- Hong Kong

- /

- Real Estate

- /

- SEHK:158

Read This Before Buying Melbourne Enterprises Limited (HKG:158) For Its Dividend

Could Melbourne Enterprises Limited (HKG:158) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

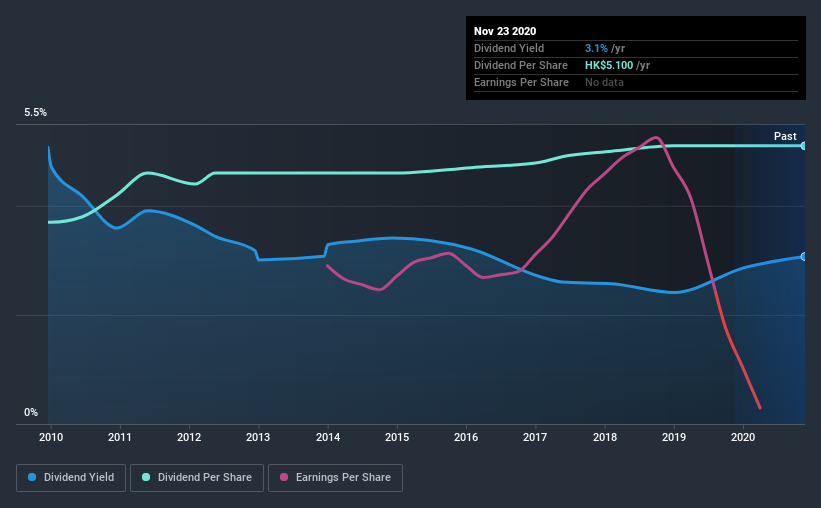

With Melbourne Enterprises yielding 3.1% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. It would not be a surprise to discover that many investors buy it for the dividends. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Explore this interactive chart for our latest analysis on Melbourne Enterprises!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Although Melbourne Enterprises pays a dividend, it was loss-making during the past year. When a company recently reported a loss, we should investigate if its cash flows covered the dividend.

Melbourne Enterprises paid out 87% of its cash flow last year. This may be sustainable but it does not leave much of a buffer for unexpected circumstances.

While the above analysis focuses on dividends relative to a company's earnings, we do note Melbourne Enterprises' strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Melbourne Enterprises' financial position here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Melbourne Enterprises' dividend payments. During this period the dividend has been stable, which could imply the business could have relatively consistent earnings power. During the past 10-year period, the first annual payment was HK$3.7 in 2010, compared to HK$5.1 last year. This works out to be a compound annual growth rate (CAGR) of approximately 3.3% a year over that time.

Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. It's not great to see that Melbourne Enterprises' have fallen at approximately 7.1% over the past five years. If earnings continue to decline, the dividend may come under pressure. Every investor should make an assessment of whether the company is taking steps to stabilise the situation.

Conclusion

To summarise, shareholders should always check that Melbourne Enterprises' dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're not keen on the fact that Melbourne Enterprises paid dividends despite reporting a loss over the past year, although fortunately its dividend was covered by cash flow. It's not great to see earnings per share shrinking. The dividends have been relatively consistent, but we wonder for how much longer this will be true. In summary, Melbourne Enterprises has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are likely more attractive alternatives out there.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, Melbourne Enterprises has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you’re looking to trade Melbourne Enterprises, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:158

Melbourne Enterprises

An investment holding company, engages in property investment business in Hong Kong.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives