- Hong Kong

- /

- Real Estate

- /

- SEHK:1638

Key Things To Understand About Kaisa Group Holdings' (HKG:1638) CEO Pay Cheque

This article will reflect on the compensation paid to Fan Mai who has served as CEO of Kaisa Group Holdings Ltd. (HKG:1638) since 2017. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Kaisa Group Holdings

How Does Total Compensation For Fan Mai Compare With Other Companies In The Industry?

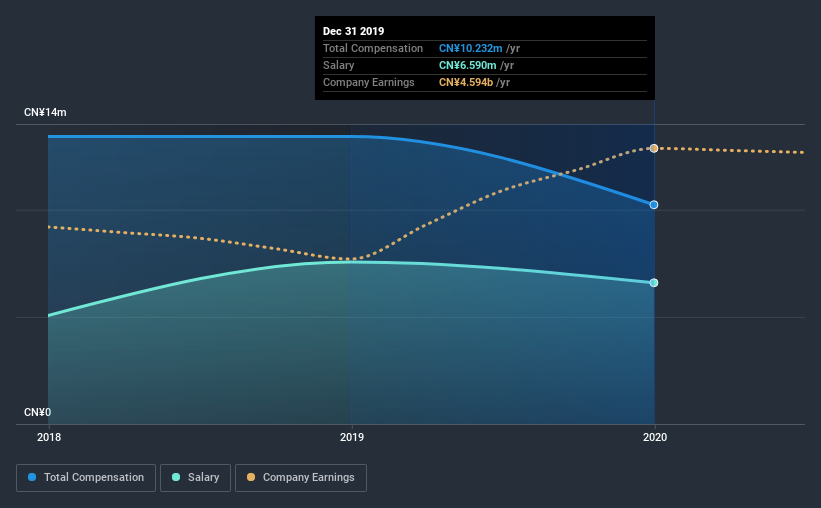

Our data indicates that Kaisa Group Holdings Ltd. has a market capitalization of HK$23b, and total annual CEO compensation was reported as CN¥10m for the year to December 2019. We note that's a decrease of 24% compared to last year. We note that the salary portion, which stands at CN¥6.59m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations ranging from HK$16b to HK$50b, the reported median CEO total compensation was CN¥5.0m. Accordingly, our analysis reveals that Kaisa Group Holdings Ltd. pays Fan Mai north of the industry median. Moreover, Fan Mai also holds HK$4.4m worth of Kaisa Group Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CN¥6.6m | CN¥7.6m | 64% |

| Other | CN¥3.6m | CN¥5.9m | 36% |

| Total Compensation | CN¥10m | CN¥13m | 100% |

Talking in terms of the industry, salary represented approximately 70% of total compensation out of all the companies we analyzed, while other remuneration made up 30% of the pie. There isn't a significant difference between Kaisa Group Holdings and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Kaisa Group Holdings Ltd.'s Growth

Kaisa Group Holdings Ltd. has seen its earnings per share (EPS) increase by 40% a year over the past three years. Its revenue is up 15% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Kaisa Group Holdings Ltd. Been A Good Investment?

Kaisa Group Holdings Ltd. has served shareholders reasonably well, with a total return of 15% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

As we touched on above, Kaisa Group Holdings Ltd. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But the company has impressed us with its EPS growth, over three years. We also think investor returns are steady over the same time period. You might wish to research management further, but on this analysis, considering the EPS growth, we wouldn't say CEO compensation problematic.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 3 warning signs for Kaisa Group Holdings (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Kaisa Group Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Kaisa Group Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kaisa Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1638

Kaisa Group Holdings

An investment holding company, engages in the property development, investment, and management businesses in the People’s Republic of China.

Good value with low risk.

Market Insights

Community Narratives