- Hong Kong

- /

- Real Estate

- /

- SEHK:1238

Here's Why I Think Powerlong Real Estate Holdings (HKG:1238) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Powerlong Real Estate Holdings (HKG:1238). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Powerlong Real Estate Holdings

How Quickly Is Powerlong Real Estate Holdings Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. As a tree reaches steadily for the sky, Powerlong Real Estate Holdings's EPS has grown 20% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

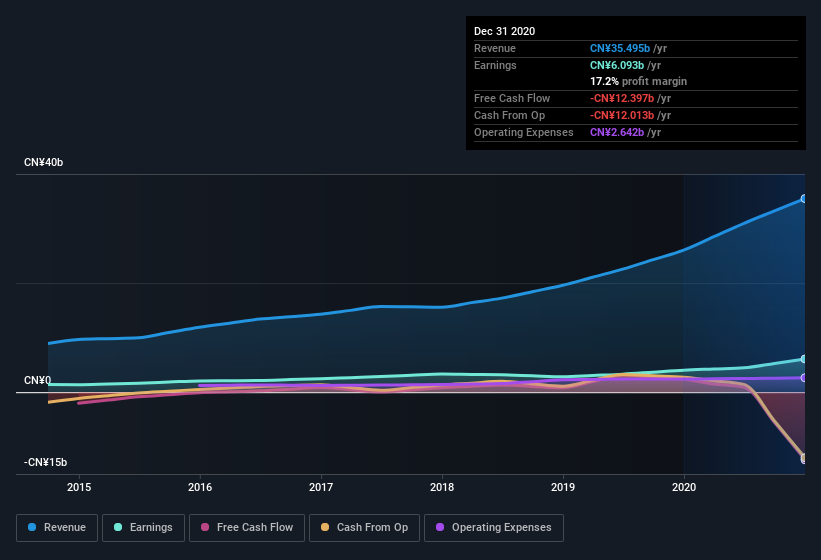

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Powerlong Real Estate Holdings's EBIT margins were flat over the last year, revenue grew by a solid 36% to CN¥35b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Powerlong Real Estate Holdings's future profits.

Are Powerlong Real Estate Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for Powerlong Real Estate Holdings is the serious outlay one insider has made to buy shares, in the last year. Specifically, in one large transaction Non-Executive Director Wa Fan Hoi paid HK$6.5m, for stock at HK$5.30 per share. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Powerlong Real Estate Holdings insiders own more than a third of the company. Indeed, with a collective holding of 65%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a whopping CN¥18b. Now that's what I call some serious skin in the game!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Wa Fong Hoi is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between CN¥13b and CN¥41b, like Powerlong Real Estate Holdings, the median CEO pay is around CN¥4.2m.

The CEO of Powerlong Real Estate Holdings only received CN¥1.2m in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Powerlong Real Estate Holdings To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Powerlong Real Estate Holdings's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. Don't forget that there may still be risks. For instance, we've identified 4 warning signs for Powerlong Real Estate Holdings (2 are potentially serious) you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Powerlong Real Estate Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Powerlong Real Estate Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1238

Powerlong Real Estate Holdings

An investment holding company, invests in, develops, operates, and manages commercial real estate projects in the People’s Republic of China.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives