- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1373

If You Like EPS Growth Then Check Out International Housewares Retail (HKG:1373) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in International Housewares Retail (HKG:1373). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for International Housewares Retail

International Housewares Retail's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. I, for one, am blown away by the fact that International Housewares Retail has grown EPS by 43% per year, over the last three years. Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

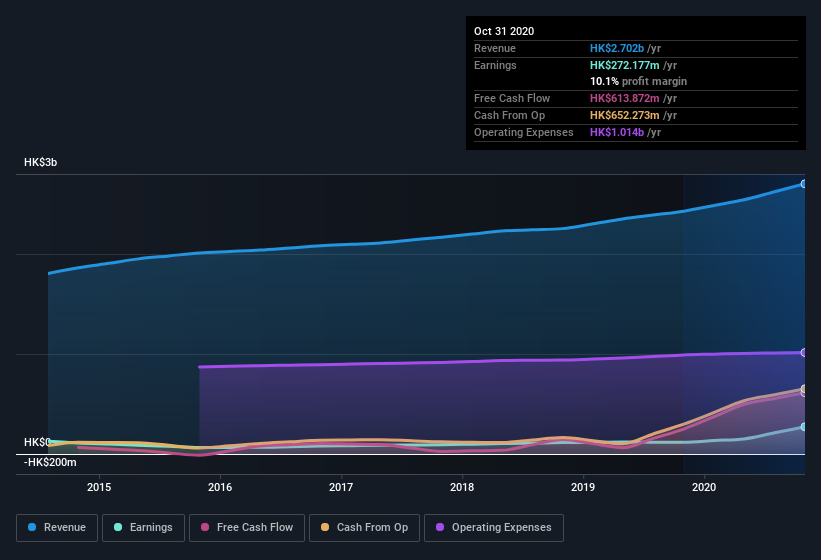

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. International Housewares Retail shareholders can take confidence from the fact that EBIT margins are up from 6.0% to 12%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since International Housewares Retail is no giant, with a market capitalization of HK$2.1b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are International Housewares Retail Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling International Housewares Retail shares, in the last year. So it's definitely nice that David Webb bought HK$107k worth of shares at an average price of around HK$2.67.

On top of the insider buying, it's good to see that International Housewares Retail insiders have a valuable investment in the business. Indeed, they hold HK$309m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 15% of the company, demonstrating a degree of high-level alignment with shareholders.

Is International Housewares Retail Worth Keeping An Eye On?

International Housewares Retail's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest International Housewares Retail belongs on the top of your watchlist. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for International Housewares Retail that you should be aware of.

The good news is that International Housewares Retail is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1373

International Housewares Retail

An investment holding company, engages in the retail sale and trading of housewares products.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives