- Hong Kong

- /

- Retail Distributors

- /

- SEHK:1957

MBV International Limited's (HKG:1957) Shareholders Might Be Looking For Exit

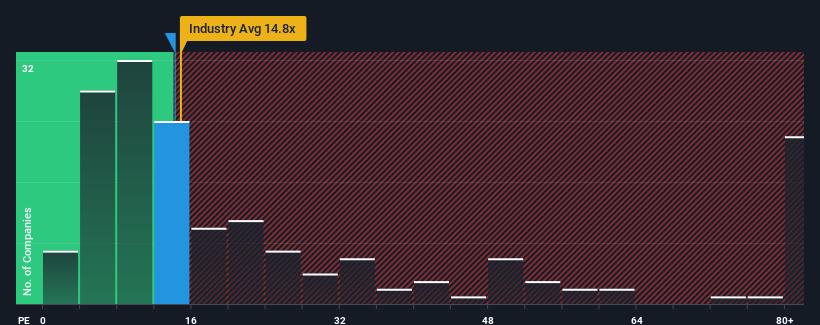

MBV International Limited's (HKG:1957) price-to-earnings (or "P/E") ratio of 14.2x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 8x and even P/E's below 4x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, MBV International has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for MBV International

Is There Enough Growth For MBV International?

The only time you'd be truly comfortable seeing a P/E as steep as MBV International's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 31% gain to the company's bottom line. Pleasingly, EPS has also lifted 86% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 22% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

With this information, we find it interesting that MBV International is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent earnings trends would weigh down the share price eventually.

What We Can Learn From MBV International's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of MBV International revealed its three-year earnings trends aren't impacting its high P/E as much as we would have predicted, given they look similar to current market expectations. Right now we are uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 3 warning signs for MBV International (of which 2 are concerning!) you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1957

MBV International

An investment holding company, engages in sourcing, wholesaling, supplying, and marketing of imprintable apparel and gift products in Malaysia and Singapore.

Flawless balance sheet and good value.