- Hong Kong

- /

- Real Estate

- /

- SEHK:9916

Xingye Wulian Service Group Co. Ltd.'s (HKG:9916) Shares Bounce 26% But Its Business Still Trails The Market

Xingye Wulian Service Group Co. Ltd. (HKG:9916) shareholders have had their patience rewarded with a 26% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.1% in the last twelve months.

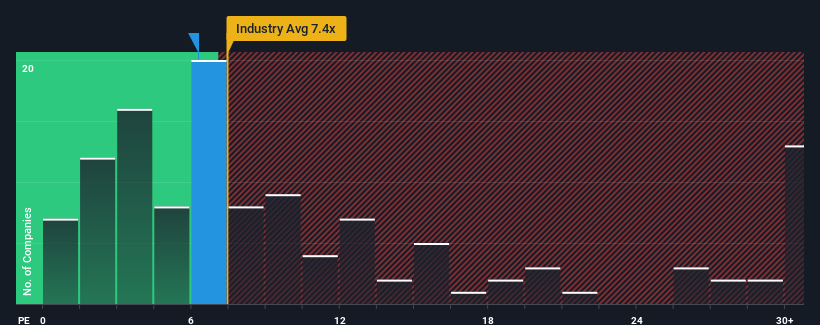

Even after such a large jump in price, Xingye Wulian Service Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.3x, since almost half of all companies in Hong Kong have P/E ratios greater than 10x and even P/E's higher than 20x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Xingye Wulian Service Group's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Xingye Wulian Service Group

Is There Any Growth For Xingye Wulian Service Group?

Xingye Wulian Service Group's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 12% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 21% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Xingye Wulian Service Group's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Xingye Wulian Service Group's P/E?

Xingye Wulian Service Group's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Xingye Wulian Service Group revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 1 warning sign for Xingye Wulian Service Group that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9916

Xingye Wulian Service Group

An investment holding company, provides property management, value-added, and property engineering services in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives