- Hong Kong

- /

- Real Estate

- /

- SEHK:1379

Wenling Zhejiang Measuring and Cutting Tools Trading Centre's (HKG:1379) Sluggish Earnings Might Be Just The Beginning Of Its Problems

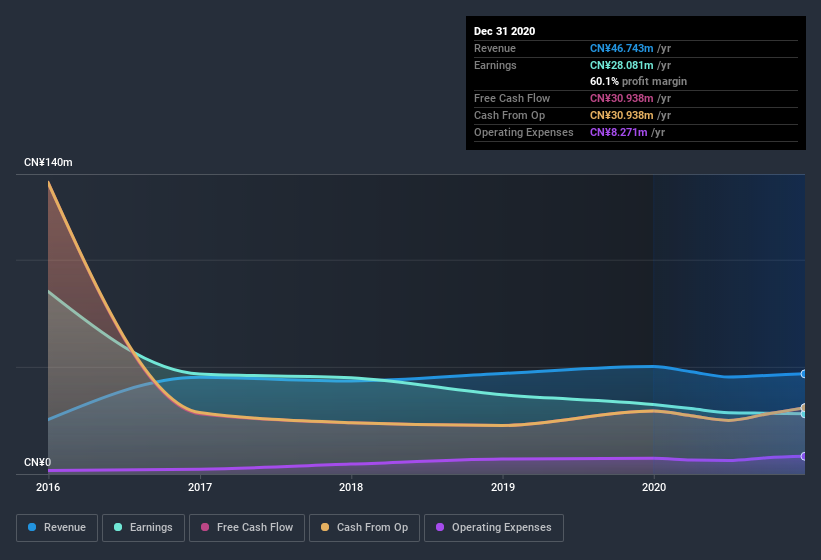

The subdued market reaction suggests that Wenling Zhejiang Measuring and Cutting Tools Trading Centre Company Limited's (HKG:1379) recent earnings didn't contain any surprises. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

Check out our latest analysis for Wenling Zhejiang Measuring and Cutting Tools Trading Centre

How Do Unusual Items Influence Profit?

To properly understand Wenling Zhejiang Measuring and Cutting Tools Trading Centre's profit results, we need to consider the CN¥7.6m gain attributed to unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. If Wenling Zhejiang Measuring and Cutting Tools Trading Centre doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Wenling Zhejiang Measuring and Cutting Tools Trading Centre.

Our Take On Wenling Zhejiang Measuring and Cutting Tools Trading Centre's Profit Performance

Arguably, Wenling Zhejiang Measuring and Cutting Tools Trading Centre's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that Wenling Zhejiang Measuring and Cutting Tools Trading Centre's statutory profits are better than its underlying earnings power. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you want to do dive deeper into Wenling Zhejiang Measuring and Cutting Tools Trading Centre, you'd also look into what risks it is currently facing. Case in point: We've spotted 3 warning signs for Wenling Zhejiang Measuring and Cutting Tools Trading Centre you should be mindful of and 1 of these is concerning.

Today we've zoomed in on a single data point to better understand the nature of Wenling Zhejiang Measuring and Cutting Tools Trading Centre's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Wenling Zhejiang Measuring and Cutting Tools Trading Centre or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wenling Zhejiang Measuring and Cutting Tools Trading Centre might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1379

Wenling Zhejiang Measuring and Cutting Tools Trading Centre

Provides property leasing and property management services in Mainland China.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)