- Hong Kong

- /

- Specialty Stores

- /

- SEHK:2473

XXF Group Holdings Limited's (HKG:2473) P/E Is Still On The Mark Following 32% Share Price Bounce

XXF Group Holdings Limited (HKG:2473) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

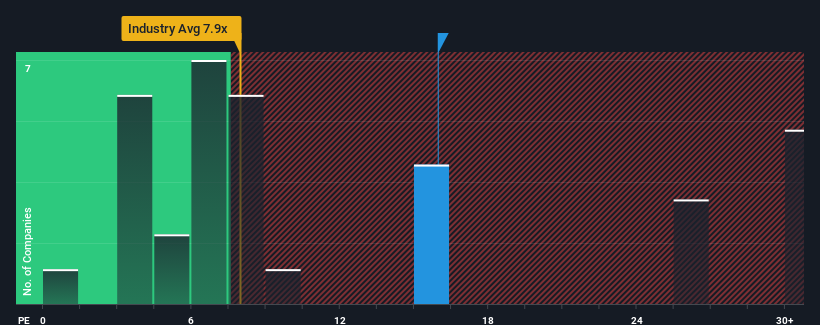

After such a large jump in price, XXF Group Holdings may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 16x, since almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 5x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

The earnings growth achieved at XXF Group Holdings over the last year would be more than acceptable for most companies. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for XXF Group Holdings

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as XXF Group Holdings' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 30% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 454% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 21% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's understandable that XXF Group Holdings' P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

What We Can Learn From XXF Group Holdings' P/E?

The strong share price surge has got XXF Group Holdings' P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that XXF Group Holdings maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for XXF Group Holdings you should be aware of, and 1 of them is significant.

Of course, you might also be able to find a better stock than XXF Group Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2473

XXF Group Holdings

An automobile retailer, provides automobile finance lease services primarily through self-operated sales outlets in the People’s Republic of China.

Questionable track record with imperfect balance sheet.