- Hong Kong

- /

- Real Estate

- /

- SEHK:158

Here's Why We're Wary Of Buying Melbourne Enterprises' (HKG:158) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Melbourne Enterprises Limited (HKG:158) is about to trade ex-dividend in the next four days. This means that investors who purchase shares on or after the 9th of February will not receive the dividend, which will be paid on the 24th of February.

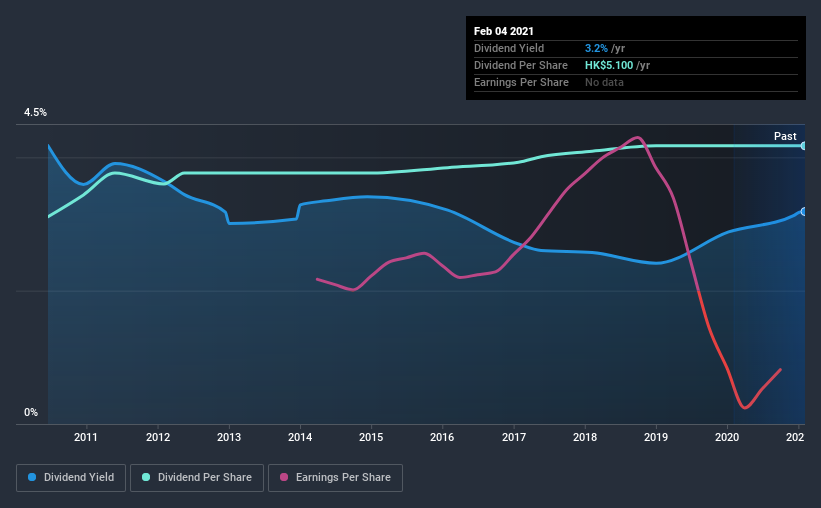

Melbourne Enterprises's next dividend payment will be HK$2.80 per share, and in the last 12 months, the company paid a total of HK$5.10 per share. Based on the last year's worth of payments, Melbourne Enterprises has a trailing yield of 3.2% on the current stock price of HK$160. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for Melbourne Enterprises

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Melbourne Enterprises reported a loss last year, so it's not great to see that it has continued paying a dividend. With the recent loss, it's important to check if the business generated enough cash to pay its dividend. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. It paid out 109% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Companies usually need cash more than they need earnings - expenses don't pay themselves - so it's not great to see it paying out so much of its cash flow.

Click here to see how much of its profit Melbourne Enterprises paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Melbourne Enterprises was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, 10 years ago, Melbourne Enterprises has lifted its dividend by approximately 3.0% a year on average.

We update our analysis on Melbourne Enterprises every 24 hours, so you can always get the latest insights on its financial health, here.

The Bottom Line

Should investors buy Melbourne Enterprises for the upcoming dividend? We're a bit uncomfortable with it paying a dividend while being loss-making, especially given that the dividend was not well covered by free cash flow. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Melbourne Enterprises. For instance, we've identified 2 warning signs for Melbourne Enterprises (1 shouldn't be ignored) you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Melbourne Enterprises, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Melbourne Enterprises, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:158

Melbourne Enterprises

An investment holding company, engages in property investment business in Hong Kong.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives