- Hong Kong

- /

- Specialty Stores

- /

- SEHK:2209

Is YesAsia Holdings (HKG:2209) In A Good Position To Deliver On Growth Plans?

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether YesAsia Holdings (HKG:2209) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for YesAsia Holdings

How Long Is YesAsia Holdings' Cash Runway?

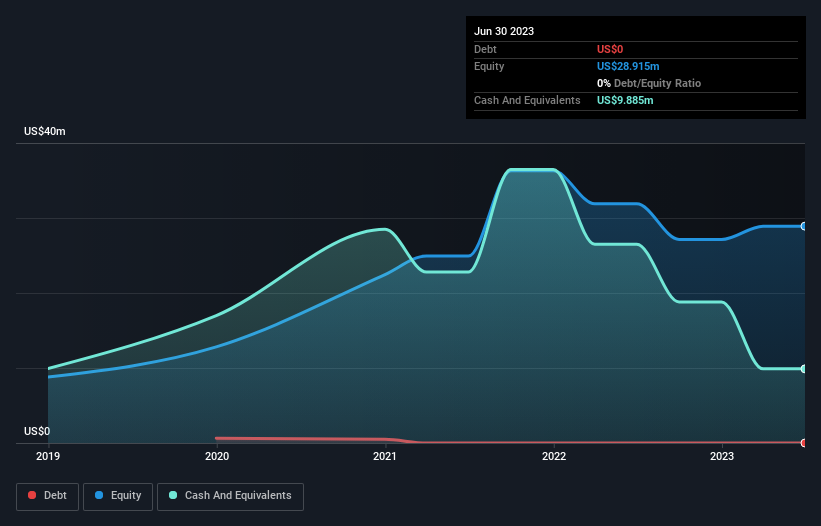

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at June 2023, YesAsia Holdings had cash of US$9.9m and no debt. Importantly, its cash burn was US$11m over the trailing twelve months. Therefore, from June 2023 it had roughly 11 months of cash runway. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. The image below shows how its cash balance has been changing over the last few years.

How Well Is YesAsia Holdings Growing?

It was quite stunning to see that YesAsia Holdings increased its cash burn by 294% over the last year. That does give us pause, and we can't take much solace in the operating revenue growth of 14% in the same time frame. Considering both these metrics, we're a little concerned about how the company is developing. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic earnings and revenue shows how YesAsia Holdings is building its business over time.

How Easily Can YesAsia Holdings Raise Cash?

Given the trajectory of YesAsia Holdings' cash burn, many investors will already be thinking about how it might raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

YesAsia Holdings' cash burn of US$11m is about 33% of its US$34m market capitalisation. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

How Risky Is YesAsia Holdings' Cash Burn Situation?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought YesAsia Holdings' revenue growth was relatively promising. Considering all the measures mentioned in this report, we reckon that its cash burn is fairly risky, and if we held shares we'd be watching like a hawk for any deterioration. On another note, YesAsia Holdings has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course YesAsia Holdings may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking to trade YesAsia Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2209

YesAsia Holdings

An investment holding company, engages in the procurement, sale, and trading of Asian fashion and lifestyle, beauty, cosmetics, accessories, and entertainment products.

Exceptional growth potential with flawless balance sheet.