- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1815

Mount Everest Gold Group Company Limited's (HKG:1815) Shares Climb 55% But Its Business Is Yet to Catch Up

Mount Everest Gold Group Company Limited (HKG:1815) shares have had a really impressive month, gaining 55% after a shaky period beforehand. This latest share price bounce rounds out a remarkable 892% gain over the last twelve months.

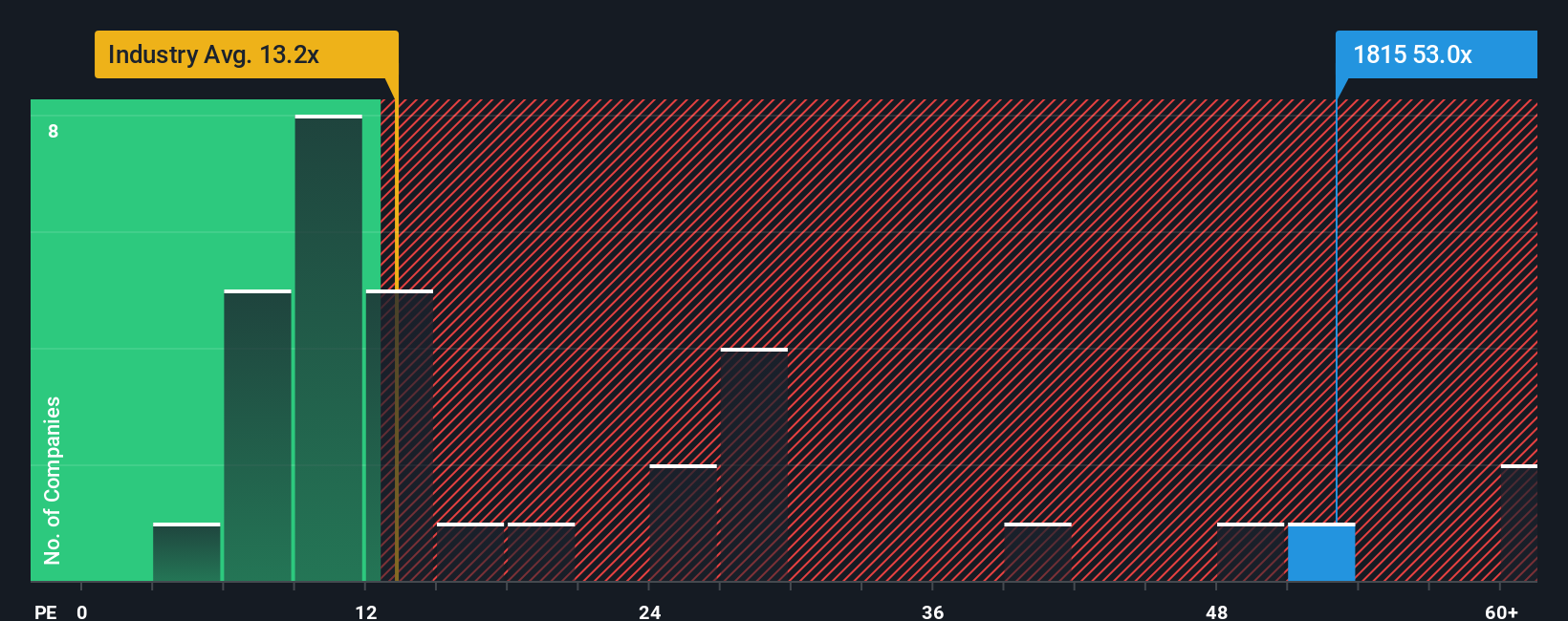

After such a large jump in price, Mount Everest Gold Group's price-to-earnings (or "P/E") ratio of 53x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 12x and even P/E's below 7x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's exceedingly strong of late, Mount Everest Gold Group has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Mount Everest Gold Group

Does Growth Match The High P/E?

In order to justify its P/E ratio, Mount Everest Gold Group would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 304% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Comparing that to the market, which is predicted to deliver 20% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's alarming that Mount Everest Gold Group's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Shares in Mount Everest Gold Group have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Mount Everest Gold Group currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Mount Everest Gold Group that you need to be mindful of.

If you're unsure about the strength of Mount Everest Gold Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1815

Mount Everest Gold Group

An investment holding company, engages in the design and sale of gold, silver, colored gemstones, gem-set, and other jewellery products in the People’s Republic of China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives