- Hong Kong

- /

- Real Estate

- /

- SEHK:9993

What Is The Ownership Structure Like For Radiance Holdings (Group) Co. Limited (HKG:9993)?

If you want to know who really controls Radiance Holdings (Group) Co. Limited (HKG:9993), then you'll have to look at the makeup of its share registry. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

Radiance Holdings (Group) isn't enormous, but it's not particularly small either. It has a market capitalization of HK$18b, which means it would generally expect to see some institutions on the share registry. Our analysis of the ownership of the company, below, shows that institutions are not on the share registry. We can zoom in on the different ownership groups, to learn more about Radiance Holdings (Group).

View our latest analysis for Radiance Holdings (Group)

What Does The Lack Of Institutional Ownership Tell Us About Radiance Holdings (Group)?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. Alternatively, there might be something about the company that has kept institutional investors away. Radiance Holdings (Group) might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

We note that hedge funds don't have a meaningful investment in Radiance Holdings (Group). Because actions speak louder than words, we consider it a good sign when insiders own a significant stake in a company. In Radiance Holdings (Group)'s case, its Top Key Executive, Ting Lam, is the largest shareholder, holding 84% of shares outstanding.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There is a little analyst coverage of the stock, but not much. So there is room for it to gain more coverage.

Insider Ownership Of Radiance Holdings (Group)

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders own more than half of Radiance Holdings (Group) Co. Limited. This gives them effective control of the company. That means insiders have a very meaningful HK$15b stake in this HK$18b business. Most would be pleased to see the board is investing alongside them. You may wish to discover if they have been buying or selling.

General Public Ownership

The general public holds a 16% stake in Radiance Holdings (Group). This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Take risks for example - Radiance Holdings (Group) has 1 warning sign we think you should be aware of.

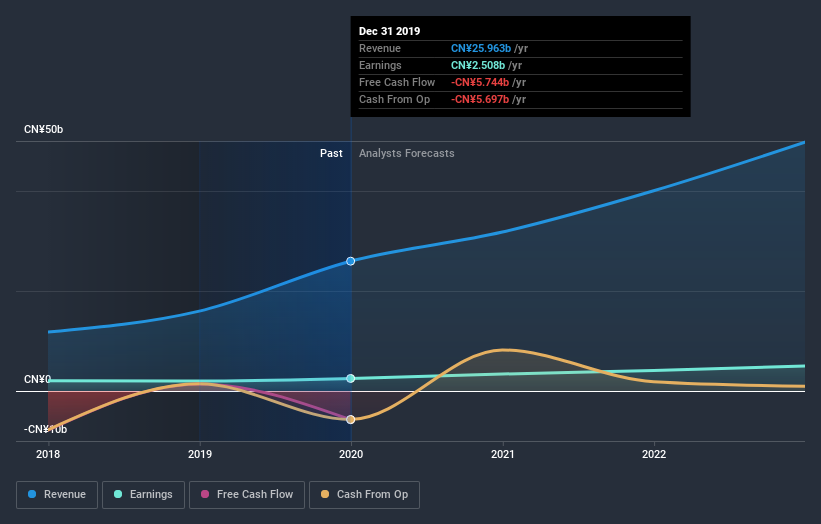

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade Radiance Holdings (Group), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:9993

Radiance Holdings (Group)

An investment holding company, engages in property development business in Mainland China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026