- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1872

Subdued Growth No Barrier To Guan Chao Holdings Limited (HKG:1872) With Shares Advancing 52%

Despite an already strong run, Guan Chao Holdings Limited (HKG:1872) shares have been powering on, with a gain of 52% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 80% in the last year.

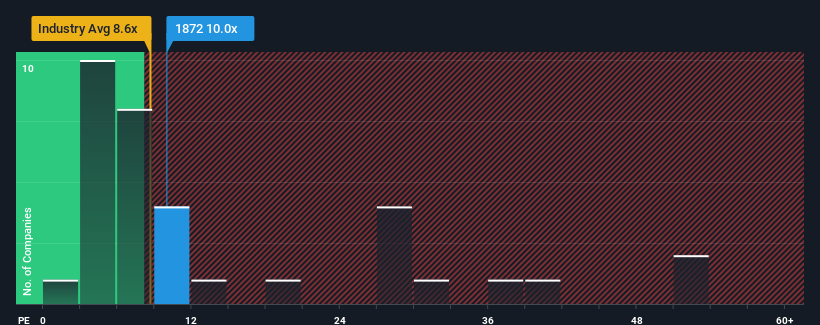

Even after such a large jump in price, there still wouldn't be many who think Guan Chao Holdings' price-to-earnings (or "P/E") ratio of 10x is worth a mention when the median P/E in Hong Kong is similar at about 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

As an illustration, earnings have deteriorated at Guan Chao Holdings over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Guan Chao Holdings

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Guan Chao Holdings' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 73%. The last three years don't look nice either as the company has shrunk EPS by 79% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 21% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Guan Chao Holdings is trading at a fairly similar P/E to the market. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Bottom Line On Guan Chao Holdings' P/E

Guan Chao Holdings' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Guan Chao Holdings revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware Guan Chao Holdings is showing 7 warning signs in our investment analysis, and 2 of those make us uncomfortable.

If you're unsure about the strength of Guan Chao Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1872

Guan Chao Holdings

An investment holding company, engages in the sale of parallel-import and pre-owned motor vehicles in Singapore.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026