- Hong Kong

- /

- Real Estate

- /

- SEHK:884

Here's Why I Think CIFI Holdings (Group) (HKG:884) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like CIFI Holdings (Group) (HKG:884), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for CIFI Holdings (Group)

How Fast Is CIFI Holdings (Group) Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. We can see that in the last three years CIFI Holdings (Group) grew its EPS by 5.4% per year. While that sort of growth rate isn't amazing, it does show the business is growing.

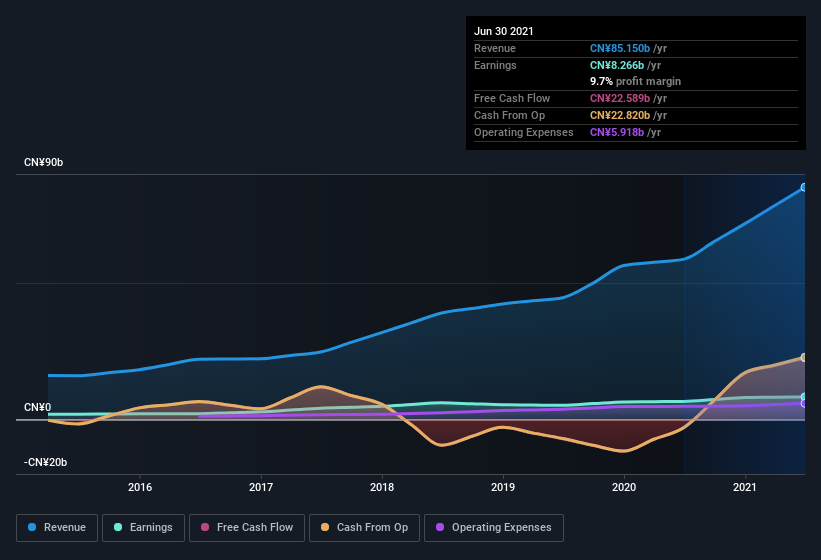

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. On the one hand, CIFI Holdings (Group)'s EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future CIFI Holdings (Group) EPS 100% free.

Are CIFI Holdings (Group) Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news is that CIFI Holdings (Group) insiders spent a whopping CN¥149m on stock in just one year, and I didn't see any selling. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. We also note that it was the CEO & Executive Director, Feng Lin, who made the biggest single acquisition, paying HK$44m for shares at about HK$4.00 each.

On top of the insider buying, it's good to see that CIFI Holdings (Group) insiders have a valuable investment in the business. Indeed, they have a glittering mountain of wealth invested in it, currently valued at CN¥5.4b. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

Is CIFI Holdings (Group) Worth Keeping An Eye On?

One positive for CIFI Holdings (Group) is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. It's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with CIFI Holdings (Group) (at least 1 which is a bit unpleasant) , and understanding these should be part of your investment process.

The good news is that CIFI Holdings (Group) is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:884

CIFI Holdings (Group)

Engages in the property development and investment business in the People’s Republic of China.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives