- Hong Kong

- /

- Real Estate

- /

- SEHK:1638

Kaisa Group Holdings' (HKG:1638) Upcoming Dividend Will Be Larger Than Last Year's

Kaisa Group Holdings Ltd. (HKG:1638) will increase its dividend on the 17th of December to HK$0.04. This takes the annual payment to 6.2% of the current stock price, which is about average for the industry.

View our latest analysis for Kaisa Group Holdings

Kaisa Group Holdings' Earnings Easily Cover the Distributions

We aren't too impressed by dividend yields unless they can be sustained over time. However, Kaisa Group Holdings' earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

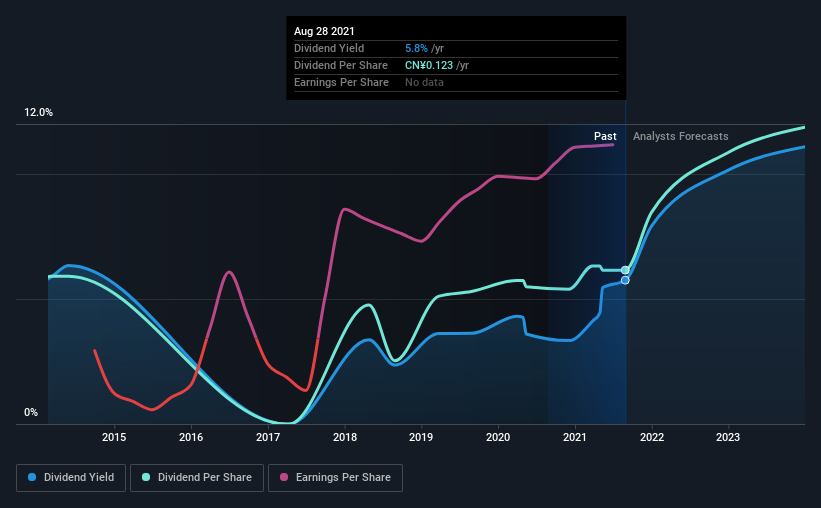

Looking forward, earnings per share is forecast to rise by 15.5% over the next year. If the dividend continues on this path, the payout ratio could be 16% by next year, which we think can be pretty sustainable going forward.

Kaisa Group Holdings' Dividend Has Lacked Consistency

Looking back, Kaisa Group Holdings' dividend hasn't been particularly consistent. This suggests that the dividend might not be the most reliable. The first annual payment during the last 8 years was CN¥0.12 in 2013, and the most recent fiscal year payment was CN¥0.12. Dividend payments have been growing, but very slowly over the period. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. It's encouraging to see Kaisa Group Holdings has been growing its earnings per share at 24% a year over the past five years. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

We'd also point out that Kaisa Group Holdings has issued stock equal to 15% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

We Really Like Kaisa Group Holdings' Dividend

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 4 warning signs for Kaisa Group Holdings (1 is a bit unpleasant!) that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kaisa Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1638

Kaisa Group Holdings

An investment holding company, engages in the property development, investment, and management businesses in the People’s Republic of China.

Good value with low risk.

Market Insights

Community Narratives