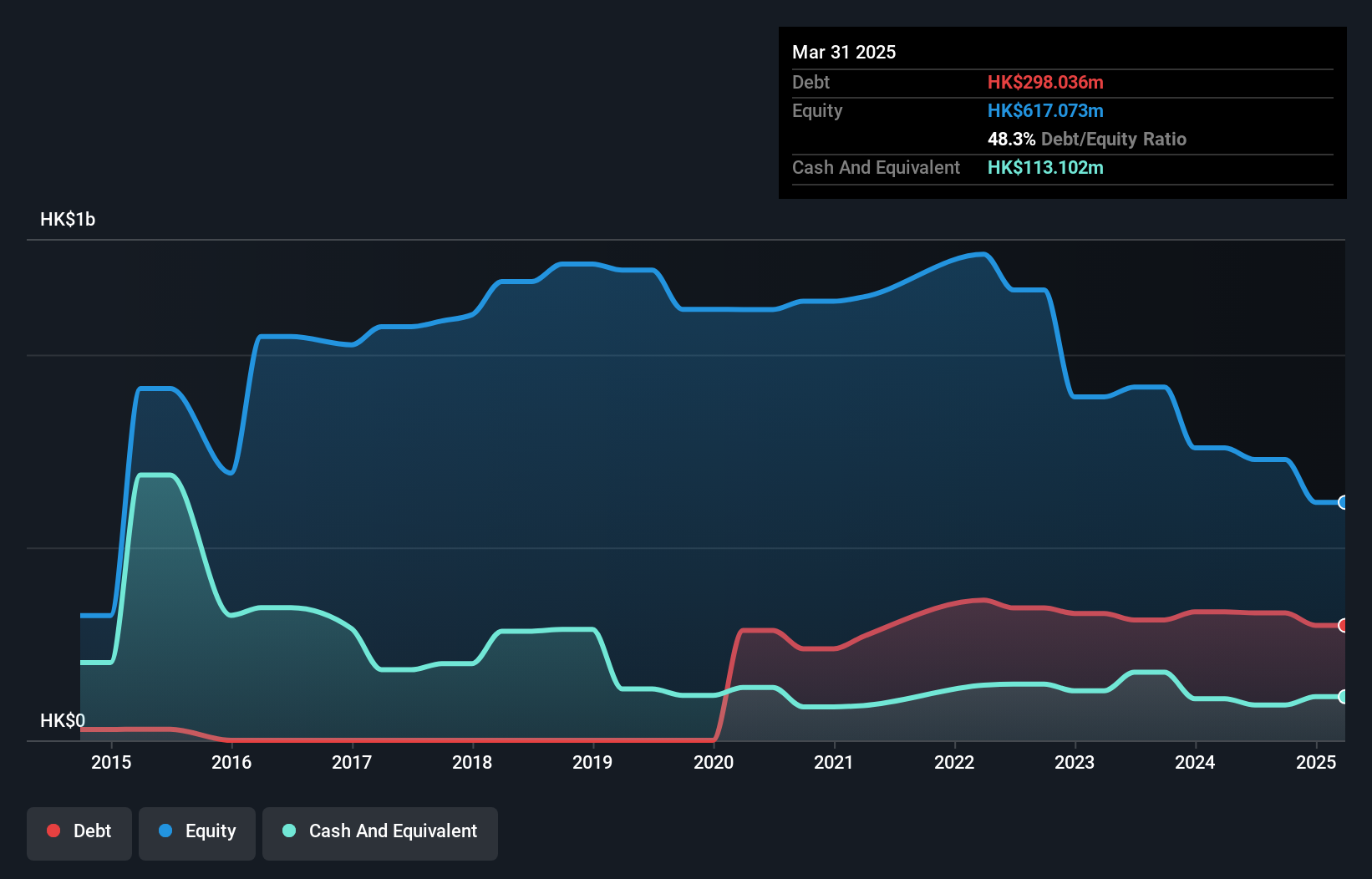

C-MER Medical Holdings (SEHK:3309)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: C-MER Medical Holdings Limited operates as an investment holding company offering ophthalmic services under the C-MER Dennis Lam brand in Hong Kong and Mainland China, with a market cap of HK$2.04 billion.

Operations: C-MER Medical Holdings Limited generates revenue from its Hong Kong medical business (HK$901.59 million), Mainland China dental services (HK$464.58 million), and ophthalmic operations in Mainland China (HK$546.99 million).

Market Cap: HK$2.04B

C-MER Medical Holdings Limited, with a market cap of HK$2.04 billion, faces challenges typical of penny stocks, such as recent unprofitability and increasing losses over the past five years. Despite this, its operating cash flow significantly covers debt obligations, indicating financial resilience. The company's revenue streams from Hong Kong and Mainland China medical services total HK$1.91 billion for 2024 but have slightly decreased compared to the previous year due to competitive pressures and weakened consumer sentiment. Recent impairments have led to a net loss of HK$135.16 million for 2024 despite proposing a modest dividend payout for shareholders in mid-2025.

- Click here to discover the nuances of C-MER Medical Holdings with our detailed analytical financial health report.

- Understand C-MER Medical Holdings' track record by examining our performance history report.

China Best Group Holding (SEHK:370)

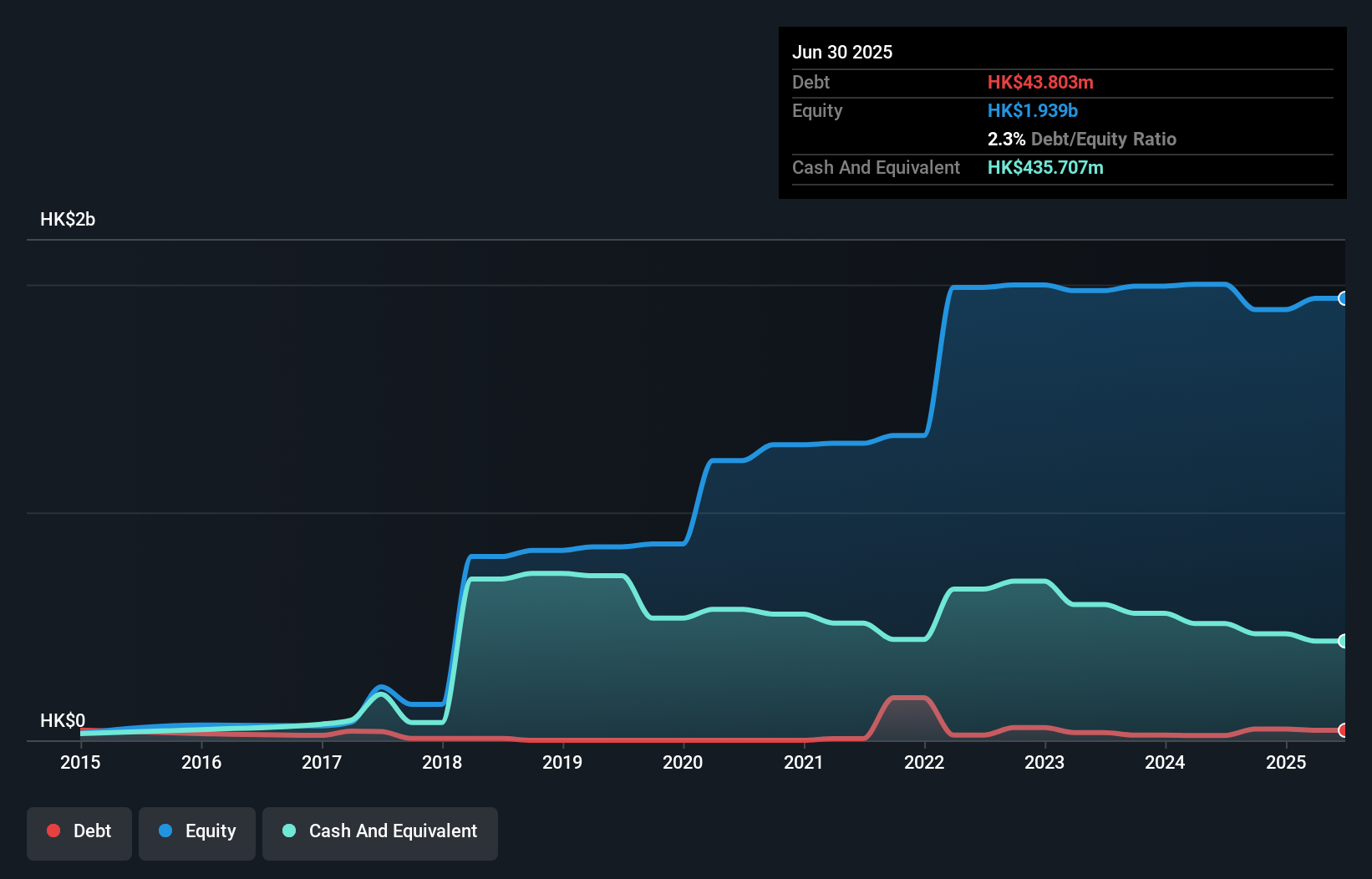

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Best Group Holding Limited is an investment holding company that trades in electronic appliances across the People’s Republic of China, Singapore, and Hong Kong, with a market capitalization of HK$2.07 billion.

Operations: The company's revenue is derived from several segments: Building Construction Contracting (HK$72.40 million), Centralised Heating (HK$50.07 million), Geothermal Energy (HK$16.87 million), Customised Technical Support (HK$14.87 million), Property Investment (HK$6.32 million), and Money Lending (HK$6.98 million).

Market Cap: HK$2.07B

China Best Group Holding, with a market cap of HK$2.07 billion, is navigating the complexities of penny stocks through strategic diversification and partnerships. The company has recently entered into agreements to develop a wellness park in Jiangsu Province and a joint venture for humanoid robotics in Hong Kong, highlighting its shift towards digital-oriented services amid real estate challenges in China. Despite being unprofitable with increasing losses over five years, it maintains a satisfactory net debt to equity ratio of 32.8% and sufficient cash runway for over three years due to positive free cash flow growth.

- Click to explore a detailed breakdown of our findings in China Best Group Holding's financial health report.

- Explore historical data to track China Best Group Holding's performance over time in our past results report.

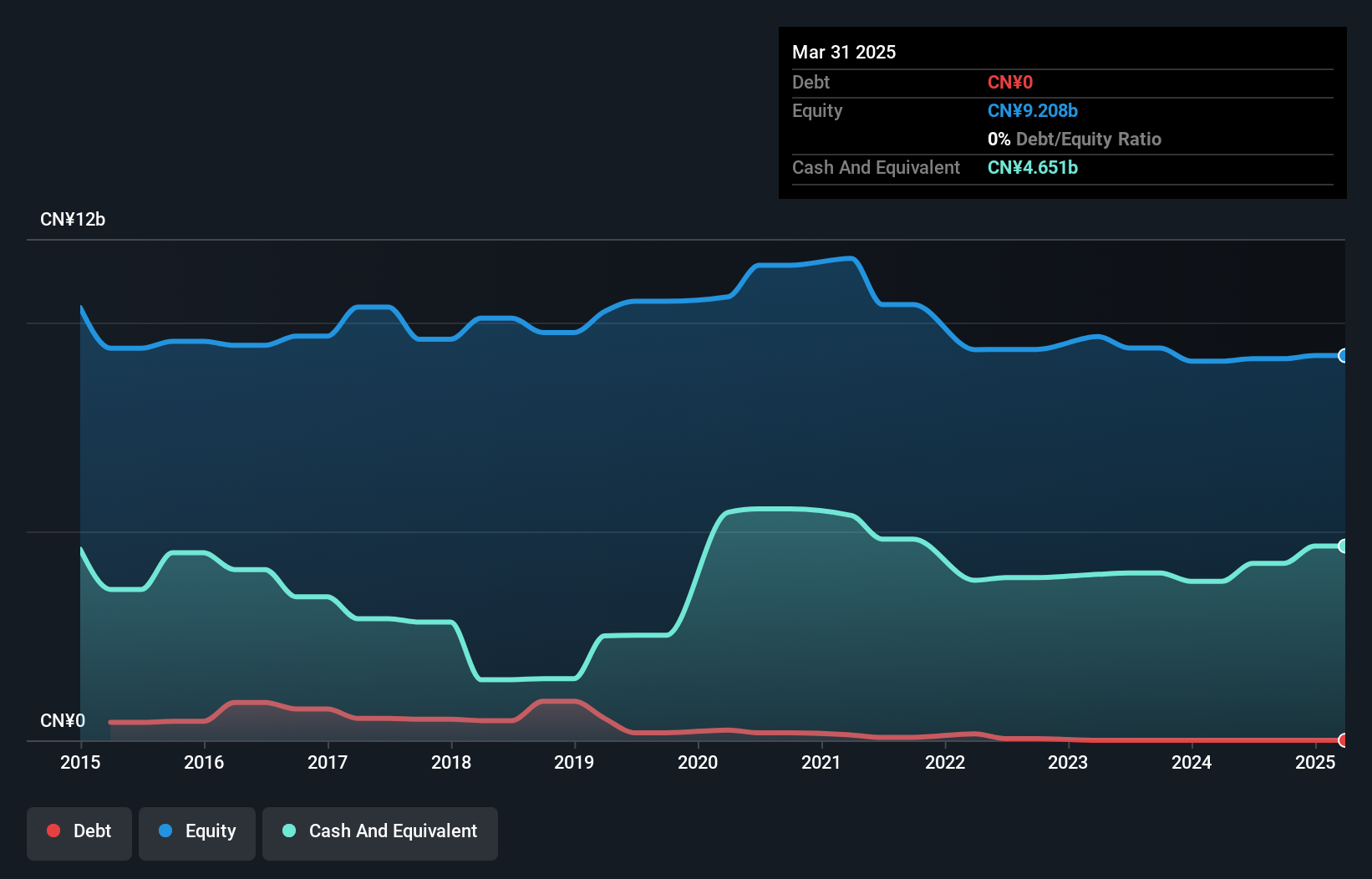

China Dongxiang (Group) (SEHK:3818)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Dongxiang (Group) Co., Ltd. operates in the design, development, marketing, and sale of sport-related apparel, footwear, and accessories both in China and internationally with a market cap of approximately HK$2.23 billion.

Operations: The company generates revenue from its China-Apparel segment, which amounted to CN¥1.72 billion.

Market Cap: HK$2.23B

China Dongxiang (Group) Co., Ltd., with a market cap of HK$2.23 billion, faces challenges typical of penny stocks, including unprofitability and increasing losses over five years at a rate of 42% annually. Despite these hurdles, the company benefits from strong liquidity; its short-term assets (CN¥4.9 billion) comfortably cover both short-term and long-term liabilities. The absence of debt further alleviates financial pressure, though its dividend yield of 7.42% is not supported by earnings or free cash flow. Management and board stability provide some operational continuity amid efforts to improve profitability in the competitive sports apparel sector.

- Jump into the full analysis health report here for a deeper understanding of China Dongxiang (Group).

- Examine China Dongxiang (Group)'s past performance report to understand how it has performed in prior years.

Where To Now?

- Click this link to deep-dive into the 1,165 companies within our Asian Penny Stocks screener.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Robotics Group Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:370

Hong Kong Robotics Group Holding

An investment holding company, trades in electronic appliances in the People’s Republic of China, Singapore, and Hong Kong.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives