- Hong Kong

- /

- Retail Distributors

- /

- SEHK:1123

Here's Why China-Hongkong Photo Products Holdings (HKG:1123) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in China-Hongkong Photo Products Holdings (HKG:1123). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for China-Hongkong Photo Products Holdings

China-Hongkong Photo Products Holdings' Improving Profits

China-Hongkong Photo Products Holdings has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, China-Hongkong Photo Products Holdings' EPS grew from HK$0.015 to HK$0.034, over the previous 12 months. Year on year growth of 125% is certainly a sight to behold.

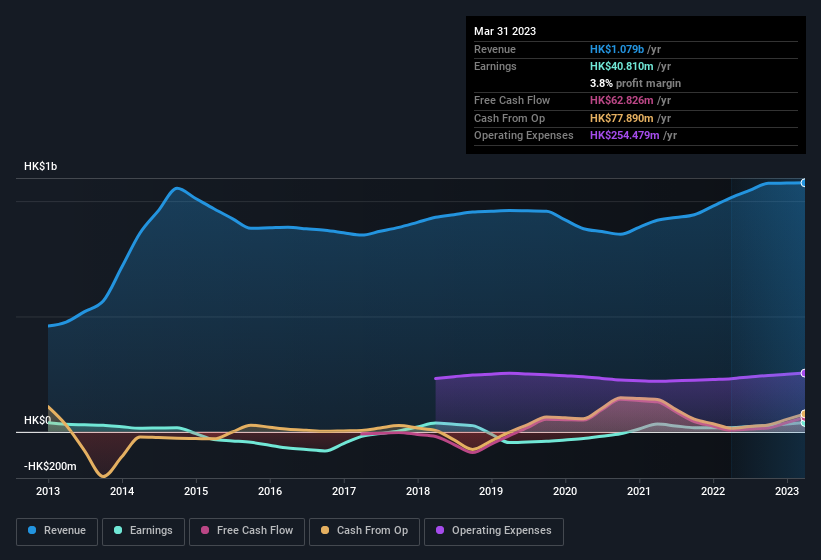

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note China-Hongkong Photo Products Holdings achieved similar EBIT margins to last year, revenue grew by a solid 6.3% to HK$1.1b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since China-Hongkong Photo Products Holdings is no giant, with a market capitalisation of HK$174m, you should definitely check its cash and debt before getting too excited about its prospects.

Are China-Hongkong Photo Products Holdings Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that China-Hongkong Photo Products Holdings insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 60%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Of course, China-Hongkong Photo Products Holdings is a very small company, with a market cap of only HK$174m. So despite a large proportional holding, insiders only have HK$105m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

Should You Add China-Hongkong Photo Products Holdings To Your Watchlist?

China-Hongkong Photo Products Holdings' earnings per share growth have been climbing higher at an appreciable rate. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So at the surface level, China-Hongkong Photo Products Holdings is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. What about risks? Every company has them, and we've spotted 3 warning signs for China-Hongkong Photo Products Holdings you should know about.

Although China-Hongkong Photo Products Holdings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1123

China-Hongkong Photo Products Holdings

Engages in marketing and distribution of photographic developing, processing, and printing products in Hong Kong.

Flawless balance sheet slight.

Market Insights

Community Narratives