- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1373

Is International Housewares Retail Company Limited's(HKG:1373) Recent Stock Performance Tethered To Its Strong Fundamentals?

International Housewares Retail's (HKG:1373) stock is up by a considerable 20% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. In this article, we decided to focus on International Housewares Retail's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for International Housewares Retail

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for International Housewares Retail is:

32% = HK$279m ÷ HK$868m (Based on the trailing twelve months to October 2020).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every HK$1 worth of equity, the company was able to earn HK$0.32 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of International Housewares Retail's Earnings Growth And 32% ROE

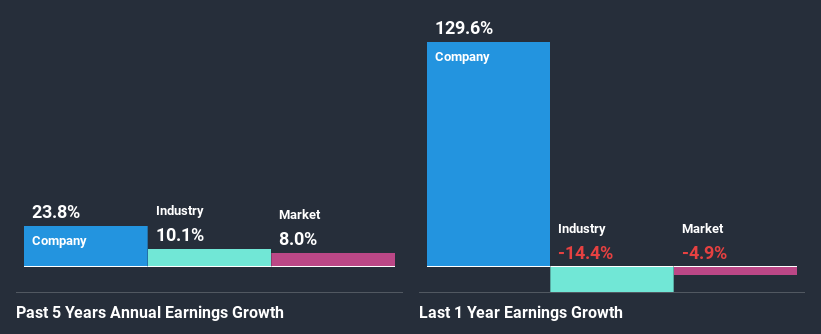

To begin with, International Housewares Retail has a pretty high ROE which is interesting. Additionally, the company's ROE is higher compared to the industry average of 8.5% which is quite remarkable. Under the circumstances, International Housewares Retail's considerable five year net income growth of 24% was to be expected.

Next, on comparing with the industry net income growth, we found that International Housewares Retail's growth is quite high when compared to the industry average growth of 10% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is International Housewares Retail fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is International Housewares Retail Efficiently Re-investing Its Profits?

The high three-year median payout ratio of 82% (implying that it keeps only 18% of profits) for International Housewares Retail suggests that the company's growth wasn't really hampered despite it returning most of the earnings to its shareholders.

Additionally, International Housewares Retail has paid dividends over a period of seven years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

On the whole, we feel that International Housewares Retail's performance has been quite good. We are particularly impressed by the considerable earnings growth posted by the company, which was likely backed by its high ROE. While the company is paying out most of its earnings as dividends, it has been able to grow its earnings in spite of it, so that's probably a good sign. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into International Housewares Retail's past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you decide to trade International Housewares Retail, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1373

International Housewares Retail

An investment holding company, engages in the retail sale and trading of housewares products.

Flawless balance sheet average dividend payer.