- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1268

What China MeiDong Auto Holdings Limited's (HKG:1268) P/S Is Not Telling You

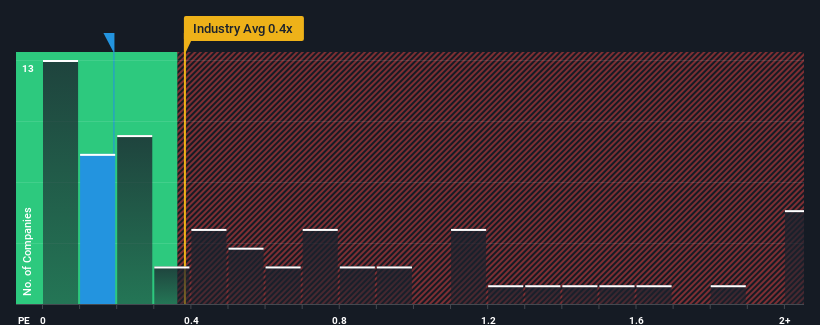

It's not a stretch to say that China MeiDong Auto Holdings Limited's (HKG:1268) price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" for companies in the Specialty Retail industry in Hong Kong, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for China MeiDong Auto Holdings

How Has China MeiDong Auto Holdings Performed Recently?

Recent times have been advantageous for China MeiDong Auto Holdings as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think China MeiDong Auto Holdings' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like China MeiDong Auto Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. Pleasingly, revenue has also lifted 69% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue growth is heading into negative territory, declining 0.02% over the next year. Meanwhile, the broader industry is forecast to expand by 16%, which paints a poor picture.

With this information, we find it concerning that China MeiDong Auto Holdings is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears that China MeiDong Auto Holdings currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

We don't want to rain on the parade too much, but we did also find 4 warning signs for China MeiDong Auto Holdings (1 is significant!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1268

China MeiDong Auto Holdings

An investment holding company, operates as an automobile dealer in the People’s Republic of China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives