- Hong Kong

- /

- Real Estate

- /

- SEHK:9993

I Ran A Stock Scan For Earnings Growth And Radiance Holdings (Group) (HKG:9993) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Radiance Holdings (Group) (HKG:9993). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Radiance Holdings (Group)

Radiance Holdings (Group)'s Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Like a falcon taking flight, Radiance Holdings (Group)'s EPS soared from CN¥0.85 to CN¥1.07, over the last year. That's a impressive gain of 26%.

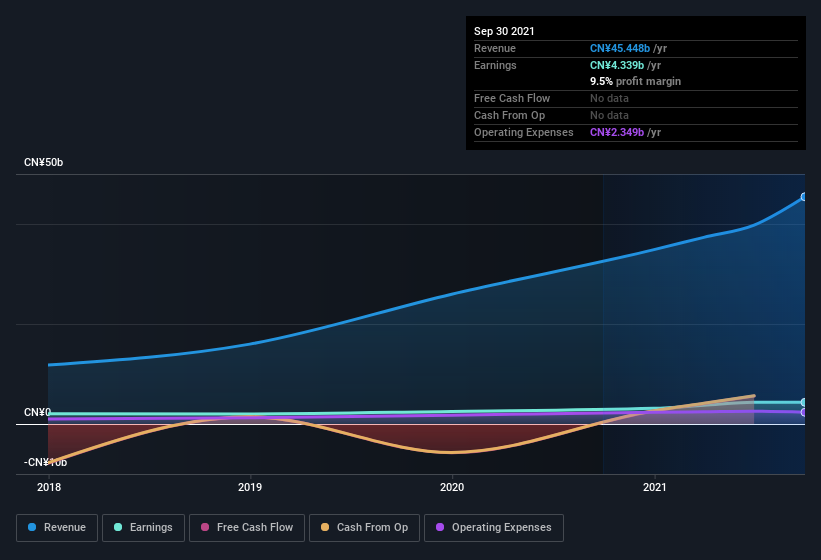

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Radiance Holdings (Group) maintained stable EBIT margins over the last year, all while growing revenue 39% to CN¥45b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Radiance Holdings (Group)'s balance sheet strength, before getting too excited.

Are Radiance Holdings (Group) Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that Radiance Holdings (Group) insiders own a significant number of shares certainly appeals to me. In fact, they own 84% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a whopping CN¥16b. That means they have plenty of their own capital riding on the performance of the business!

Is Radiance Holdings (Group) Worth Keeping An Eye On?

You can't deny that Radiance Holdings (Group) has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. We don't want to rain on the parade too much, but we did also find 2 warning signs for Radiance Holdings (Group) (1 is a bit unpleasant!) that you need to be mindful of.

Although Radiance Holdings (Group) certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9993

Radiance Holdings (Group)

An investment holding company, engages in property development business in Mainland China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026