Disclaimer: This company is currently at risk of default on its debt. The SWS snowflake scores should be taken with caution

Although Evergrande ( SEHK:3333 ) stock started drifting lower during 2020, it wasn't until May when the decline accelerated. Fueled by the whispers of debt defaults, the stock eventually cratered over 80%.

This might be slightly confusing for side observers, given the importance of real estate in the Chinese market. Yet, a perfect storm can sink any ship.

This article will reflect on the business model, demand slowdown, and a policy shift that eventually capsized Ever given grande.

Company Profile

Xu Jiayin founded Evergrande Industrial Group in 1996. It is a Real Estate company owning more than 1,300 projects in over 280 cities. Currently, it is committed to building around 1,4m individual properties. Through over 200 offshore and 2,000 domestic subsidiaries, Evergrande's 2tn CNY assets are equivalent to 2% of China's GDP.

Besides real estate, the company has been involved in many other projects, including electric vehicles (Evergrande New Energy Auto), media (HengTen Networks), sports (Guangzhou F.C), mineral water (Evergrande Spring), and others.

History of Operations

Although directly competing with the more established competitors, the company successfully launched the first project, Jinbi Garden, in 1997.

Selling at a very competitive US$40 per sqm, the company made US$12m in sales and immediately launched 13 new projects in Guangzhou. Introducing an ambitious plan, the company began a nationwide expansion in 2006, intending to " recreate 20 Evergrandes in just 3 years ". At that point, 15 years ago, the company had US$1.2b in assets and US$1b in debt.

During the financial crisis of 2008, the company was amidst national expansion, running over 30 projects when it started having a problem with the cash flow. At this time, Evergrande's liabilities were approximately US$2b.

Eventually, the company made a pre-IPO deal worth US$506m from domestic and foreign investors, led by the Chow Tai Fook group. The IPO went through in November 2009 at the valuation of HK$ 70b or US$10b. Meanwhile, the diversification effort proved unfruitful, especially the promising Evergrande Spring mineral water that was eventually sold in 2016.

By the time Xu Jiayin announced strategic changes, the liabilities had ballooned up to US$178b. He planned to reduce debt and deleverage the company while keeping the high turnover and low cost.

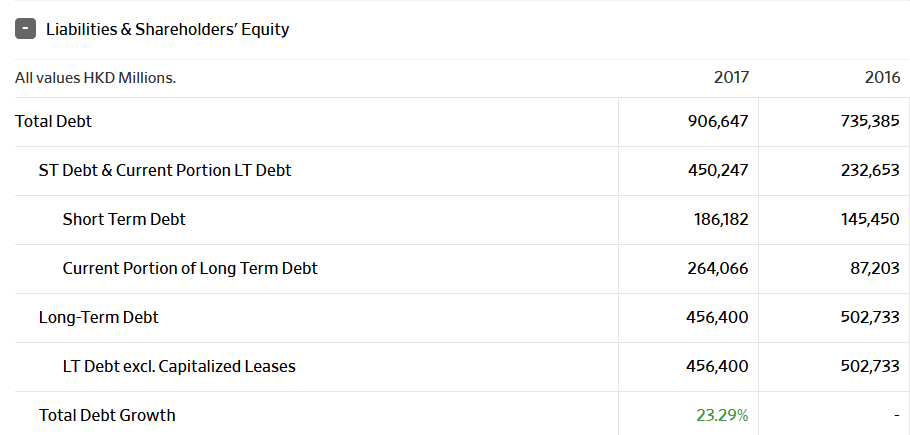

Yet, comparing the balance sheets shows a rise in short-term liabilities through 2017.

Evergrande Balance Sheet comparison; Source: wsj.com

Meanwhile, the latest expansion included investing US$7b in an electric vehicle brand Hengchi, operating through an Evergrande Auto subsidiary. The company announced 9 concept vehicles in July 2020, leading to the subsidiary valuation of US$87b in April 2021 before crashing below US$5b. As evident from examples with Nio and Tesla, car production is highly capital-intensive and often requires years before profitability. Not the best business for the company that is looking to deleverage.

As always, every party must come to an end. Facing growing debt and rising land prices, the government regulators came up with a plan in August 2020.

They set a criteria list that the People's Bank of China regulators should use to assess the real estate developers. These included:

- Liability-to-asset ratio (excluding advance receipts) of less than 70%

- Net gearing ratio of less than 100%

- Cash-to-short-term debt ratio of more than 1x

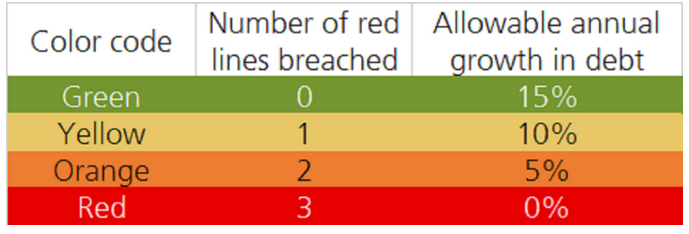

In essence, this was forced deleveraging, limiting the annual debt growth by the following table.

3 Red Line plan, Source: UBS

If we examine Evergrande's situation at the time, the results were catastrophic:

- Liability-to-asset ratio: 82%

- Net gearing ratio: 199%

- Cash-to-short-term debt ratio: 0.4

What went wrong?

Evergrande's real estate operations have been following the same template: build quickly in the previously unattractive area and set a price attractive to the middle class.

They did this in 2 steps:

- Sell debt to raise funds for purchasing land development rights

- Pre-sell the developing property and use most of the cash to buy more land rights

This strategy works well when the land rights continue appreciating, which happens when the demand is strong, allowing the company to stay ahead of the debt cost.

Relying on the " invisible hand "of the market to dictate the value of your assets while simultaneously holding a large amount of liabilities ain't the best idea, as it had already shown in 2008.

The Catch

In the wake of the forced deleveraging policy, the company responded with a plan to slash the prices on their new projects by 30% to achieve US$15.4b sales per month. Slashing the prices to unload the inventory and raise cash is not the worst of ideas unless it influences the value of assets on your balance sheet.

And there we come to the catch 22.

Evergrande holds a significant amount of real estate on its books as assets. In the past, this was not problematic as rising prices would ensure that it got sold at a profit.

Suppose it engages in aggressive sales tactics to raise the cash to pay off some liabilities and improve the liability-to-asset ratio. In that case, it will be simultaneously lowering the value of those assets.

Even so, potential buyers would be inclined to wait to get an even better deal with the blood in the streets while the piling up liabilities pressured the company.

Conclusion

While it is impossible to speculate on the outcome of this situation, there are 2 critical factors to keep in mind.

- 1.5 million people paid deposits for homes that had not yet been built

- Liquidation could create a real-estate crash

Although we are talking about China, one of the largest nations in the world, 1.5 million people losing their deposits is not an insignificant number. The government would rather avoid social unrest, especially with the National Party Congress scheduled for 2022.

Furthermore, a liquidation of the company would flood the domestic market with its assets and likely destabilize the real estate market, possibly causing the domino effect with other property developers whose assets would now depreciate while facing more scrutiny from their banks and other lenders. While the company owes money to around 171 domestic banks and 121 other financial firms, only around US$19b from the total US$300b debt is foreign.

Under those circumstances, anything but a government intervention seems like a lose-lose scenario for all parties.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About SEHK:3333

China Evergrande Group

An investment holding company, primarily engages in the property development business in the People’s Republic of China.

Slightly overvalued with weak fundamentals.

Similar Companies

Market Insights

Community Narratives