- Hong Kong

- /

- Specialty Stores

- /

- SEHK:2337

United Strength Power Holdings (HKG:2337) Shareholders Have Enjoyed A 76% Share Price Gain

By buying an index fund, investors can approximate the average market return. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, United Strength Power Holdings Limited (HKG:2337) shareholders have seen the share price rise 76% over three years, well in excess of the market decline (9.1%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 35% , including dividends .

Check out our latest analysis for United Strength Power Holdings

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years of share price growth, United Strength Power Holdings actually saw its earnings per share (EPS) drop 20% per year.

This means it's unlikely the market is judging the company based on earnings growth. Given this situation, it makes sense to look at other metrics too.

The modest 1.1% dividend yield is unlikely to be propping up the share price. You can only imagine how long term shareholders feel about the declining revenue trend (slipping at per year). The only thing that's clear is there is low correlation between United Strength Power Holdings' share price and its historic fundamental data. Further research may be required!

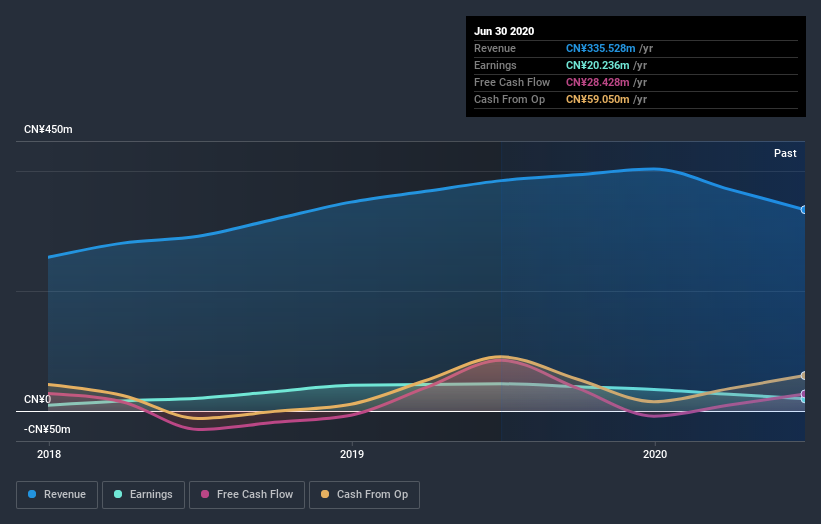

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of United Strength Power Holdings' earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for United Strength Power Holdings the TSR over the last 3 years was 84%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Pleasingly, United Strength Power Holdings' total shareholder return last year was 35%. And yes, that does include the dividend. That's better than the annualized TSR of 23% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting United Strength Power Holdings on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for United Strength Power Holdings (of which 1 is potentially serious!) you should know about.

United Strength Power Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading United Strength Power Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade United Strength Power Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:2337

United Strength Power Holdings

An investment holding company, operates vehicle natural gas refueling stations in the People's Republic of China.

Proven track record with mediocre balance sheet.