- Hong Kong

- /

- Real Estate

- /

- SEHK:1224

I Ran A Stock Scan For Earnings Growth And C C Land Holdings (HKG:1224) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in C C Land Holdings (HKG:1224). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for C C Land Holdings

How Quickly Is C C Land Holdings Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud C C Land Holdings's stratospheric annual EPS growth of 53%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of C C Land Holdings's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. To cut to the chase C C Land Holdings's EBIT margins dropped last year, and so did its revenue. That will not make it easy to grow profits, to say the least.

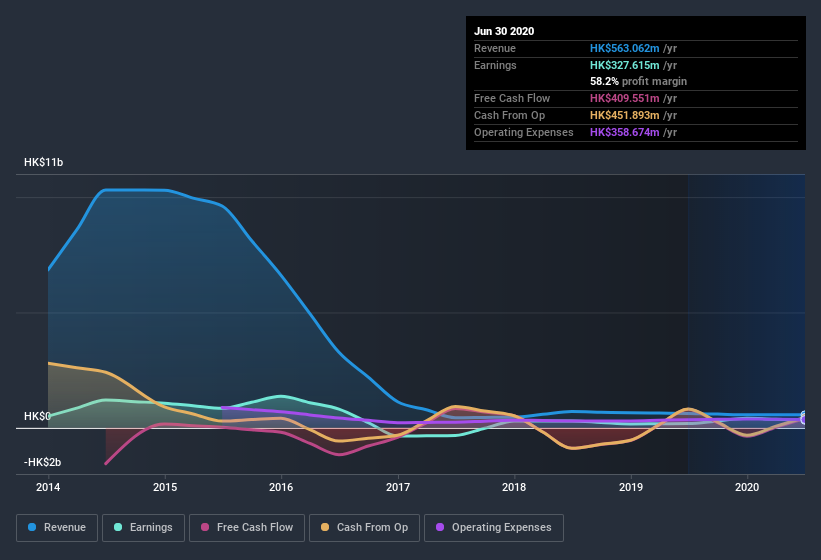

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are C C Land Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for C C Land Holdings, in the last year, is that a certain insider has buying shares with ample enthusiasm. Specifically, in one large transaction Chairman of the Board Chung Kiu Cheung paid HK$65m, for stock at HK$1.66 per share. It doesn't get much better than that, in terms of large investments from insiders.

And the insider buying isn't the only sign of alignment between shareholders and the board, since C C Land Holdings insiders own more than a third of the company. Indeed, with a collective holding of 56%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling HK$4.1b. That means they have plenty of their own capital riding on the performance of the business!

Is C C Land Holdings Worth Keeping An Eye On?

C C Land Holdings's earnings per share have taken off like a rocket aimed right at the moon. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe C C Land Holdings deserves timely attention. However, before you get too excited we've discovered 3 warning signs for C C Land Holdings (2 are concerning!) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of C C Land Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade C C Land Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1224

C C Land Holdings

An investment holding company, engages in the investment and development of properties in the United Kingdom and Hong Kong.

Imperfect balance sheet with minimal risk.

Market Insights

Community Narratives