- Hong Kong

- /

- Specialty Stores

- /

- SEHK:104

Asia Commercial Holdings (HKG:104) Has A Somewhat Strained Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Asia Commercial Holdings Limited (HKG:104) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Asia Commercial Holdings

What Is Asia Commercial Holdings's Net Debt?

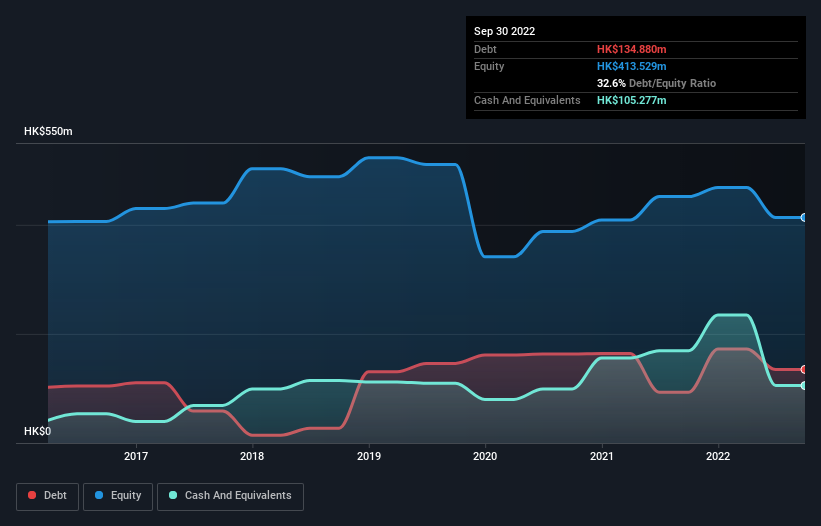

The image below, which you can click on for greater detail, shows that at September 2022 Asia Commercial Holdings had debt of HK$134.9m, up from HK$93.0m in one year. However, it also had HK$105.3m in cash, and so its net debt is HK$29.6m.

How Strong Is Asia Commercial Holdings' Balance Sheet?

We can see from the most recent balance sheet that Asia Commercial Holdings had liabilities of HK$258.8m falling due within a year, and liabilities of HK$68.5m due beyond that. On the other hand, it had cash of HK$105.3m and HK$53.3m worth of receivables due within a year. So its liabilities total HK$168.8m more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's HK$164.4m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Asia Commercial Holdings has a low net debt to EBITDA ratio of only 0.40. And its EBIT covers its interest expense a whopping 13.1 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. It is just as well that Asia Commercial Holdings's load is not too heavy, because its EBIT was down 32% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Asia Commercial Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, Asia Commercial Holdings actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

While Asia Commercial Holdings's EBIT growth rate has us nervous. To wit both its interest cover and conversion of EBIT to free cash flow were encouraging signs. We think that Asia Commercial Holdings's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Asia Commercial Holdings is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking to trade Asia Commercial Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:104

Asia Commercial Holdings

An investment holding company, engages in the trading and sale of watches in Hong Kong, the People’s Republic of China, the United Kingdom, and Switzerland.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives