The recent agreement between the U.S. and China to pause tariffs has brought a wave of optimism across global markets, including in Asia, where investors are keenly observing potential opportunities. As market conditions shift, penny stocks—though an antiquated term—continue to represent smaller or emerging companies that may hold significant value for those looking beyond established giants. This article will explore three Asian penny stocks that exhibit financial strength and potential growth prospects amidst the current economic climate.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| North East Rubber (SET:NER) | THB4.30 | THB7.95B | ✅ 5 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.10 | SGD42.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.181 | SGD36.06M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.13 | SGD8.38B | ✅ 5 ⚠️ 0 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.14 | SGD861.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.91 | HK$3.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.51 | HK$51.63B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.28 | HK$2.14B | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,167 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

YesAsia Holdings (SEHK:2209)

Simply Wall St Financial Health Rating: ★★★★★★

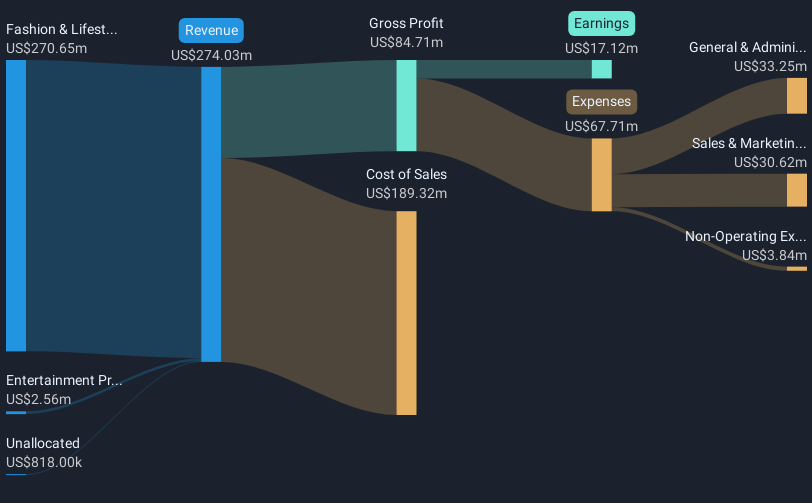

Overview: YesAsia Holdings Limited is an investment holding company involved in the procurement, sale, and trading of Asian fashion, lifestyle, beauty, cosmetics, accessories, and entertainment products with a market cap of HK$1.83 billion.

Operations: The company generates revenue primarily from two segments: Entertainment Products, contributing $1.99 million, and Fashion & Lifestyle and Beauty Products, which account for $343.31 million.

Market Cap: HK$1.83B

YesAsia Holdings Limited, with a market cap of HK$1.83 billion, has demonstrated significant growth in its financial performance. The company reported sales of US$345.78 million for 2024, up from US$201.34 million the previous year, and net income increased to US$19.06 million from US$7.57 million. It remains debt-free and boasts strong short-term asset coverage over liabilities, both short-term (US$89.5M vs US$51M) and long-term (US$89.5M vs US$16.6M). Recent board changes may influence strategic direction while a proposed dividend reflects confidence in future earnings potential amidst robust profit growth trends and reduced volatility over the past year.

- Jump into the full analysis health report here for a deeper understanding of YesAsia Holdings.

- Gain insights into YesAsia Holdings' outlook and expected performance with our report on the company's earnings estimates.

Routon Electronic (SHSE:600355)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Routon Electronic Co., Ltd. specializes in providing intelligent control and commercial terminal products in China, with a market cap of CN¥1.38 billion.

Operations: Routon Electronic Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥1.38B

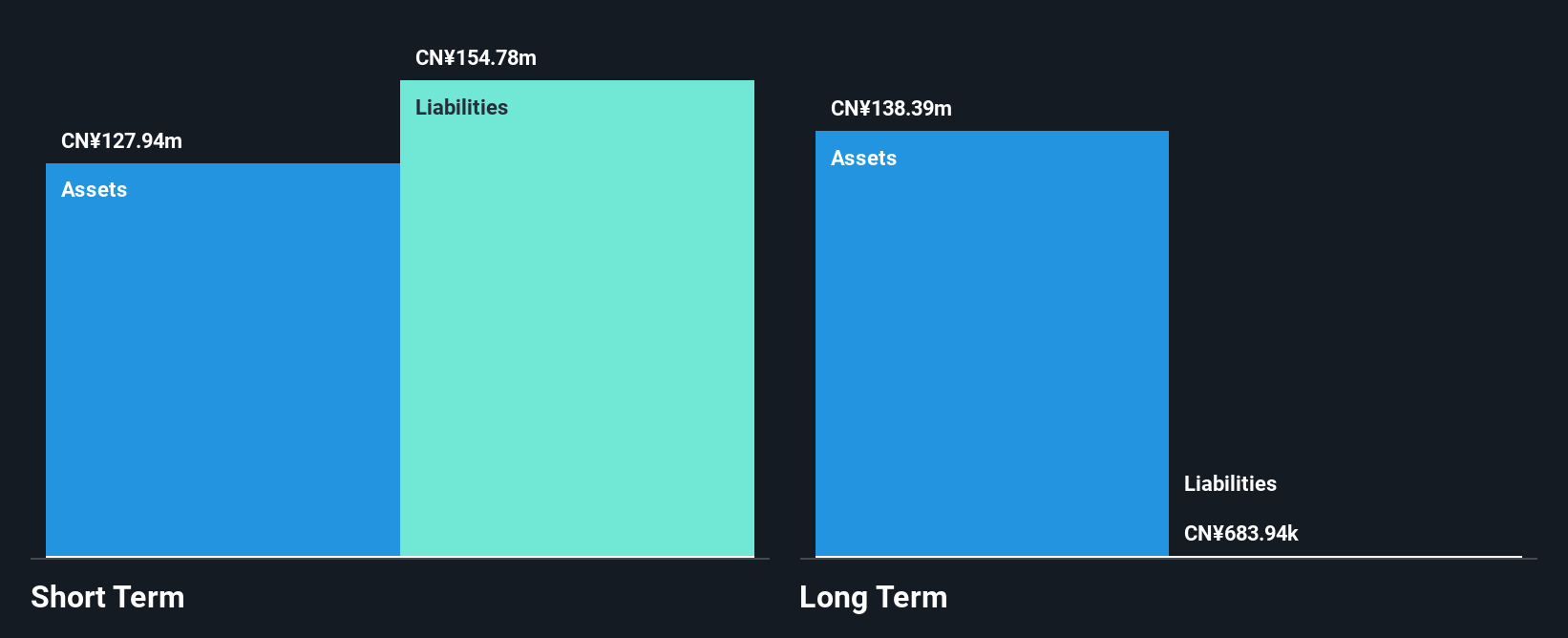

Routon Electronic Co., Ltd., with a market cap of CN¥1.38 billion, has faced challenges as it remains unprofitable despite reducing losses by 8.5% annually over the past five years. Recent earnings show a decline in sales to CN¥18.96 million from CN¥29.59 million year-on-year for Q1 2025, with net losses slightly increasing to CN¥9.78 million. The company maintains a satisfactory net debt to equity ratio of 11.2%, though its short-term assets (CN¥110.8M) fall short of covering its liabilities (CN¥123.3M). Share price volatility remains high, reflecting broader market uncertainties and operational hurdles.

- Dive into the specifics of Routon Electronic here with our thorough balance sheet health report.

- Explore historical data to track Routon Electronic's performance over time in our past results report.

HARBIN GLORIA PHARMACEUTICALS (SZSE:002437)

Simply Wall St Financial Health Rating: ★★★★★★

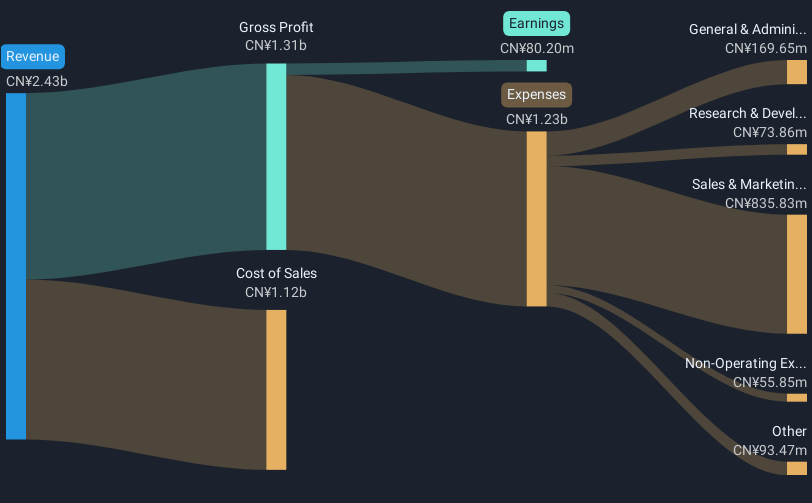

Overview: Harbin Gloria Pharmaceuticals Co., Ltd focuses on the research, development, production, and sale of pharmaceutical products primarily in China, with a market cap of CN¥5.82 billion.

Operations: Harbin Gloria Pharmaceuticals Co., Ltd does not report distinct revenue segments.

Market Cap: CN¥5.82B

Harbin Gloria Pharmaceuticals, with a market cap of CN¥5.82 billion, has demonstrated strong financial health by maintaining earnings growth and reducing its debt to equity ratio significantly over the past five years. The company reported Q1 2025 sales of CN¥551.26 million, down from the previous year, yet net income rose to CN¥60.25 million due to improved profit margins and effective cost management. Despite a large one-off gain impacting recent results, its operating cash flow comfortably covers debt obligations. Recent share buybacks indicate confidence in future prospects while the board's relatively short tenure suggests potential strategic shifts ahead.

- Take a closer look at HARBIN GLORIA PHARMACEUTICALS' potential here in our financial health report.

- Examine HARBIN GLORIA PHARMACEUTICALS' earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 1,164 more companies for you to explore.Click here to unveil our expertly curated list of 1,167 Asian Penny Stocks.

- Searching for a Fresh Perspective? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HARBIN GLORIA PHARMACEUTICALS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002437

HARBIN GLORIA PHARMACEUTICALS

Harbin Gloria Pharmaceuticals Co., Ltd engages in the research, development, production, and sale of pharmaceutical products primarily in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives